Risk appetite returns as geopolitical fears calm

Relief rally

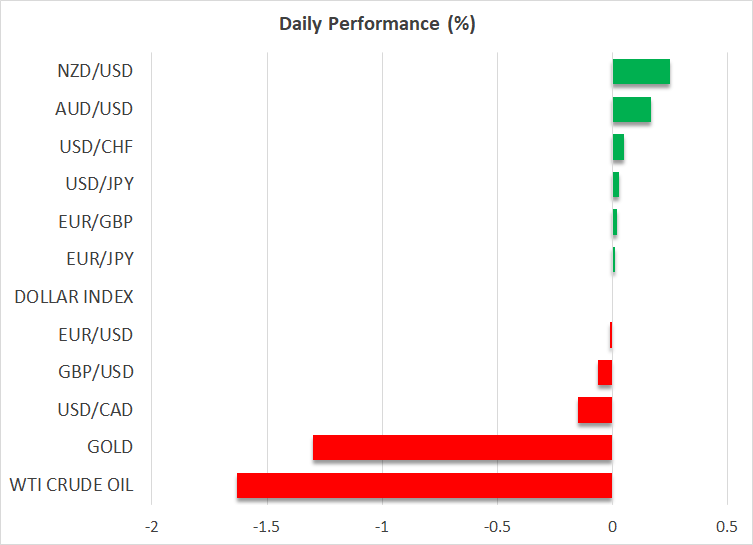

Global markets started the new week on a positive note, as the absence of further escalation in the Israel-Iran crisis helped calm investor nerves. Riskier assets such as equities recovered some ground early on Monday while crude oil and gold prices declined, reflecting fading concerns about a wider conflict.

Judging by their ‘measured’ counterattacks that were calibrated to avoid any casualties, it’s pretty clear that neither Israel nor Iran is interested in an actual war. The same goes for the United States, which has been trying to defuse tensions behind the scenes.

Hence, investors are piling back into riskier trades and liquidating their hedges, hopeful that the aftershocks will be contained. Crude oil has served as a barometer for Middle East worries given the risk of supply disruptions, and with prices having fallen 5% from last week, it appears energy traders are betting on de-escalation.

Stocks and Bitcoin bounce

Reflecting this sense of calm, Wall Street futures point to gains of around 0.4% when markets reopen today. While encouraging, this only represents a fraction of last week’s losses, so investors don’t seem willing to load their portfolios with risk yet.

Beyond geopolitical tensions, stock markets need to grapple with a sharp rise in bond yields that threatens to compress valuation multiples, especially if corporate America does not deliver impressive results this earnings season. Tesla will get the ball rolling with its quarterly earnings tomorrow, ahead of Meta Platforms, Google, and Microsoft later this week.

Bitcoin prices joined the party as well, rising almost 2% on Monday following the ‘halving’ event this weekend. On paper, this event is bullish for Bitcoin prices because it reduces supply growth, but in practice, it seems most of the good news was already priced in.

Gold retreats, yen stuck near lows

Gold prices encountered a rare selloff on Monday but remained close to the record highs reached earlier this month. Overall, sentiment around gold remains favorable, something evident by how shallow any declines have been this year despite a steady grind higher in bond yields and the US dollar, both of which are detrimental for bullion.

In the FX arena, the mood was calmer. Most major pairs were trading near their opening levels on Monday, following some volatility on Friday amid geopolitical concerns. What stands out is that the British pound has been unable to recover its Friday losses, which speaks to some lingering caution.

Meanwhile, the Japanese yen remains stuck near multi-decade lows, keeping traders on alert for FX intervention. That said, the language used by Japanese officials so far does not suggest they are ready to pull the intervention trigger, nor does the options market.

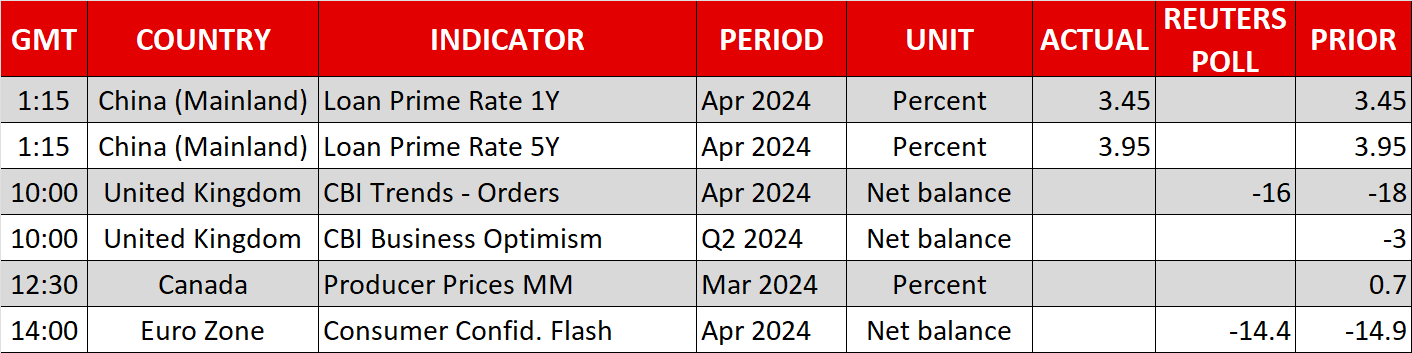

Looking ahead, it’s going to be a busy week with business surveys from around the world being released tomorrow, ahead of GDP growth stats from the United States on Thursday and a Bank of Japan meeting on Friday.

.jpg)