Bitcoin and Ethereum are racing to the top

Bitcoin and Ethereum are racing to the top

Market Picture

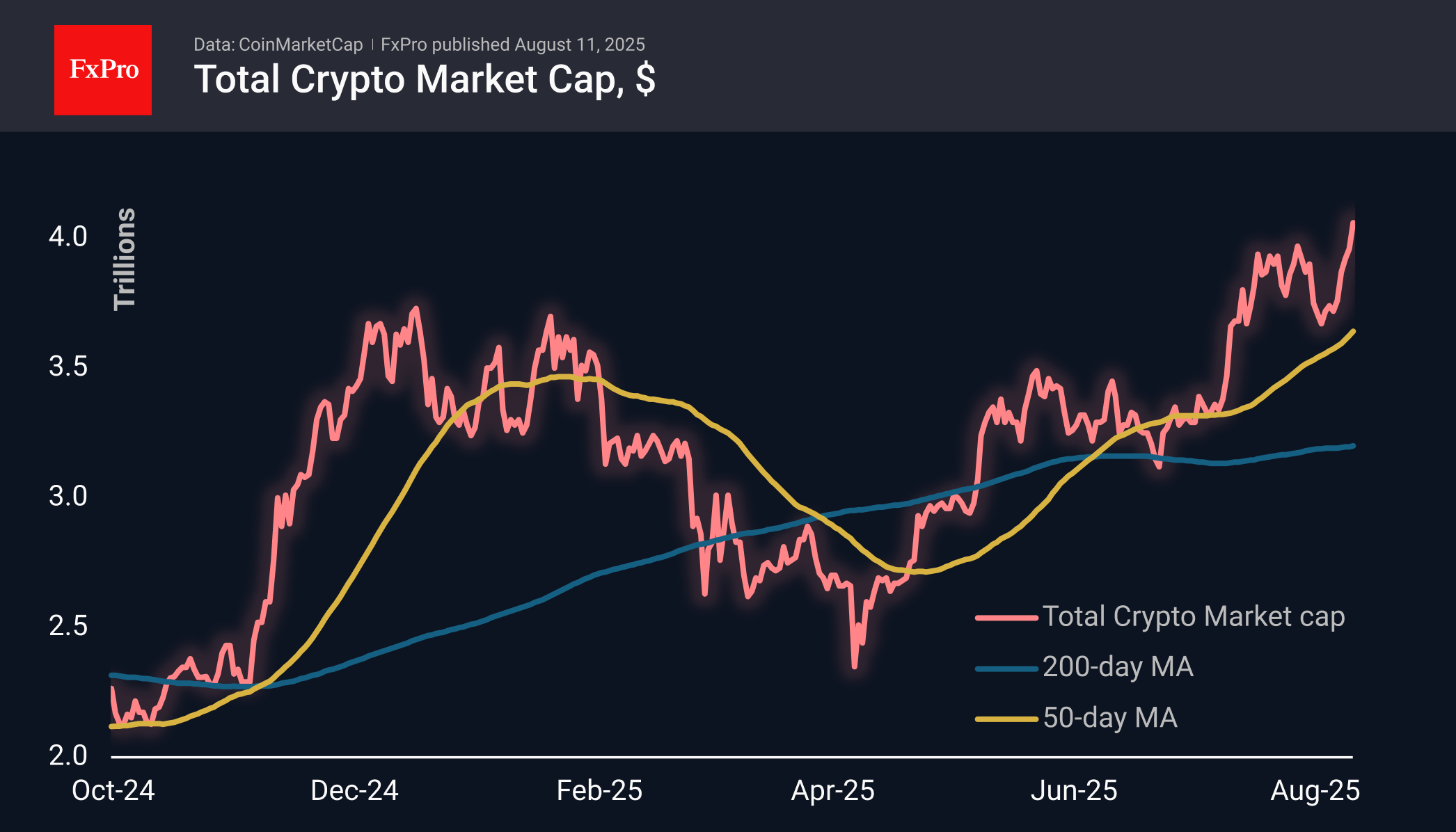

The cryptocurrency market cap is updating its historical highs, reaching $4.06 trillion thanks to Bitcoin's rally since the start of the day on Monday. Altcoins are mostly staying out of this race for now, taking a break after last week's rally. This is one of the few times when a rally in major altcoins has inspired BTC to break through. It's usually the other way around.

Bitcoin is trading above $122K, testing historical highs. An important area of resistance was around $120K. For the media, it is formally important to update the highs, although from a technical point of view, the breakthrough has already been made. The bull’s nearest target now looks to be the $135-138K area.

Ethereum has gained over 21% in seven days and 45% in the last 30 days, becoming one of the beneficiaries of recent legislative changes in the United States. The second-largest cryptocurrency by capitalisation is trading near $4,300, above which it was for less than four weeks at the end of 2021, with a historic peak just above $4,800. We would not be surprised to see this figure updated in the coming days.

News Background

The market received a positive boost from Trump signing an executive order on retirement savings. The document instructs the Department of Labour to prepare conditions for adding cryptocurrencies, private equity and other alternative assets to 401(k) retirement plans.

According to Bitwise, corporate treasuries and ETFs have purchased 371,111 BTC since the beginning of the year, which is 3.75 times more than the amount mined by miners during the same period.

Retail investors have also started accumulating. According to Glassnode, wallets with a balance of up to 100 BTC purchase about 17,000 BTC monthly, which exceeds the current issuance of 13,850 BTC. The situation is exacerbated by a rapid decline in liquidity on OTC platforms, which could trigger a sharp rise in Bitcoin.

According to Capriole Investments founder Charles Edwards, Bitcoin is trading 45% below its ‘energy value’ of $167,800. The indicator determines BTC's fair value as a function of the amount of energy expended, the rate of supply growth, and a constant coefficient reflecting its value in dollars.

The latest recalculation increased the difficulty of mining Bitcoin by 1.42% to 129.44 T. According to Glassnode, the BTC network's hash rate reached a record high of 1,031 ZH/s.

Ethereum is growing against the background of increased on-chain activity. The daily transaction volume on the network is updating historical highs, and the number of new addresses is approaching the historical high reached in May 2021.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)