Crypto Bears in charge

Market picture

Crypto market capitalisation fell 0.5% to $2.44 trillion as Thursday's growth attempt failed to gain traction due to a new wave of dollar strength. Risk demand is gradually diminishing, forming a sequence of declining intraday highs. However, horizontal support remains in the 2.42 trillion area, where the market also stabilised from May 17th to 20th.

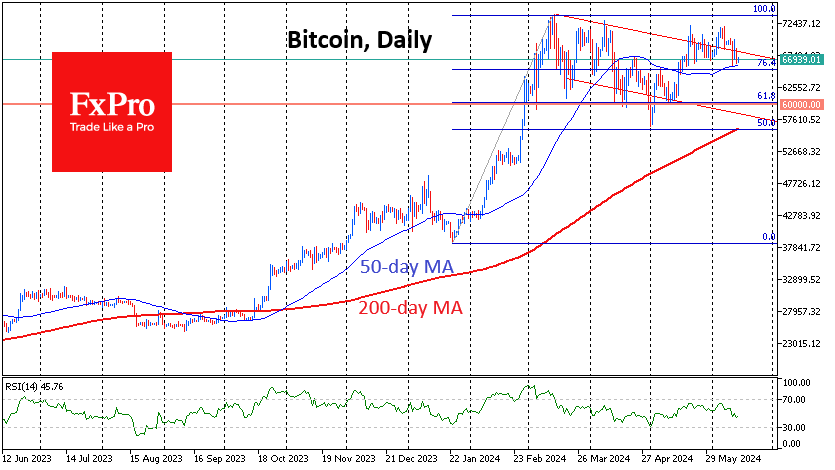

Bitcoin has pulled back below $67K, losing 0.7% in 24 hours. It continues to test the strength of the 50-day moving average, but it doesn't find enough reason to dive lower. Such persistent testing of the lows sets the bears up for quick success with their next target at $60K.

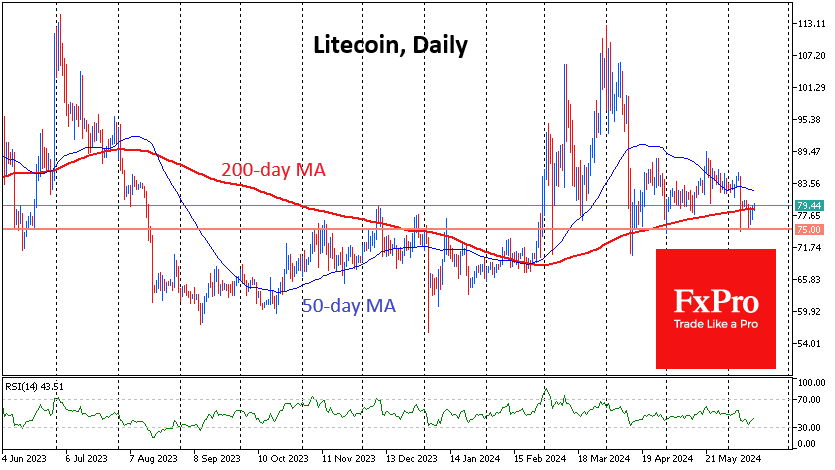

Litecoin is trying to cling to the 200-day moving average near $79.4. There has been support around $75 since March, which has been actively playing the role of resistance from November to January. A failure below promises to be a significant trend reversal signal, with next supports near $67 and $60.

News background

JPMorgan questioned the sustainability of the inflow of funds into spot bitcoin-ETFs. According to the bank's experts, "the high rate of BTC both in relation to the cost of its mining and to the price of gold" may lead to a slowdown in investment growth.

According to on-chain analyst Ali Martinez, the reduced profitability of bitcoin mining due to the April halving has triggered a "wave of capitulation" by miners. Thus, it has simply not been profitable for most miners to mine Bitcoin lately.

Terraform Labs and its co-founder Do Kwon will pay the SEC $4.47bn after settling the ecosystem collapse. Terraform Labs will cease operations and hand over management of the network to the community.

MicroStrategy will place $500 million in eight-year convertible unsecured notes to "acquire additional bitcoins and fund general corporate purposes."

The Block estimated that funds distributed through airdrops have exceeded $4bn since the beginning of the year. The top three largest airdrops were Jupiter, StarkNet, and Notcoin. Based on the number of tokens issued and average quotes in the following months, each project distributed about $1 bn. Airdrops from Wormhole, Ether follow them.fi, Friend.Tech, and Wen.

Australian authorities have banned the use of cryptocurrencies for online casino gambling. Companies that do not comply with the rules face fines of more than A$230K.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)