Crypto: Hope for a bottom

Market Picture

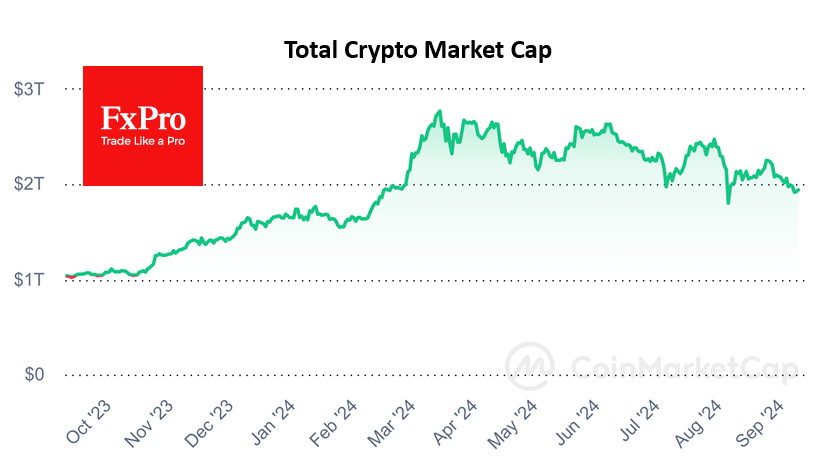

The crypto market is trying to stabilise around the $1.94 trillion mark for the third day (+0.8% in 24 hours and -4% in 7 days) after Friday's sharp sell-off. It will soon be apparent whether support at the $2 trillion level has turned into resistance.

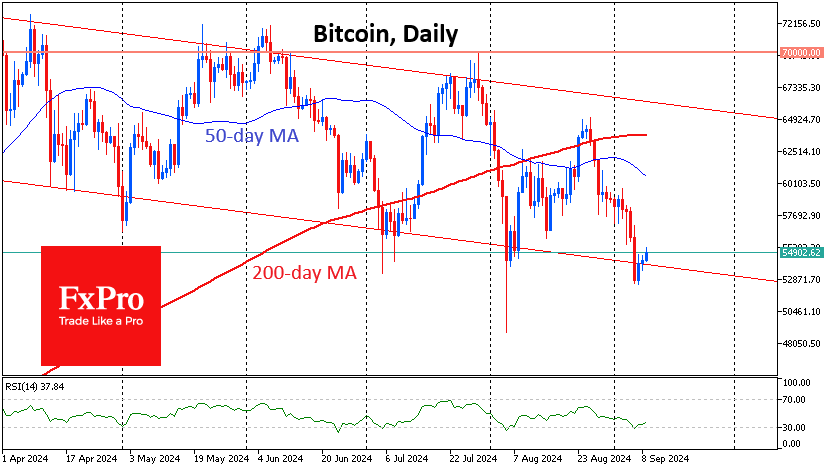

Bitcoin is trading just below $55K on Monday morning, near the bottom of the downward corridor that has been in place since March. Technical indicators are pointing to a possible bounce as the price has moved out of the oversold territory on the daily timeframe, which has preceded rallies several times over the past three months.

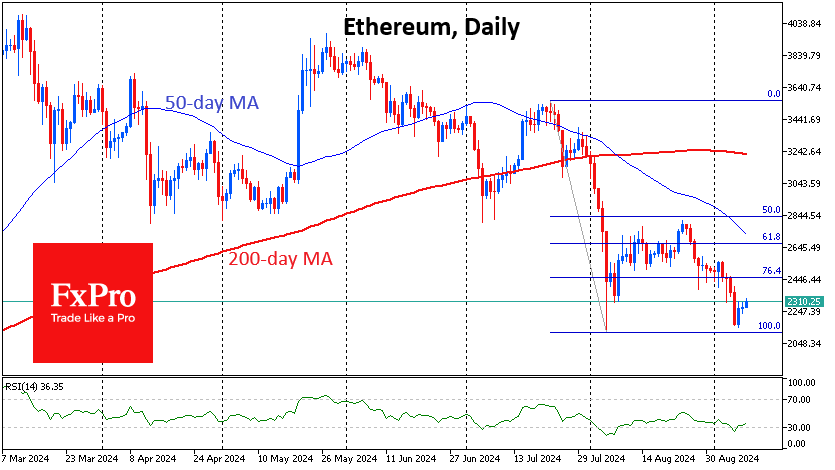

Ethereum is trading above $2300, bouncing off the August lows and not yet deepening the decline. The RSI has also moved out of the oversold territory, and the current low on the index is higher than the previous low, indicating that the intensity of the decline has eased.

News Background

According to SoSoValue, outflows from spot bitcoin ETFs in the US totalled $706.2 million last week, following outflows of $277.1 million the previous week. Since the launch of BTC ETFs in January, cumulative inflows fell to $16.89 billion (-4% for the week).

In the Ethereum ETF, outflows rose to $91 million last week, continuing the negative trend for the fourth consecutive week. Net outflows since the product launch increased to $568.3 million (+19.1% for the week).

According to CCData, Ethereum's market depth on exchanges has fallen by 20% since the launch of spot ETFs, indicating reduced liquidity and increased sensitivity to large orders.

Pressman Film, a company known for producing films, will launch a tokenised fund to finance new projects through the Republic platform on the Avalanche network. Asset buyers will be able to become co-owners of six films. The price of Avalanche rose 7% to over $23.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)