EBC Markets Briefing | Bulls yet to have tired legs as tech stocks advance

Global equities edged lower on Tuesday while Treasury yields rose with help from Powell's cautious tone. The S&P 500 and Nasdaq 100 managed small advances, adding to their streak of record closing highs.

Oppenheimer just lifted its S&P 500 price target to 5900, marking the second-highest forecast on Wall Street. RBC recently raised its target to 5,700 but saw gains increasingly hard to come by.

Goldman Sachs Asset Management expects the US economy to grow at a slower clip of about 2% in the second half of 2024 with equity indexes seen largely flat due to declining earnings growth and political anxieties.

The BlackRock Investment Institute is bullish on US stocks and AI. With regards to Treasuries ahead of the presidential election, long-term debt prices are not sufficiently reflective of the prospect of widening fiscal deficits.

The experts added recent parliamentary elections in Britain had made valuation of UK equities attractive, while Japan stocks remained its favoured equity investment play.

JP Morgan stuck to its contrarian view that a major correction could hit the top 20 US stocks. The bank remains cautious on the benchmark index, noting that a 20% downside could be on the cards.

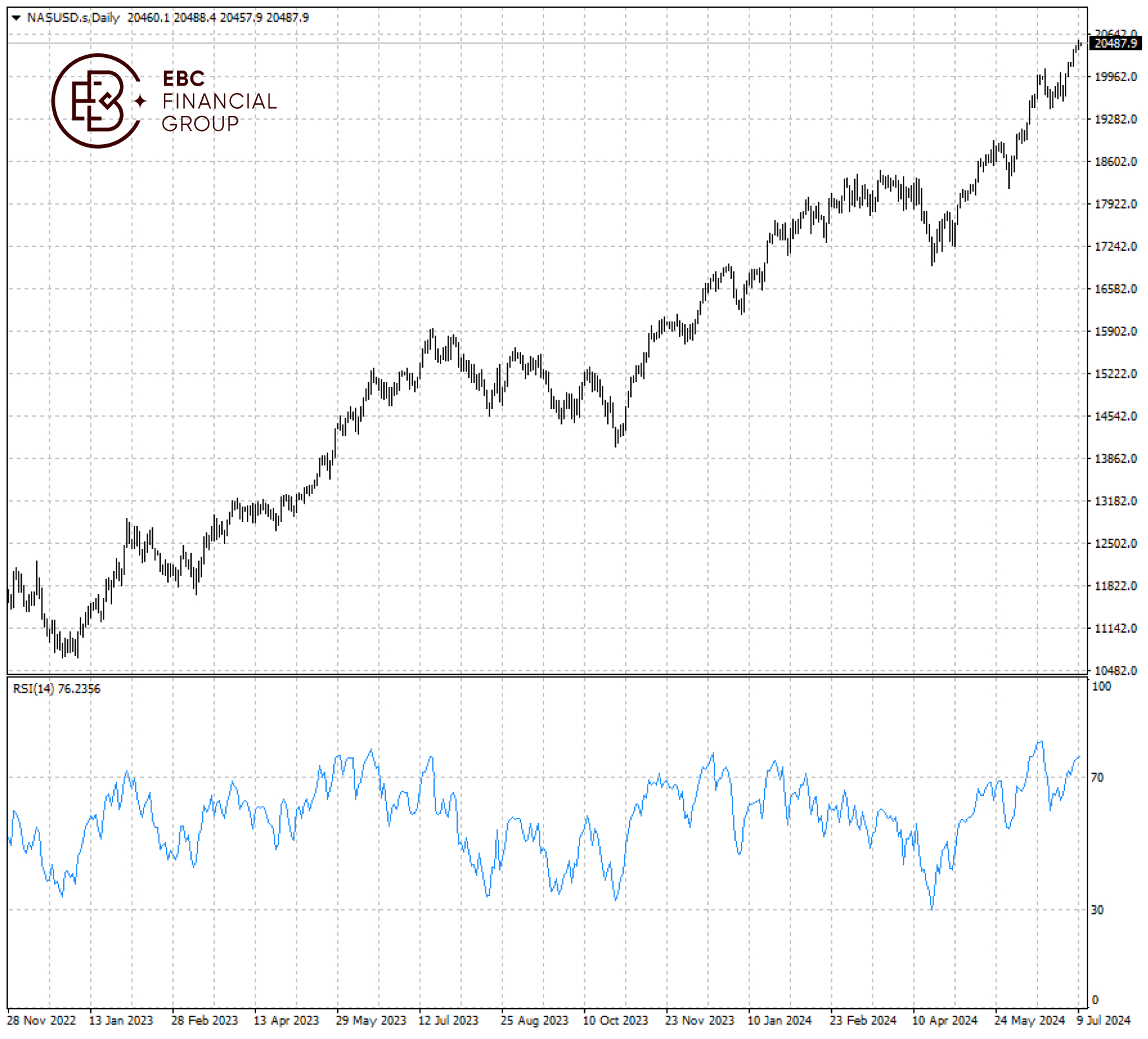

It took little time for the Nasdaq 100 to climb above 20,000 which has served as support. RSI indicates the market could reach a fatigue point in the near term, although the bullish run should continue.

EBC Financial Market Forecast Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Economic Research Findings or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.