EBC Markets Briefing | EU plans to hit Big Tech if needed

US stocks ended a see-saw session with gains and Treasury yields slid on Wednesday as mixed economic data counterbalanced easing jitters of a global trade war.

A stronger-than-expected ADP's private payrolls data was offset by a surprise deceleration in the services sector, while record high imports pushed the US trade deficit sharply wider.

Alphabet shares plunged as its Q4 report missed on revenue expectations, raising doubts about the hyped AI prospect. Growth for search business, YouTube ads business and services unit all slowed compared to a year ago.

The company also announced that it plans to invest $75 billion in capex in 2025 as it continues to expand on its AI strategy. That is well above the consensus forecast for $58.84 billion, according to FactSet.

The EU is planning to hit Big Tech with retaliatory measures if Trump follows through on threats to impose tariffs on the bloc. France’s trade minister told FT they might need to act faster.

Several years ago, Macron outlined an ambitious push for Europe to create 10 technology giants worth €100 billion each in valuation by 2030. But there has been little progress yet in developing them.

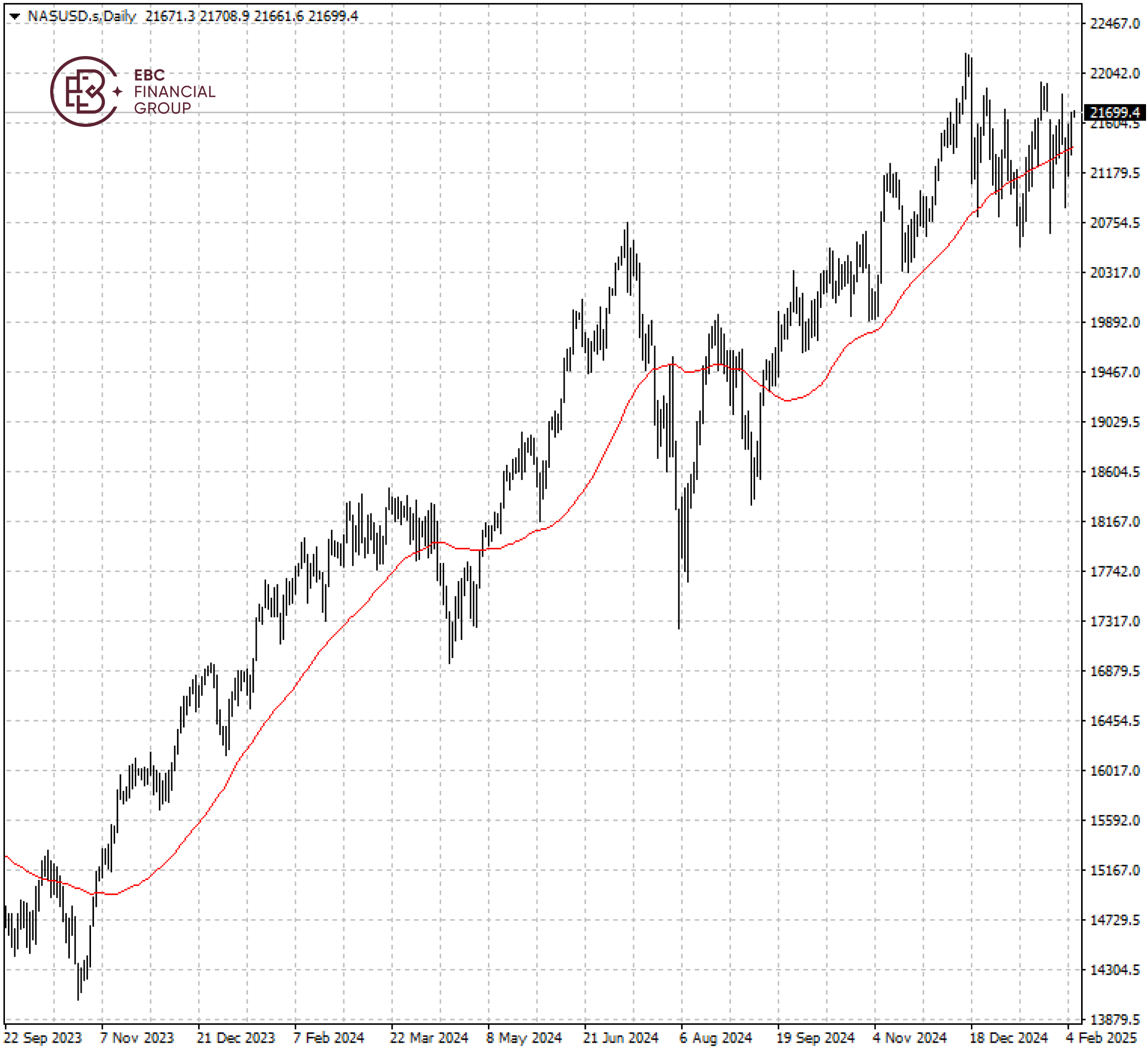

The Nasdaq 100 has been fluctuating around 50 SMA since a retreat from a record peak above 22,200. As such the index looks bearish in the short term without fresh catalyst.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.