EBC Markets Briefing | Loonie digests strong gains on domestic job losses

Loonie was little change amid risk-on mood on Monday. Many economists reckon the reaction to the US jobs data was overblown given the numbers may be skewed by immigration and Hurricane Beryl.

The Canadian dollar notched its biggest weekly advance in eight months, as domestic jobs data did little to alter expectations for further loosening. The BOC has cut its benchmark interest rate twice since June.

The economy shed 2,800 jobs in July, while the unemployment rate remained at a 30-month high of 6.4%. Analysts had forecast a gain of 22,500 jobs and the unemployment rate to rise to 6.5%.

Following the CIRB decision that does not bring the labour conflict any closer to a resolution, CN is formally requesting the Minister of Labour’s intervention to eliminate the impacts of prolonged uncertainty.

Speculators have raised their bearish bets on the currency to an all-time high, recent data from the CFTC showed. Meanwhile, oil prices held on to most of last week’s more than 3% gain.

The risk of an escalation in the Middle East continued to support prices after Iran and Hezbollah vowed to retaliate for the Israel’s assassinations. An airstrike in Gaza on Saturday killed at least 90 people.

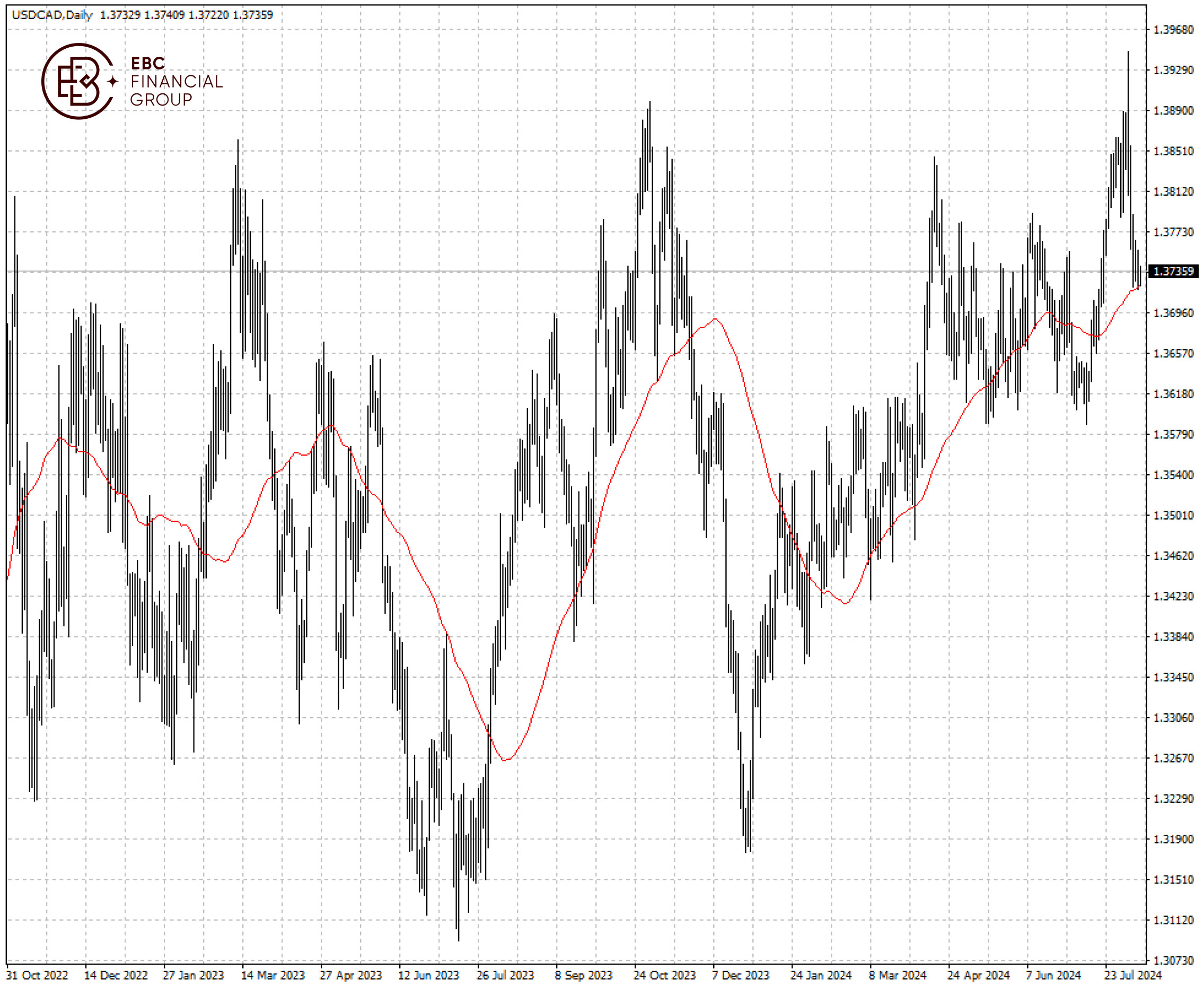

The pair traded around the 50 SMA following a sharp pullback into its previous trading range. A push above 1.3790 could be what it takes to resume the uptrend.

EBC Fintech Development Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Group Brand Influence or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.