EBC Markets Briefing | Loonie keeps falling on lacklustre data

The Canadian dollar inched down on Monday after three consecutive months of decline. Slowing growth and inflation in line with the 2% target put the currency at a disadvantage compared with a strong greenback.

Loonie just registered a weekly as GDP data bolstered bets for aggressive loosening from the BOC. Investors see a roughly 50% chance of a 50-bp reduction later this month, swap market data showed.

The economy grew at an annualised rate of 1% in Q3, undershooting the forecast of 1.5%. Trump’s proposed tariffs and shaky oil prices will likely come to the detriment to the country ahead.

PM Trudeau returned home Saturday after his meeting with Trump without assurances the president-elect will back away from threatened tariffs on all products from the major American trading partner.

But Mexican President Claudia Sheinbaum, after speaking with Trump on the telephone, said Thursday she was confident a trade war with Washington would be averted.

Last week, both oil benchmarks posted a weekly decline of more than 3%, on easing concerns over supply risks from the Israel-Hezbollah conflict and forecasts of surplus supply in 2025.

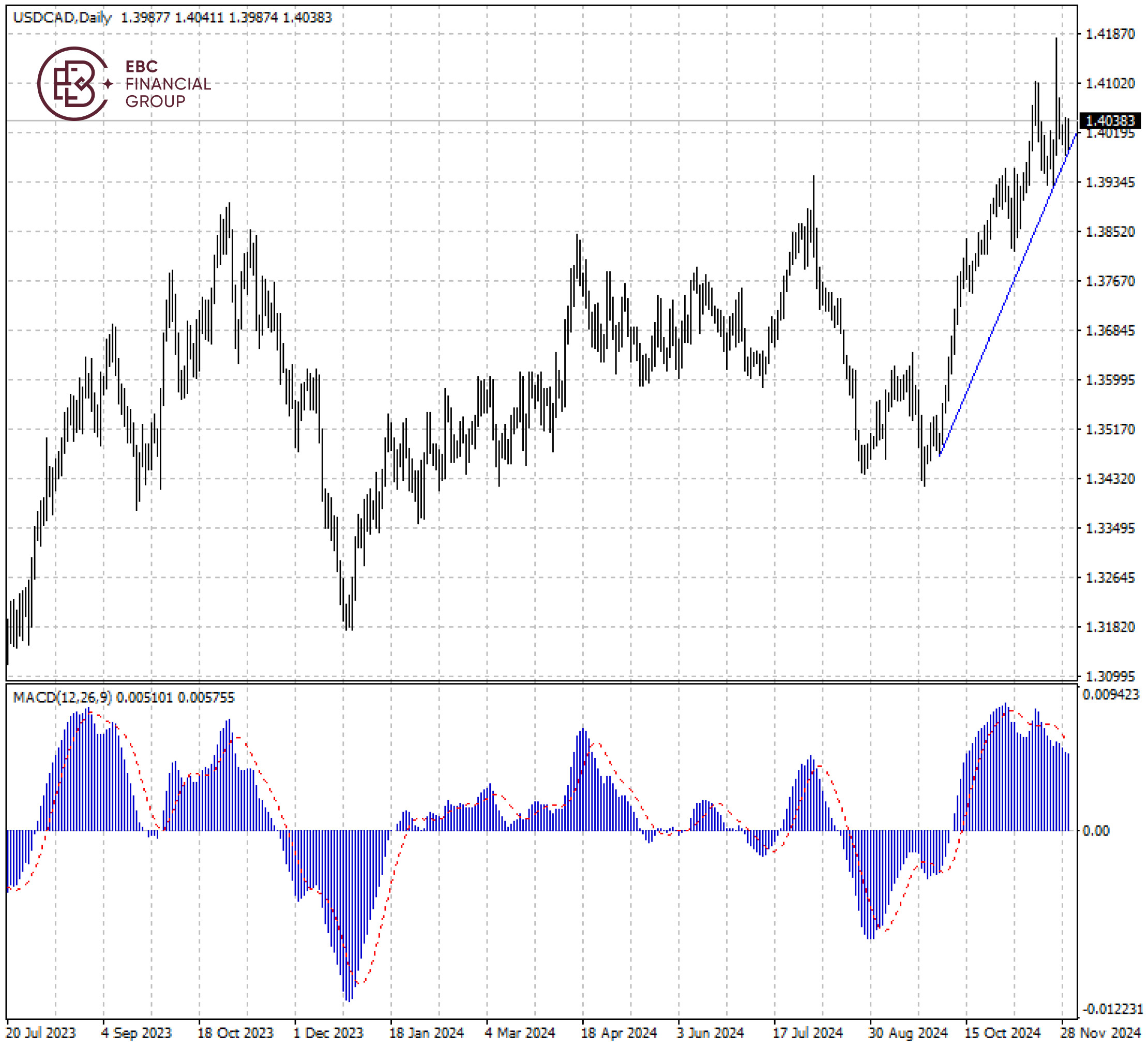

The Canadian dollar still traded below its descending trendline, signaling ongoing downside risks. Even so, a moderate rally towards 1.3820 per dollar is possible with MACD divergence.

EBC Capital Market Consulting Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Trading Platform Security or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.