EBC Markets Briefing | Trump pits European stocks against Wall St

European shares ended lower on Friday as losses in banks and mining-related stocks weighed, with focus now shifting to the July deadline for trading partners to reach a deal with the White House.

European stocks outperformed their US peers by the biggest margin on record in dollar terms during the first half, and a remarkable rise of 13% in the euro have made the gap ever wider.

The region has had false dawns before as political instability and cumbersome regulations dented investor confidence. But something profound has happened, particularly after Germany removed its debt brake.

While the US and Europe likely provide similar profit growth next year, the former trades at a 35% discount and pays higher dividends. The thing is US economic data begins look up relative to that for Europe.

As Big Tech stocks take the lead, a much predicted broadening in US equities has stalled. Some investors think turbulence on Wall Street could return as Trump continues to wage his trade war.

UBS analysts expect $1.4 trillion of capital to rotate from US to European equities in the next five years. International shares are expected to be the top asset class during the period, according to a BofA survey.

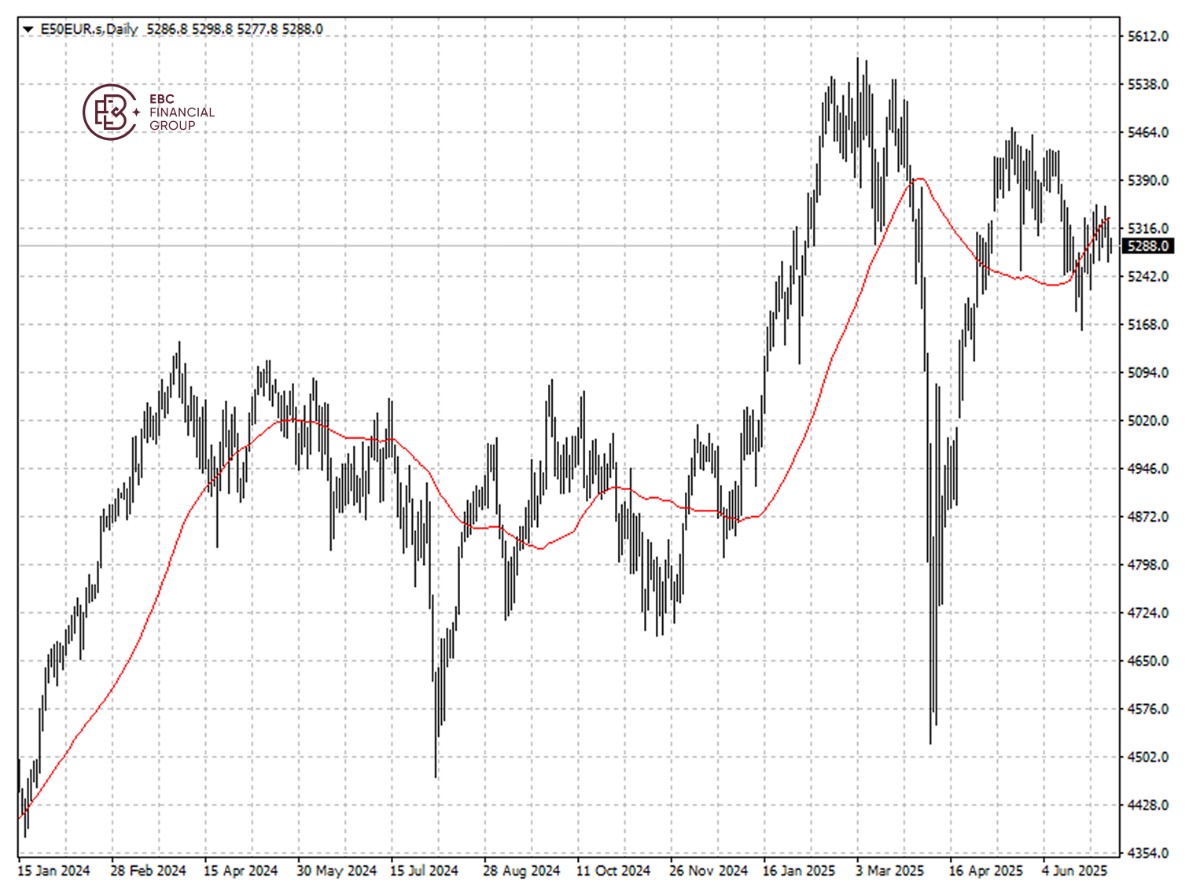

The Stoxx 50 has pushed below its 50 SMA and traded sideways. A breakout seems unlikely for the index amid looming tariffs, so we expect it to flirt with 5,300 before a retreat.

EBC Forex Market Analysis Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Industry In-depth Analysis or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.