Oil Holds Strong Despite Bearish Fundamentals

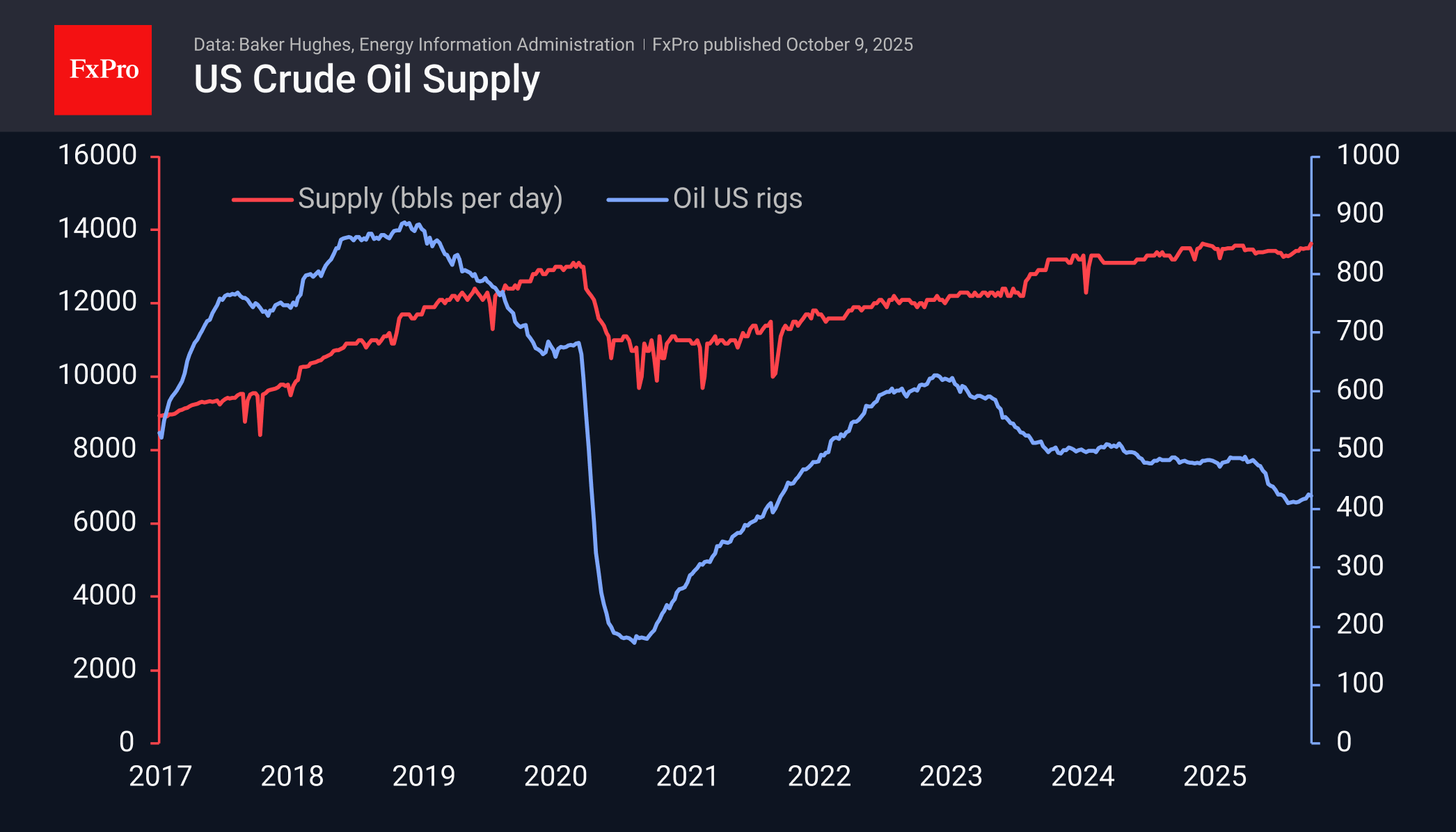

Weekly data from the EIA noted that the US returned to record oil production rates last week, supplying an average of 13.6 million barrels per day to the market, according to the latest EIA data. The trend towards increased supply began in August, but producers have only now returned to the peak levels recorded at the end of last year.

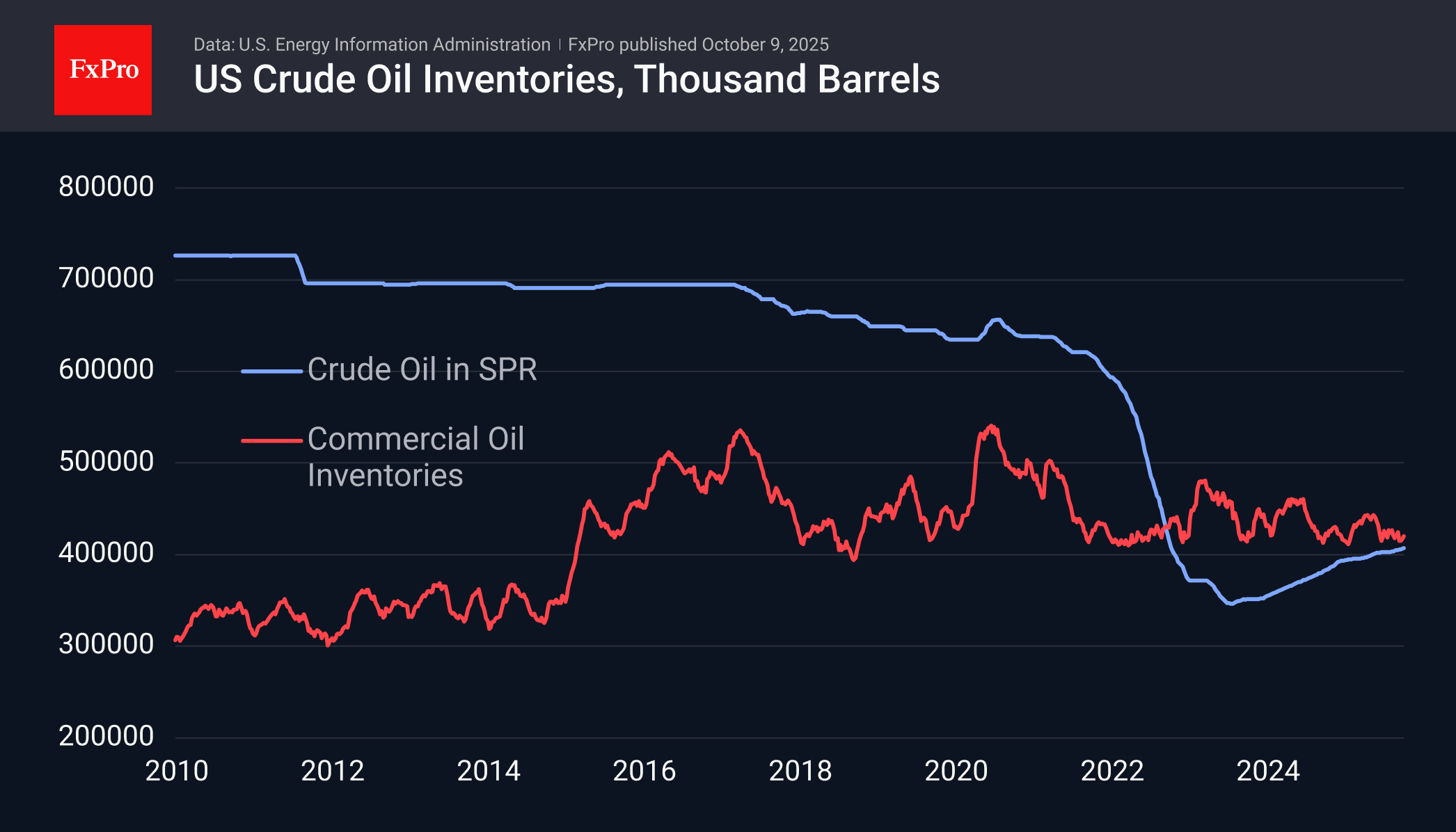

Despite a 5.5 million barrel increase in US commercial inventories over the past two weeks, stocks remain at the lower end of the range seen over the past decade, leaving considerable room for growth. The same can largely be said for the strategic reserve, which holds nearly 40% less oil than it did five years ago before the start of the active sell-off.

It is an interesting game in which, on the one hand, the US (the largest oil producer) is increasing supplies, while OPEC+ is increasing quotas on a monthly basis. This extremely bearish combination of factors did not cause oil prices to collapse; it was only because of global trade in currency depreciation that caused precious metals, stock indices, and cryptocurrencies to rise.

Oil prices have not peaked in recent weeks but have been rising since the end of last week on reports that OPEC+ is not increasing quotas as quickly as observers feared. This is an indicator of a strong market. In addition, in the event of an oil surplus in the US domestic market, based on peak levels in recent years, up to 400 million barrels of oil could be placed in strategic reserve and commercial storage facilities.

At the same time, oil is helped by the lack of statistics from the US, where we do not know the state of the labour market. The saying that no news is good news is quite applicable to oil at the moment. Quotes are cementing their base at nearly $60 per barrel of WTI amid very bearish fundamentals, the accumulation of which does not allow us to talk about long-term growth prospects. For now, we are only considering a delay in updating the 2021 lows.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)