Headwinds knocked down Bitcoin & Ethereum

Headwinds knocked down Bitcoin & Ethereum

Market pictureThe crypto market is losing about 4.5% from its peak on Friday, having reversed to the downside after news positive for the dollar. Another batch of labour market figures well above expectations has raised doubts that the Fed will soon follow the ECB and Bank of Canada in cutting rates. This shift in sentiment has reduced risk appetite, hurting cryptos.

Bitcoin failed its attempt to climb above $72K on Friday, pulling back below $70K. We haven’t yet seen an acceleration of the first cryptocurrency's rise after breaking downward resistance. On the other hand, selling is also not gaining momentum. Clearly, the cryptocurrency market remains in a state of buying on downturns. Meanwhile, headwinds such as a rising dollar and tighter monetary policy are prolonging the consolidation.

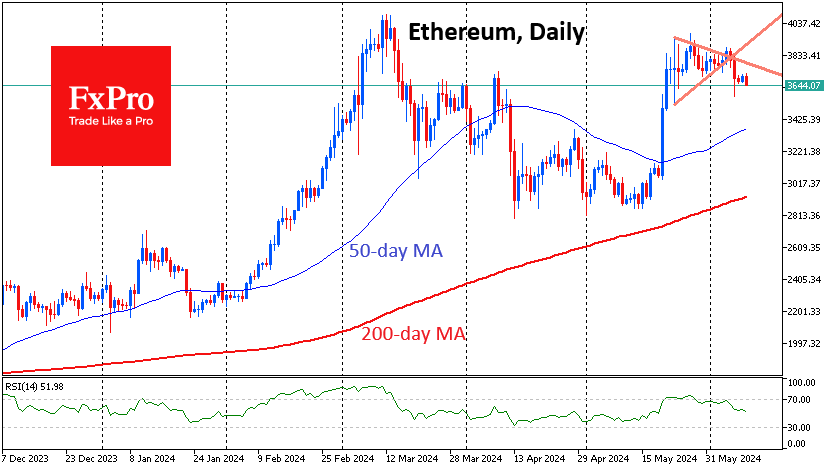

At the same time, Ethereum is sending a very worrying technical signal. Timid attempts to move up from consolidation around $3800 were replaced by a very impressive sell-off. The second-largest cryptocurrency fell below the previous local lows to $3650. The next potentially important support area could be $3300, an important pivot area from March.

News backgroundThe number of bitcoins in IBIT, a spot ETF from BlackRock, has surpassed 300,000. The fund's capitalisation reached $21 billion, making IBIT the leader among spot ETFs in terms of capitalisation.

The volume of open short positions on MicroStrategy shares has tripled in the last six months to $6.9 billion. Shorts are counting on a correction after the company's capitalisation jumped 5.5 times in the last year. MicroStrategy owns 214,400 BTC worth approximately $15.25bn.

Ex-CEO of BitMEX Arthur Hayes called for buying bitcoin (and later altcoins) because the rate cut cycle is starting. Last week, the ECB and Bank of Canada lowered their key rates by 25 bps. According to him, "Crypto bulls are waking up and are about to start tearing the skins off profligate central bankers."

According to PeckShield, hackers stole at least $575 million in May, with damage from hacking attempts in the first quarter up 42 per cent compared to the first quarter of 2023. Attackers are giving up on finding vulnerabilities in smart contracts and are focusing on phishing attacks and stealing users' private keys.

Ripple CTO David Schwartz warned of a new wave of scams using phishing links to steal XRP holders' personal data.

Donald Trump declared his intention to become a cryptocurrency president and criticised Democrats' attempts to regulate the industry.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)