Is the market underestimating XRP’s breakout potential?

Bitcoin is making waves above $100K. Ethereum has the ETF crowd buzzing. But XRP? It’s quietly gearing up for what could be its biggest move yet - and most people aren’t paying attention.

While crypto headlines have been dominated by high-flying coins and courtroom drama, XRP has been building strength in the background. The price is ticking upwards, whales are loading up, and ETF deadlines are just around the corner. It’s not flashy, not hyped, but that might be exactly why it’s time to look twice.

Because if history is any guide, XRP has a knack for moving fast when no one’s watching.

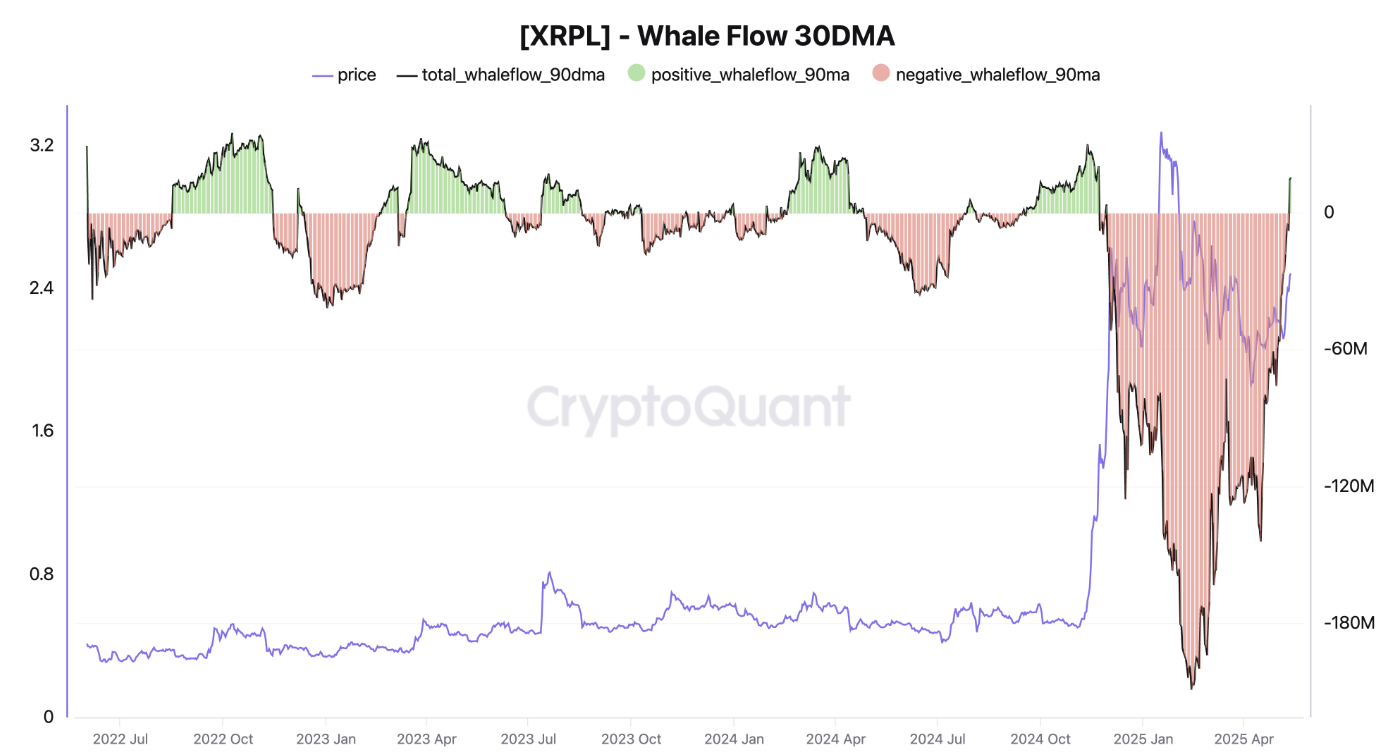

Whales are snapping up XRP again

Let’s start with the big money - quite literally. For the first time since November 2024, XRP’s whale flows have turned positive. That means large holders think institutions, funds, and serious crypto players are no longer offloading XRP, they’re accumulating it.

Source: CryptoQuant

And this isn’t just a feel-good signal. The last time this shift happened - in mid-2024 - XRP surged from around $0.43 to $3.55 by January 2025. If that’s any indication, we might be looking at the early stages of something much bigger.

In markets, whales rarely chase trends. They position early, patiently, and with purpose. If they’re back in accumulation mode, the rest of us might want to pay attention.

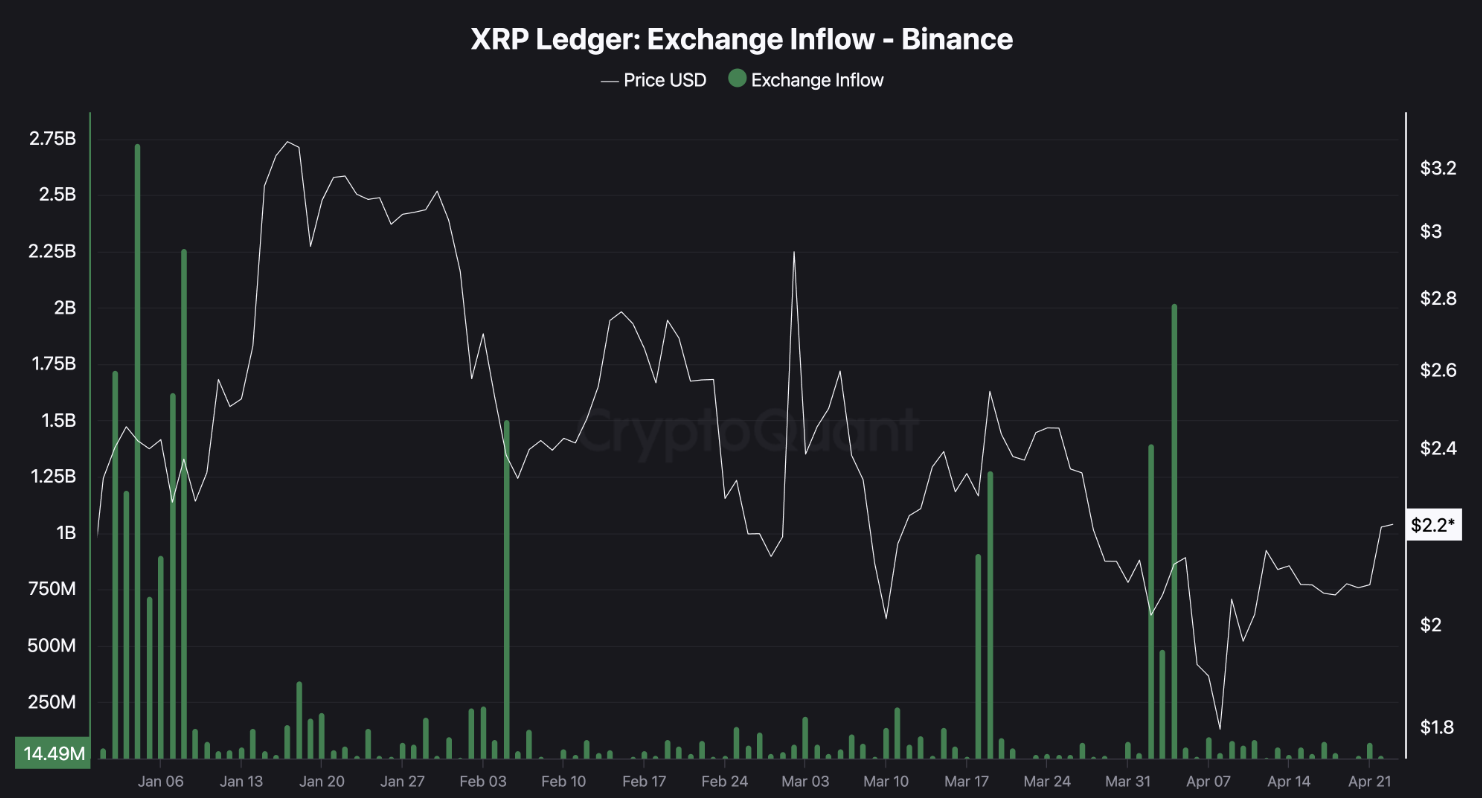

Less XRP on exchanges means one thing

While the whales have been scooping up XRP, another quiet shift has been taking place: exchange inflows have plummeted.

According to CryptoQuant, XRP inflows have dropped from over 2 billion coins to just 14.5 million. That’s not a typo. There has been a 99%-plus collapse in tokens moving to exchanges.

Source: CryptoQuant

Why does this matter? Fewer coins on exchanges mean less immediate selling pressure. Investors are choosing to hold their XRP in private wallets - typically a sign of long-term conviction. When people stop preparing to sell, prices have room to breathe and break out.

ETF approval could change the game overnight

But here’s where things really get interesting: the XRP spot ETF race is heating up.

Several big players, including 21Shares, Bitwise, Grayscale, WisdomTree, and Canary Funds, have XRP-spot ETF applications up for review. Intermediate deadlines are fast approaching, and while the SEC recently kicked the can down the road with the Franklin XRP Fund (pushing its decision to 17 June), the final round of decisions is due by October 2025.

Normally, that would all sound fairly straightforward. But there’s a twist: the fate of these ETFs might rest not with the SEC but with the courts.

The Ripple lawsuit Is still hanging over everything

The SEC and Ripple are still locked in legal limbo. While a settlement is on the table, if Judge Torres rejects it, Ripple may proceed with a cross-appeal, prompting the SEC to reignite its own appeal.

That could throw a spanner in the ETF approval process. Some analysts argue that until the court signs off on a resolution, particularly on institutional XRP sales - the SEC may remain hesitant to greenlight any XRP-based funds.

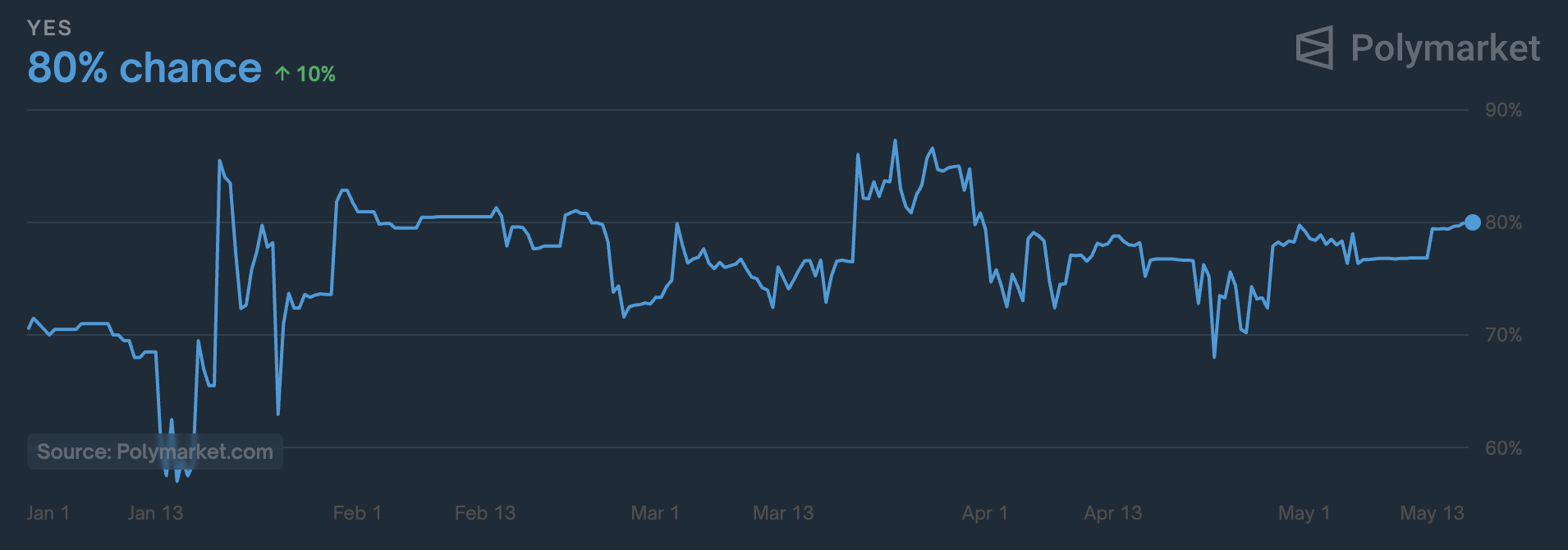

But here’s the thing: markets don’t wait for clarity, they position for outcomes. According to prediction platform Polymarket, the odds of XRP spot ETF approval in 2025 currently sit at 80%. That’s down from 87% in March but up significantly from 68% in April.

Source: Polymarket

Translation? Despite the legal fog, sentiment is turning bullish.

XRP could be building for a breakout that catches everyone off guard

Put all the pieces together; whale accumulation, drying exchange supply, technical breakouts, and potential ETF tailwinds and it paints a picture the market doesn’t seem fully awake to.

Right now, XRP looks undervalued not just in price, but in perception.

Traders are distracted by louder coins and shinier narratives. But XRP has historically delivered some of its biggest moves when no one was watching. And if ETF approvals land or legal clarity emerges, XRP could be re-rated very quickly.

Is an 80% rally possible? Based on analyst views and past cycles - it could be possible. The question is whether the market catches up before or after the move.

Technical outlook: Breakout incoming?

XRP isn’t the loudest name in the room right now, but maybe that’s the point. With fundamentals firming, whales circling, and the regulatory picture slowly taking shape, the breakout potential is real.

At the time of writing, XRP is hovering at a resistance level, with sell-side bias evident on the daily chart. A recent inverse head-and-shoulders formation hints at a potential bullish moment. The volume bars also buttress the bullish narrative, with sell bars currently contracting. Should we see a slide, the price could find support at the $2.0780 price level. Should we see a bounce, prices could find a resistance wall at $2.6000.

Source: Deriv MT5

Source: Deriv MT5