What's next for the markets

What's next for the markets

In the new week, Fed Chairman Jerome Powell will address Congress on Tuesday and the House of Representatives on Wednesday. The prepared speech will be the same in both cases, but all attention will be focused on his answers to lawmakers' questions and the outlook for monetary policy.

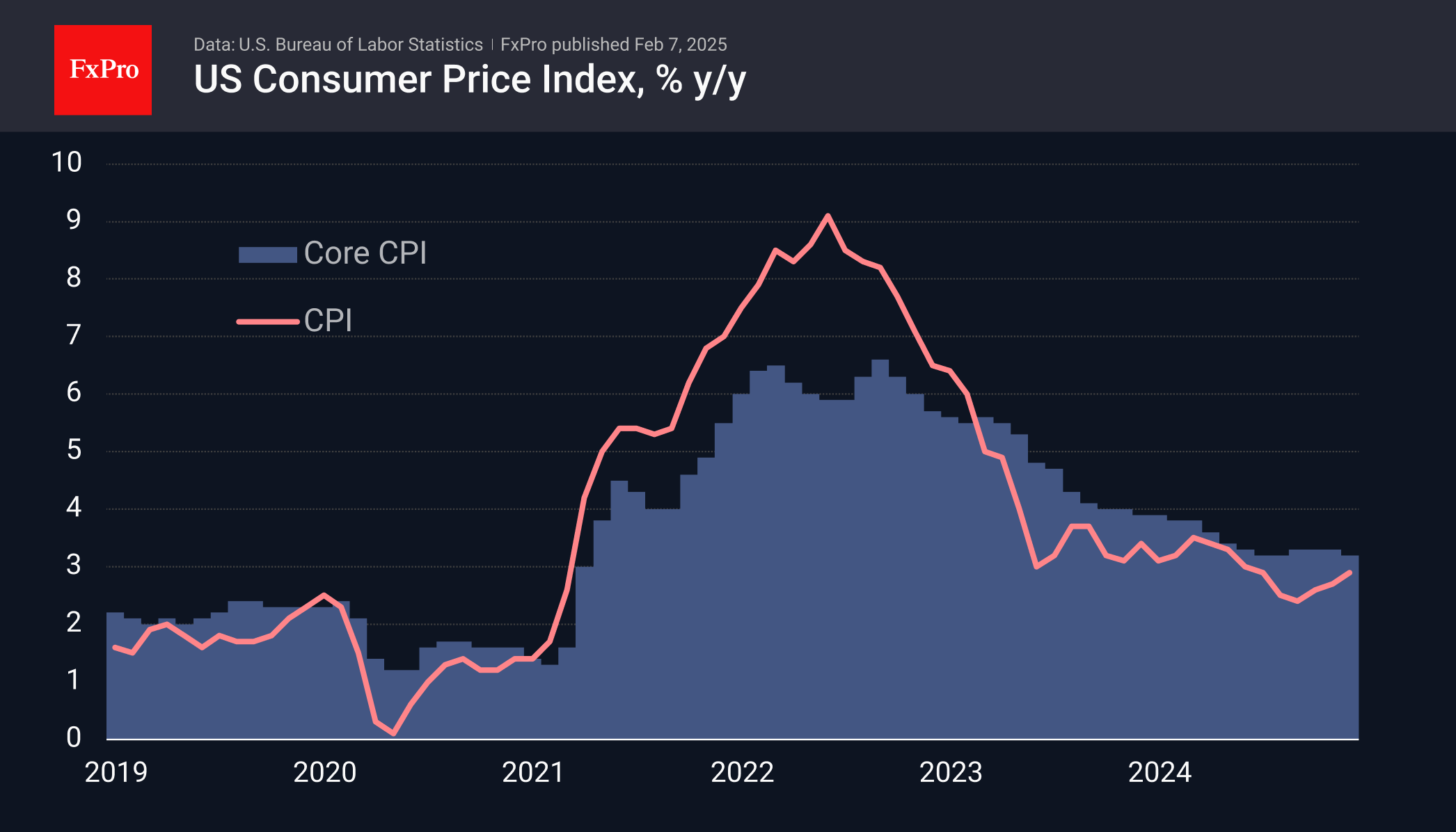

The key economic news will be the release of US consumer inflation data on Wednesday, 12 February. It has been accelerating since September and reached 2.9% in December. Further acceleration is a strong positive for the Dollar as it pushes back the timing of a rate cut.

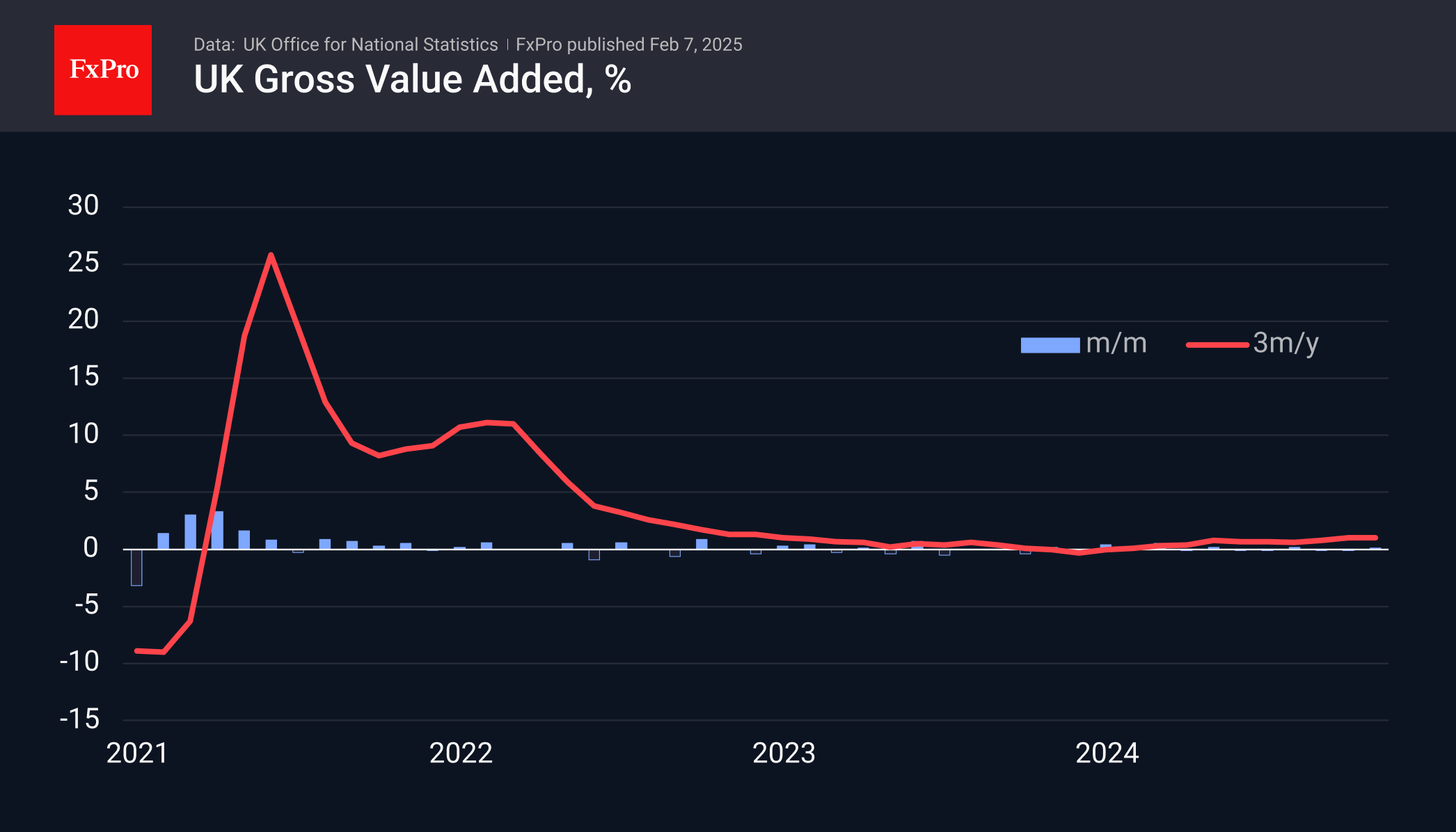

Don't miss the UK's monthly and quarterly GDP estimates on Thursday, 13 February. The Bank of England has just lowered its growth forecast for this year to 0.75%, which is expected to be weak and negative for the Pound.

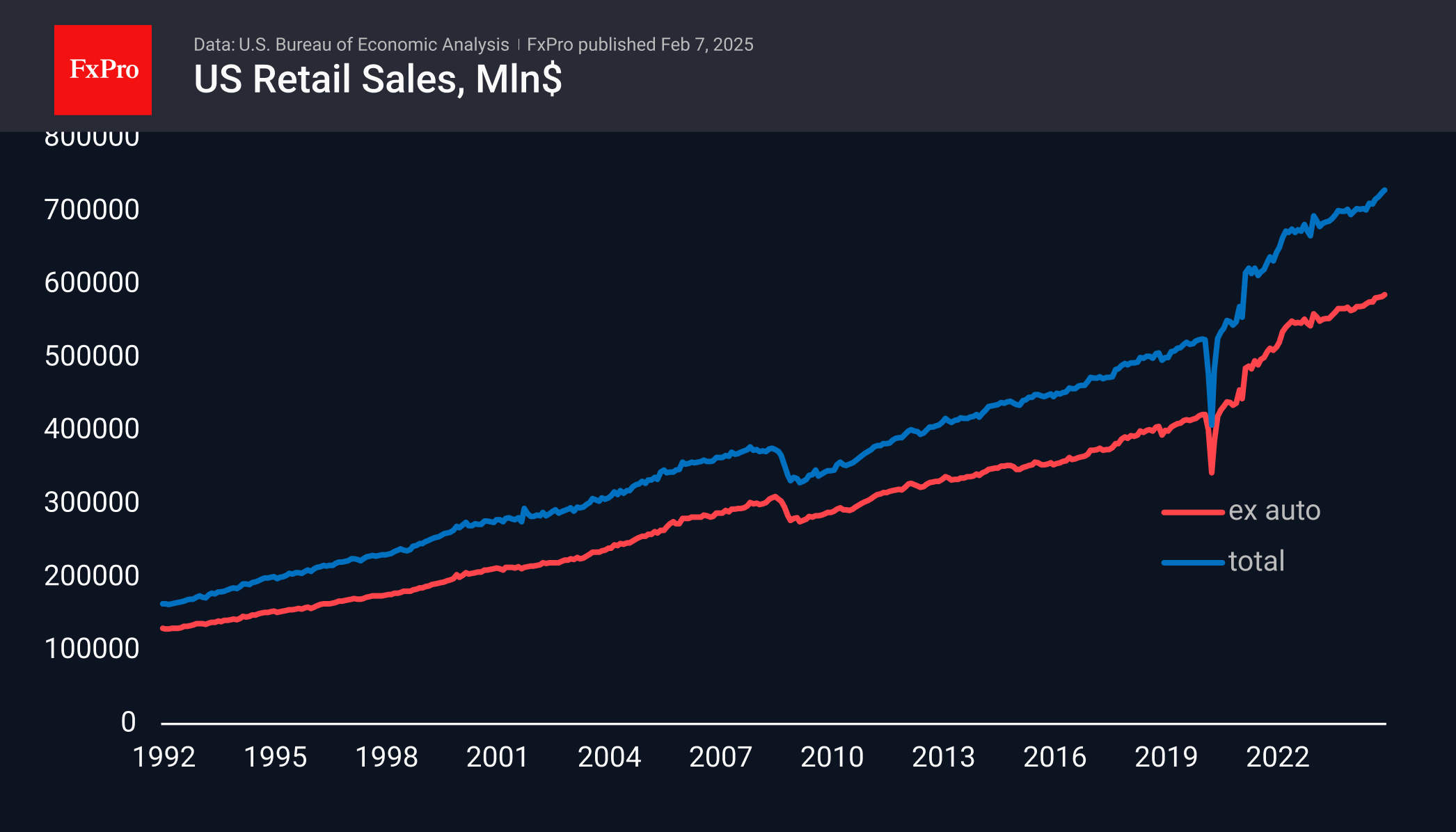

On Friday, 14th February, US retail sales are due to be released. Sales excluding autos and gasoline have been rising every month since last May. The big question is whether this trend will be broken.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)