Advertisement

Sistem terbaru

| System | Gain | Drawdown | Monthly | Performance | |

|---|---|---|---|---|---|

|

|

+15.40% | 2.10% | +15.40% | ||

|

|

+419.65% | 14.86% | +41.72% | ||

|

|

+10.46% | 29.84% | +7.12% | ||

|

|

+34.11% | 25.75% | +34.11% | ||

|

|

+159.78% | 12.41% | +95.50% | ||

|

|

+31.16% | 4.88% | +15.16% | ||

|

|

+38.64% | 0.00% | +38.64% | ||

|

|

+330.75% | 17.84% | +330.75% | ||

|

|

+13.98% | 3.74% | +9.17% | ||

|

|

+311.70% | 54.71% | +311.70% |

Kalender Ekonomi

|

Event

|

Prev.

|

Cons.

|

Act.

|

|||

|---|---|---|---|---|---|---|

|

16m

Med

|

USD | |||||

|

46m

Med

|

USD | |||||

|

1h 46m

Low

|

USD | 16.4M |

16.1M

|

|||

|

3h 16m

Med

|

USD | -0.974M |

-3.4M

|

|||

|

5h 46m

Low

|

KRW | $14.27B |

$15B

|

|||

|

6h 36m

Low

|

JPY | -¥167.2B | ||||

|

6h 36m

Low

|

JPY | -¥496.8B | ||||

|

6h 46m

None

|

EGP |

Milad - SEBUAH - Nabi

|

||||

|

6h 46m

None

|

GMD |

Maulid Nabi - Hari Kelahiran Nabi

|

||||

|

6h 46m

None

|

JOD |

Milad - SEBUAH - Nabi

|

||||

|

6h 46m

None

|

TND |

Milad - SEBUAH - Nabi

|

||||

|

6h 46m

Med

|

AUD | |||||

|

8h 16m

Low

|

AUD | -3.1% | ||||

|

8h 16m

Low

|

AUD | 6% | ||||

|

8h 16m

High

|

AUD | A$5.365B |

A$5B

|

|||

|

8h 16m

Low

|

AUD | 0.5% |

0.2%

|

|||

|

8h 16m

Low

|

AUD | 4.8% |

5%

|

|||

|

8h 46m

Low

|

UGX | -$515.9M |

-$550M

|

|||

|

8h 46m

Low

|

UGX | 58.3 |

59

|

|||

|

10h 16m

Low

|

THB | -0.7% |

-0.7%

|

|||

|

10h 16m

Low

|

THB | 0.84% |

0.75%

|

|||

|

10h 21m

Low

|

JPY | 3.089% | ||||

|

11h 46m

Low

|

EUR | 2.9% |

3.9%

|

|||

|

11h 46m

Low

|

EUR | -0.5% |

0.5%

|

|||

|

12h 46m

Low

|

NOK | NOK286.5B |

NOK219B

|

|||

|

12h 46m

Low

|

SEK | 2% |

1.8%

|

|||

|

12h 46m

Low

|

SEK | 0.8% |

1.1%

|

|||

|

12h 46m

Low

|

SEK | 0.2% |

-0.4%

|

|||

|

12h 46m

Low

|

SEK | 0.3% |

-0.3%

|

|||

|

12h 46m

Low

|

SEK | 3% |

3.2%

|

|||

|

12h 46m

Low

|

SEK | SEK119.3B |

SEK109B

|

|||

|

13h 16m

Low

|

HUF | 3% |

3.2%

|

|||

|

13h 16m

Low

|

CHF | 0% |

0%

|

|||

|

13h 16m

Med

|

CHF | 0.2% |

0.2%

|

|||

|

13h 46m

High

|

CHF | 2.7% |

2.8%

|

|||

|

13h 46m

Low

|

CZK | 2.7% |

2.5%

|

|||

|

13h 46m

Low

|

CZK | 0.5% |

0.1%

|

|||

|

13h 46m

Low

|

MYR | 2.75% |

2.75%

|

|||

|

14h 16m

Low

|

EUR | 44.7 |

45

|

|||

|

14h 16m

Low

|

EUR | 39.7 |

40

|

|||

|

14h 16m

Low

|

EUR | 46.3 |

46.4

|

|||

|

14h 16m

Low

|

EUR | 48.3 |

48.5

|

|||

|

14h 46m

Low

|

JOD | -0.18% |

-0.3%

|

|||

|

14h 46m

Low

|

GBP | -5% |

-2%

|

|||

|

15h 16m

Low

|

EUR | -€1601.2M | ||||

|

15h 16m

Med

|

GBP | 44.3 |

45

|

|||

|

15h 16m

High

|

GBP | 3.2% | ||||

|

15h 16m

Low

|

GBP | 3.7% | ||||

|

15h 26m

Low

|

EUR | 3.452% | ||||

|

15h 26m

Low

|

EUR | 0.81% | ||||

|

15h 26m

Low

|

EUR | 2.166% | ||||

|

15h 26m

Low

|

EUR | 2.72% | ||||

|

15h 46m

High

|

EUR | 0.3% |

-0.2%

|

|||

|

15h 46m

High

|

EUR | 3.1% |

2.4%

|

|||

|

15h 46m

Low

|

EUR | 3.72% | ||||

|

15h 46m

Low

|

ISK | -ISK59.5B |

-ISK68B

|

|||

|

15h 46m

Low

|

GBP | 2.235% | ||||

|

15h 46m

Low

|

EUR | 4.05% | ||||

|

15h 46m

Low

|

EUR | 3.27% | ||||

|

16h 16m

Low

|

EUR | |||||

|

16h 46m

Med

|

EUR | 76.1 |

77

|

|||

|

16h 46m

Low

|

ILS | -21.5% | ||||

|

16h 46m

Low

|

EUR | 20% |

12.5%

|

|||

|

16h 46m

Low

|

EUR | 7.4% |

-1%

|

|||

|

16h 46m

Low

|

EUR | -7.2% |

-2%

|

|||

|

16h 46m

Low

|

EUR | -3.9% |

-1.8%

|

|||

|

16h 46m

Low

|

EUR | €5.8B |

€17B

|

|||

|

17h 16m

Low

|

JOD | 21.3% |

21.4%

|

|||

|

17h 46m

Low

|

MKD | 3% |

2.7%

|

|||

|

18h 16m

Low

|

EGP | $49.04B |

$49.1B

|

|||

|

18h 16m

Low

|

TRY | $91.09B | ||||

|

18h 16m

Low

|

USD | 62.075K |

89K

|

|||

|

18h 46m

Low

|

MXN | -7.1% |

-4.6%

|

|||

|

18h 46m

Low

|

MXN | 0.9% |

0%

|

|||

|

19h 1m

High

|

USD | 104K |

65K

|

|||

|

19h 16m

High

|

CAD | -C$5.86B |

-C$4.75B

|

|||

|

19h 16m

Low

|

CAD | C$67.6B |

C$68B

|

|||

|

19h 16m

Low

|

CAD | C$61.74B |

C$61.9B

|

|||

|

19h 16m

Med

|

USD | $277.3B |

$277.1B

|

|||

|

19h 16m

Med

|

USD | $337.5B |

$356.4B

|

|||

|

19h 16m

Med

|

USD | -$60.2B |

-$75.7B

|

|||

|

19h 16m

Low

|

USD | -1.8% |

2.7%

|

|||

|

19h 16m

Low

|

USD | 6.9% |

1.2%

|

|||

|

19h 16m

High

|

USD | 1954K |

1960K

|

|||

|

19h 16m

High

|

USD | 229K |

230K

|

|||

|

19h 16m

High

|

USD | 228.5K |

229K

|

|||

|

20h 16m

Low

|

NGN | 10% |

0.3%

|

|||

|

20h 16m

Low

|

NGN | 3.13% |

3.5%

|

|||

|

20h 16m

High

|

CAD | 49.3 |

45.1

|

|||

|

20h 16m

Low

|

CAD | 48.7 |

46.1

|

|||

|

20h 31m

High

|

USD | 55.7 |

55.4

|

|||

|

20h 31m

Low

|

USD | 55.1 |

55.4

|

|||

|

20h 46m

Low

|

ALL | 0.4% |

-0.6%

|

|||

|

20h 46m

Low

|

USD | 46.4 |

46.2

|

|||

|

20h 46m

Low

|

USD | 52.6 |

53

|

|||

|

20h 46m

Low

|

USD | 69.9 |

70

|

|||

|

20h 46m

Low

|

USD | 50.3 |

50.1

|

|||

|

20h 46m

High

|

USD | 50.1 |

51

|

|||

|

21h 16m

Low

|

USD | 18B | ||||

|

21h 46m

Low

|

TND | 5.3% |

5.2%

|

|||

|

21h 46m

Low

|

TND | 0.3% |

0.2%

|

|||

|

22h 16m

Low

|

USD | 4.245% | ||||

|

22h 16m

Low

|

USD | 4.145% | ||||

|

22h 46m

Low

|

USD | 0.427M | ||||

|

22h 46m

Low

|

USD | -1.786M |

-0.3M

|

|||

|

22h 46m

Low

|

USD | -0.838M | ||||

|

22h 46m

Low

|

USD | -0.113M | ||||

|

22h 46m

Low

|

USD | 0.102M | ||||

|

22h 46m

Med

|

USD | -1.236M |

-1M

|

|||

|

22h 46m

Med

|

USD | -2.392M |

-3.4M

|

|||

|

22h 46m

Low

|

USD | 0.299M | ||||

|

22h 46m

Low

|

USD | -0.328M | ||||

|

22h 46m

Low

|

USD | 5.69% | ||||

|

22h 46m

Low

|

USD | 6.56% | ||||

|

22h 51m

Med

|

USD | |||||

|

23h 46m

Low

|

EUR | -1.7% |

2.3%

|

|||

|

23h 46m

Low

|

UYU | 4.53% |

4.5%

|

|||

|

1d

Med

|

BRL | $7.08B |

$4.9B

|

|||

|

1d

Low

|

COP | 2.2% |

2.5%

|

|||

|

1d

Low

|

USD | $6.6T | ||||

|

1d

Med

|

USD | |||||

|

1d

Low

|

JPY | 2.5% |

3%

|

|||

|

1d

Low

|

JPY | 0.9% |

1.1%

|

|||

|

1d

Med

|

JPY | 1.3% |

2.3%

|

|||

|

1d

Med

|

JPY | -5.2% |

1.3%

|

Most Popular Challenges

Instant | 10K

$235

FundingPips Pro | 100K

$399

$379.05

Experienced (1 Phase) | 12.5K

$119

$107.1

_PN.png)

Diamond Program | 1k

$50

$42

Berita

Consumer Staples, Materials Stocks Rise As TSX Hits New Record High

The Canadian market is up in positive territory a little past noon on Wednesday, thanks to strong gains in consumer staples, materials and technology sectors. Energy and healthcare stocks are weak, while shares from rest of the sectors are turning in a mixed performance.

RTTNews

|

26 minutes ago

U.S. Job Openings Fall To Ten-Month Low In July

Job openings in the U.S. fell to their lowest level in ten months in July, according to a report released by the Labor Department on Wednesday. The Labor Department said job openings dipped to 7.181 million in July after tumbling to a downwardly revised 7.357 million in June.

RTTNews

|

1h 38min ago

U.S. Factory Orders Slump Roughly In Line With Estimates In July

A report released by the Commerce Department on Wednesday showed an extended slump by new orders for U.S. manufactured goods in the month of July. The Commerce Department said factory orders fell by 1.3 percent in July after plunging by 4.8 percent in June. Economists had expected factory orders to decrease by 1.4 percent.

RTTNews

|

2h 45min ago

Eurozone Private Sector Growth At 1-Year High

The euro area private sector expanded at the fastest pace in a year in August but the overall pace was sluggish as the service sector held back growth, final survey data from S&P Global showed on Wednesday. The HCOB composite output index rose to 51.0 in August from 50.9 in July. The score was slightly below the initial estimate of 51.1.

RTTNews

|

4h 0min ago

Bay Street Likely To Open On Mixed Note

Canadian shares are likely to open on a somewhat mixed note on Wednesday, tracking commodity prices. With some crucial economic data, including jobs data from Canada and the U.S. due later in the week, the mood is likely to remain cautious.

RTTNews

|

4h 21min ago

Analisis

GBP/USD Tumbles: Investors Lose Confidence in UK Fiscal Sustainability

The GBP/USD pair declined to 1.3366 on Wednesday, reflecting intensified selling pressure on the pound. Sterling’s weakness stems from a sharp rise in UK government bond yields and broader global concerns regarding fiscal stability.

RoboForex

|

6h 39min ago

Gold touches new record, dollar holds firm, pound’s losses deepen

Gold and US dollar remain in demand amid bond market selloff; Pound slips again as UK yields continue to surge; But Wall Street given a lifeline following Google’s legal win; ISM manufacturing PMI spurs yo-yo price action, JOLTS awaited next

XM Group

|

7h 5min ago

Bitcoin tries to bounce back up

Expert market comment made by Chief Market Analyst Alex Kuptsikevich of the FxPro Analyst Team: Bitcoin tries to bounce back up

FxPro

|

8h 29min ago

Silver Pulls Back After 14-Year Highs as Dollar Strengthens | 3rd September 2025

Silver eased from 14-year highs near $41 as profit-taking emerged, while the US Dollar Index rose toward 98.50 on safe-haven demand. EUR/USD slipped toward 1.1600, USD/JPY held above 147.00, and USD/CNY traded near 7.11 amid cautious PBoC guidance. Markets await US jobs, PMI, and Fed signals for FX and commodity direction.

Moneta Markets

|

11h 37min ago

ATFX Market Outlook 3rd September 2025

U.S. stocks closed lower on Tuesday, with the U.S. manufacturing sector contracting for the sixth consecutive month in August, as investors assessed the outlook for President Trump's tariff policy after a federal appeals court ruled that most of his broadly imposed tariffs were illegal. Investors also awaited Friday's monthly U.S. jobs report.

ATFX

|

12h 7min ago

Suku bunga

Jam pasar

Join our community

Topik Terbaru

35

46 minutes ago

13

59 minutes ago

63

1 Hour ago

114

1 Hour ago

180

2 hours ago

73

2 hours ago

0

3 hours ago

0

4 hours ago

0

4 hours ago

2

4 hours ago

Top Services

★

4.9

out of

5

(6)

★

4.9

out of

5

(15)

★

5

out of

5

(42)

★

5

out of

5

(20)

★

5

out of

5

(1)

★

5

out of

5

(421)

Konverter mata uang

Order Book

Spread Forex Langsung

| Pialang | EUR/USD | EUR/GBP |

|---|---|---|

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Open Account

Open Account

|

- | - |

Forex Sentiment

Charts Activity

-

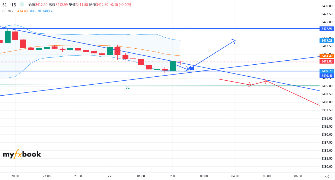

XAUUSD,H4 by Highstandard Aug 30 at 23:28

-

XAUUSD,M15 by ume456 Aug 29 at 02:18

-

XAUUSD,M30 by Ashraf5511 Aug 28 at 18:56

-

EURUSD,M5 by Ephy Aug 28 at 08:21

-

BTCUSD,M30 by Ksrao333 Aug 24 at 06:53