Dollar safe-haven pedigree to be tested if risk appetite turns sour

Dollar struggles to recover; equities' improved mood could be tested

While the US dollar was under pressure across the board last week, equity indices enjoyed a strong bid, with the US 100 index leading the rally with a robust 3.7% gain. This was the strongest weekly rally since late June, as tech stocks continued their advance, lifted by Apple and Tesla, and also supported by the prospects of a lower Fed funds rate, which is expected to translate into lower borrowing rates, and a strong earnings season.

This decent risk-on appetite could be tested today, as the US-China tariff truce deadline expires tomorrow, and there are reports that both Nvidia and AMD have agreed to pay 15% of their chip sale revenues in China to the US government in order to secure a continued and uninterrupted access to China’s market. Following Apple’s extraordinary $600bn investment commitment, the US administration has effectively obtained a foothold in both Nvidia’s and AMD’s bottom line.

The crypto world is on fire; gold is surrendering its recent gains

Meanwhile, cryptocurrencies are in their own dream world following the signature of the executive order that allows private equity, real estate, crypto and other alternative assets into 401(k) retirement accounts. With this specific defined-contribution workplace scheme holding more than $8.7 trillion in the first quarter of 2025, even a tiny reallocation to cryptos will be a massive tailwind for bitcoin and the alternative coins.

At the time of writing, bitcoin is trading north of 122k, with ether stealing the limelight. The biggest altcoin has climbed to $4,325, the highest level since December 2021, and around 200% above its April trough. However, it remains below its all-time high of $4,864.

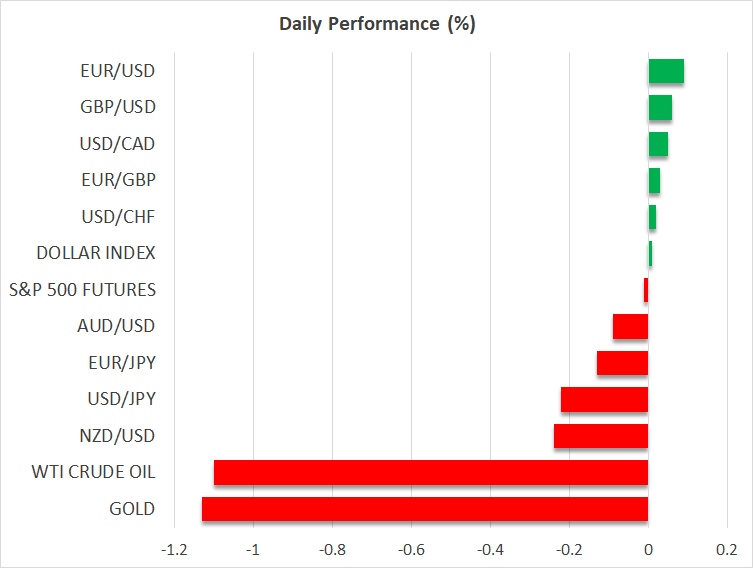

Amidst this crypto frenzy, gold is dropping today towards the $3,355 area. One could argue that the August 15 meeting between Trump and Russian President Putin is contributing to this decline, although the Ukraine-Russia conflict remains a very difficult equation to solve. With Russia demanding official recognition of its territorial gains in Ukraine, Zelensky and the European leaders, who are not invited to Friday’s meeting, have already made a statement against such an agreement.

Tuesday’s US CPI report in the spotlight

With Fed doves clearly pushing for consecutive rate cuts – FOMC Board member Bowman called for three rate cuts until year-end over the weekend – Tuesday’s CPI report for July could prove pivotal for the rates outlook. A stronger report could ease the pressure on Chair Powell for immediate action, shifting the focus to the August 21-23 Jackson Hole symposium.

Meanwhile, following Miran’s selection to take Adriana Kugler’s position at the Fed until January 31, 2026, Trump’s list for the next Fed Chair is growing almost by the day. Unfortunately for investors, this selection process could still have plenty of twists and turns before a final selection is made, potentially overshadowing the Fed’s activities and even denting its independence.

RBA set to cut by 25bps on Tuesday

The RBA will conclude its two-day meeting on Tuesday, with markets being confident that a 25bps rate cut will be announced. After July’s surprise decision to keep rates unchanged, the softer inflation report for the second quarter of 2025 has firmly opened the door to easing, particularly as the tariff picture remains clouded.

Governor Bullock is expected to maintain a steady outlook, but also advertise flexibility if conditions demand a more aggressive stance. Having resisted the dollar’s strength during July, the aussie could find itself under selling pressure on Tuesday if Bullock et al. strike a more dovish-than-anticipated tone.

.jpg)