Dollar dips on hopes of gradual tariffs ahead of US inflation data

Sentiment improves amid reports of gradual tariff hikes

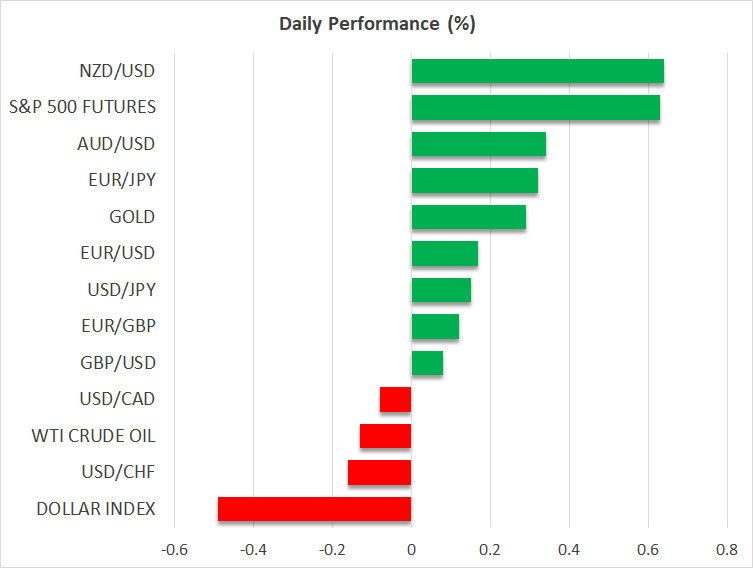

The US dollar snapped its five-day winning streak on Tuesday and risk sentiment got a much-needed boost following reports that incoming president Donald Trump’s economic team are weighing up the option of gradually raising tariffs on US imports. According to Bloomberg, tariffs could be hiked in stages by between 2% and 5% a month instead of in one go to limit the impact on inflation.

The 10-year Treasury yield, which yesterday surpassed 4.80% for the first time in 14 months, slid to around 4.75% after the reports, while the greenback pulled back from more than two-year highs against a basket of currencies, with its index losing 0.5%.

Stocks rejoiced the news, however, as investors sighed some relief amid the ongoing jitters about persistent inflation in the United States. Rate cut expectations have been sharply scaled back in recent weeks, with Friday’s hot jobs report adding to the recent run of upbeat economic indicators.

Only one 25-basis-point rate cut is fully priced in now, and although the tariff news has seen investors add a few basis points to the total cuts expected for 2025, there is scope for an even larger reversal in the recent moves, highlighting the downside risks to the dollar should Trump, who is days away from taking office, continue to soften his stance on his aggressive policies.

US stocks in patchy rebound, US data and Fed speakers eyed

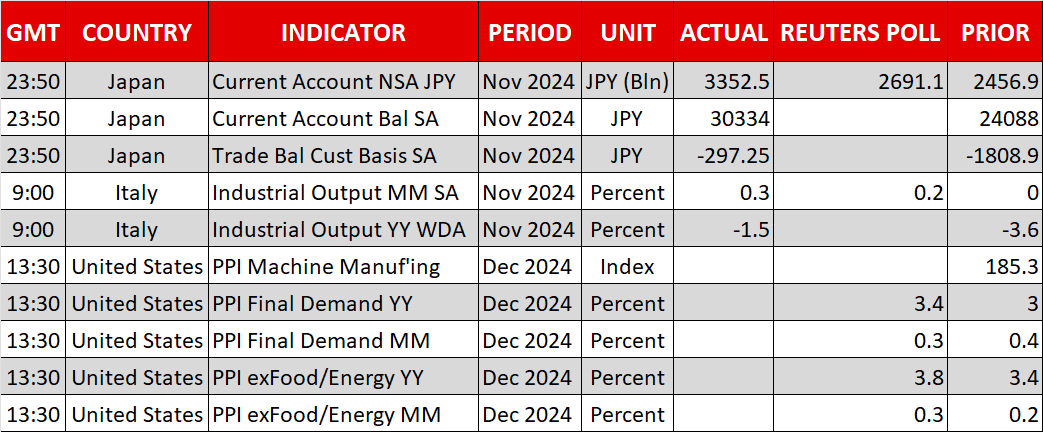

In the immediate term, however, investors will be keeping an eye on today’s producer price index for December ahead of tomorrow’s CPI numbers for the same month. Fed policymakers will also probably be making headlines with the New York Fed’s Williams and Kansas City’s Schmid due to speak later in the day.

On Wall Street, a combination of dip buying and rotation out of tech pushed the Dow Jones 0.9% higher on Monday, with the broader S&P 500 notching up modest gains. The Nasdaq 100 extended its loses, though, to near two-month lows.

In one of its final acts, the Biden administration announced a new set of restrictions on US exports of AI chips, weighing on tech stocks. The measures won’t take affect until well after Trump is in the White House, so there is the possibility of them being watered down or scrapped altogether.

But the mood music could change before that if the Q4 reporting season, which gets underway this week with bank earnings, underscores the positive outlook for the Magnificent 7.

China optimism lifts aussie and kiwi, yen and pound struggle

Equities elsewhere are rebounding today, aided by softer bond yields in Europe. Chinese stocks are the best performers after both the People’s Bank of China and the country’s securities regulator pledged further support to stabilize the yuan and the stock market.

The reports of a gradual approach to US tariffs and speculation that Chinese-owned TikTok could sell its US business to Elon Musk also added to the optimism.

In bond markets, Japanese yields bucked the trend and spiked higher as investors upped their bets that the Bank of Japan will raise interest rates when it meets next week, following somewhat hawkish remarks by Deputy Governor Himino earlier today.

But the yen succumbed to the brighter market mood and slipped against its major peers. The pound also struggled, unable to stage much of a recovery as concerns about UK borrowing persisted.

It was a more positive picture for the commodity linked Australian and New Zealand dollars, however, which rose for a second day against the greenback, driven mainly by the improving China sentiment.

.jpg)