EBC Markets Briefing | Can Trump unlock new powers?

Trump on Monday laid out a sweeping plan to maximize oil and gas production, including declaring a national energy emergency to speed permitting and rolling back environmental protections.

He reversed Biden's efforts to protect Arctic lands and coastal waters from drilling, revoking EV subsidies, suspending offshore wind lease sales, and lifting a freeze on LNG export permitting.

It is aimed to bring down still-sticky consumer prices and improve national security - the promise he made in his election trial. In the longer term, it will help secure the US supremacy in a frontier.

US data centre power use could nearly triple in the next three years, and consume as much as 12% of the country's power to fuel AI and other technologies, according to the Department of Energy.

Environmentalists deem the package a giveaway for oil barons who helped fund his campaign. The US is the second-largest emitter of greenhouse gases, next to China where energy transition is accelerating.

During his first term, Trump invoked emergency powers typically reserved for natural disasters and other crises to try and keep unprofitable coal and nuclear plants running.

Inflation ticked up in December on the back of higher energy and food prices, according to the BLS. Gasoline prices fell less than usual and the CPI registered it as an inflation increase.

Reject Involution

Rystad Energy said, althoug the shale industry may be encouraged by Trump’s policies, a potential oversupply and a stagnation in well productivity mean the producers are less likely to boost drilling budgets.

They are likely to cut back on Lower 48 drilling if prices stay below $70 per barrel, according to the consulting firm. Benchmark crude oil price is in the high 70s – hardly a buffer against output increase.

US oil and gas producers are unlikely to radically increase production under Trump as companies remain focused on capital discipline, a senior executive at Exxon Mobil echoed the view.

Exxon warned of weaker Q4 profits amid lower reefing margins. It has just completed the $60 billion acquisition of Pioneer Natural Resources, consolidating its position as the largest shale producer.

Another blow to Trump’s energy independence dream is historically weak gas prices for electricity generation, not restrictive former policies, were the main factor in suppressing US gas production in 2024.

The shale boom chewed up large portions of the most easily recoverable reserves in major shale deposits, and means the cost of extracting the remaining reserves will likely creep higher.

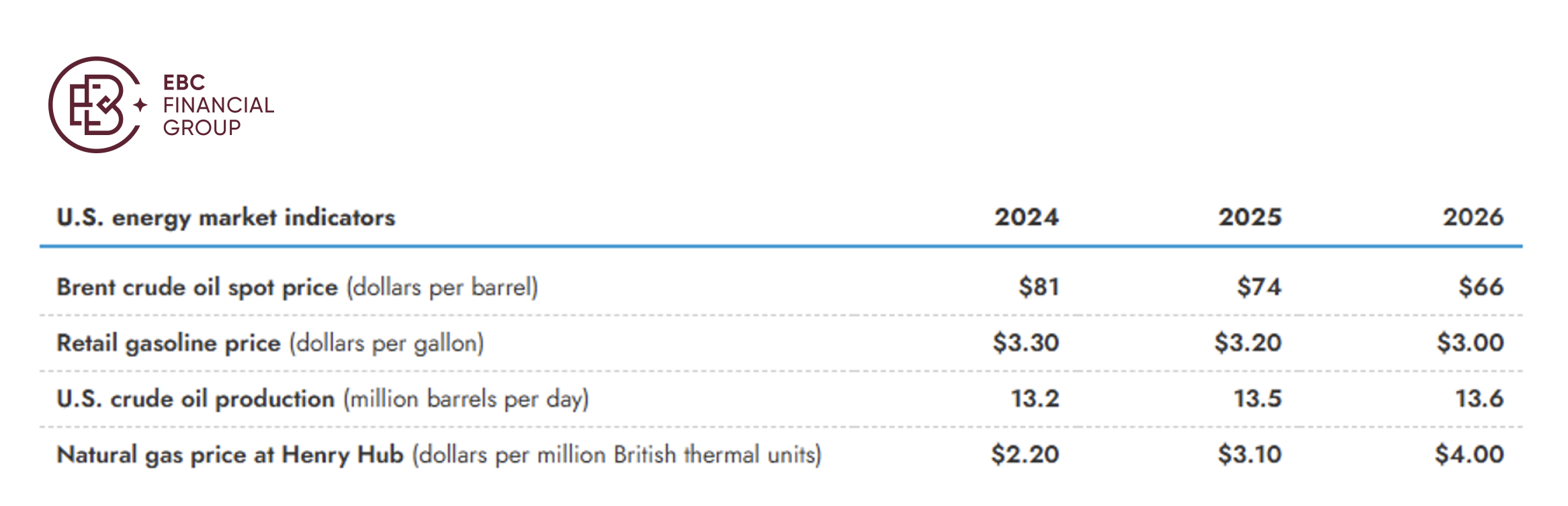

Even so, the EIA projected that US crude oil production will average 13.55 million bpd in 2025 and 13.62 million bpd in 2026. Its Brent crude price forecast is $74 for this year and $66 for the next year.

Putin’s sore sport

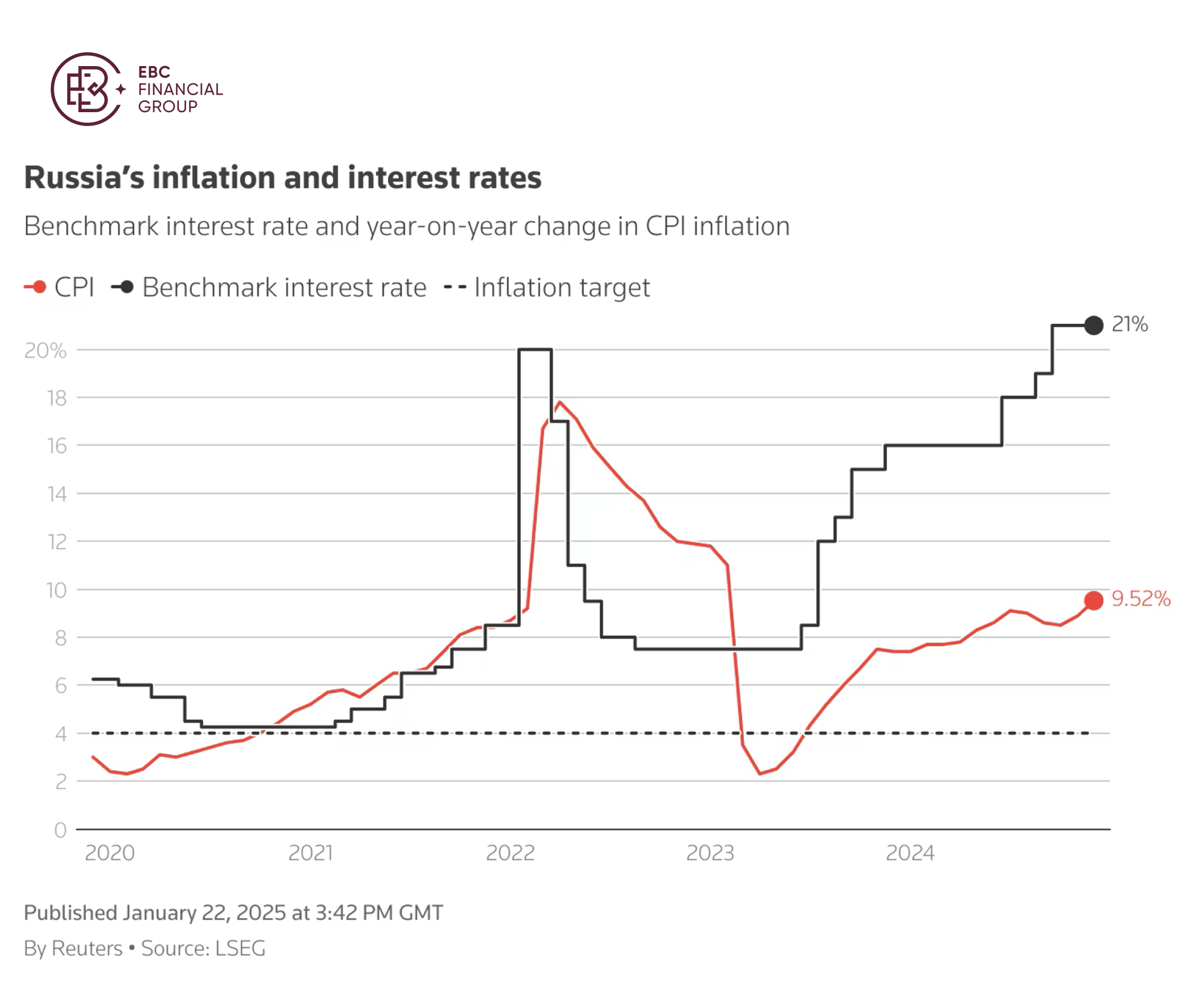

Putin has grown increasingly concerned about soaring inflation that has been driven by massive defence spending, just as Donald Trump pushes for an end to the Ukraine conflict, a Reuters report said.

Runaway consumer prices made more gains in December, rising to 9.5% from a year ago. The RCB hike its key interest rate by another 200 bps to a multi-year high of 23% in the month.

Putin is reportedly ready to discuss ceasefire options with Trump but that Russia's territorial gains in Ukraine must be accepted and that Ukraine must drop its bid to join NATO.

Joe Biden's administration recently imposed the broadest package of sanctions to so far target Russia's energy revenue, and Trump threatened more sanctions this week unless Moscow negotiates.

Russia's economy grew robustly over the past two years despite multiple rounds of Western sanctions. However, its oil exports behind the resilience will be hurt severely by the new sanctions.

Without an immediate peace deal, the US could still benefit from China and India sourcing more oil from other producers. Meanwhile, Trump asked Saudi Arabia to pump more oil.

Russia will lose more market shares if the kingdom responds to the call, putting OPEC+’s cooperation at stake. In any case, Putin has to face tougher challenges in the years to come.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.