EBC Markets Briefing | Funds take refuge in Big Tech as US economy sags

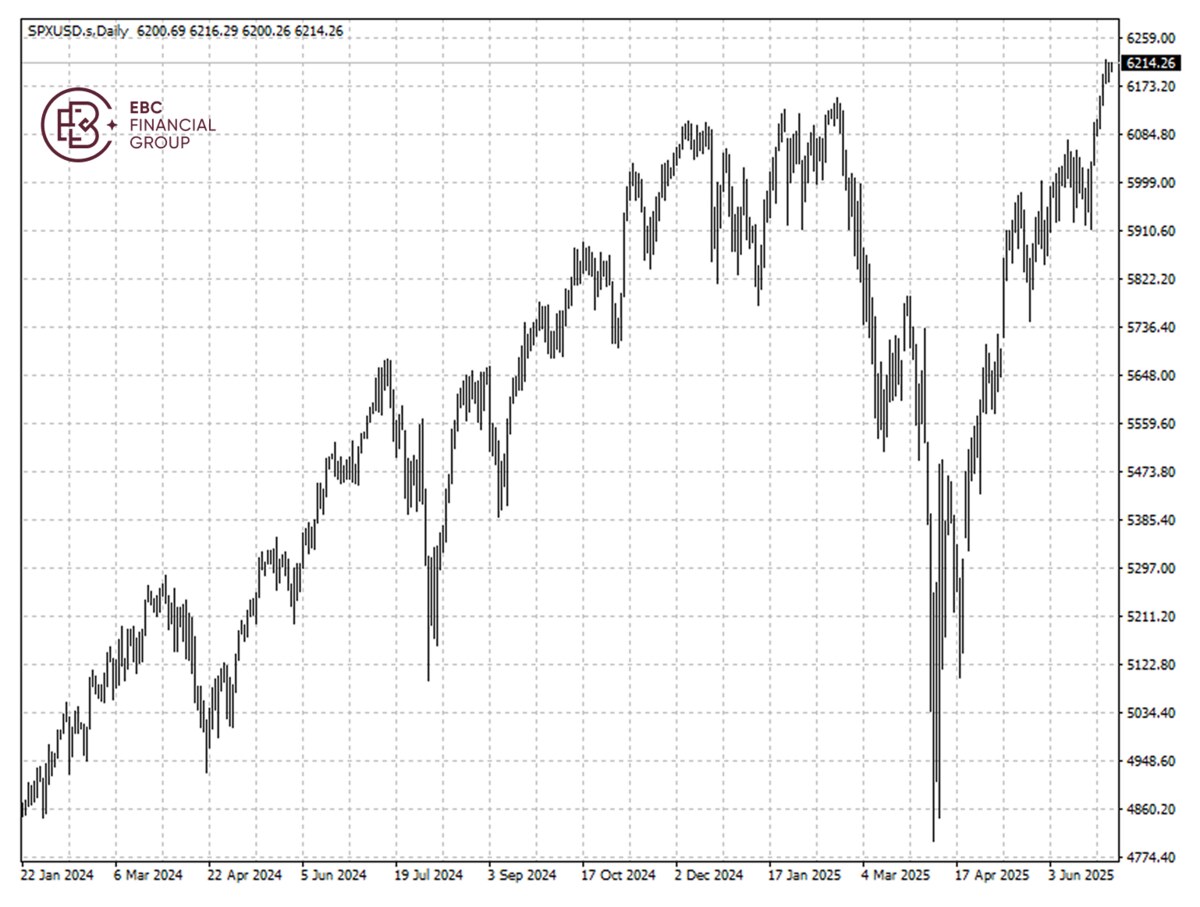

The US stock market rallied to a fresh record on last week, lifted by growing expectations of inflation back to target, cooling trade tensions and the end of Russia-Ukraine war.

Some strategists have warned the rally risks overheating into a bubble. Cash levels as a percentage of total assets remained at 3.9%, a level that is consistent with a so-called sell signal for stocks.

Global ex-US equity funds received their biggest inflows in more than four years in July, signalling diversification away from the US on concerns over the economy, stretched stock values, and a weakening dollar.

According to LSEG Lipper, those funds secured an inflow of $13.6 billion in July. In contrast, US-focused equity funds saw $6.3 billion in outflows, marking their third straight month of redemptions.

Many investors bet Germany's enormous fiscal stimulus package and an upsurge in European defence spending would drive a prolonged upturn in the region's equity markets.

However, European companies fell behind their US counterparts in Q2 earnings by a large margin mainly due to strong results from Silicon Valley's tech giants and Wall Street banks.

"No one expected a good season in Europe," said Andreas Bruckner, investment strategist at BofA.

"The bar was quite low but, excluding financials, they still missed that bar."

Not great yet

Nonfarm payroll growth was slower than expected in July and the unemployment rate ticked higher. Fed Chair Powell's final Jackson Hole speech may clarify if he persists in wait-and-see approach.

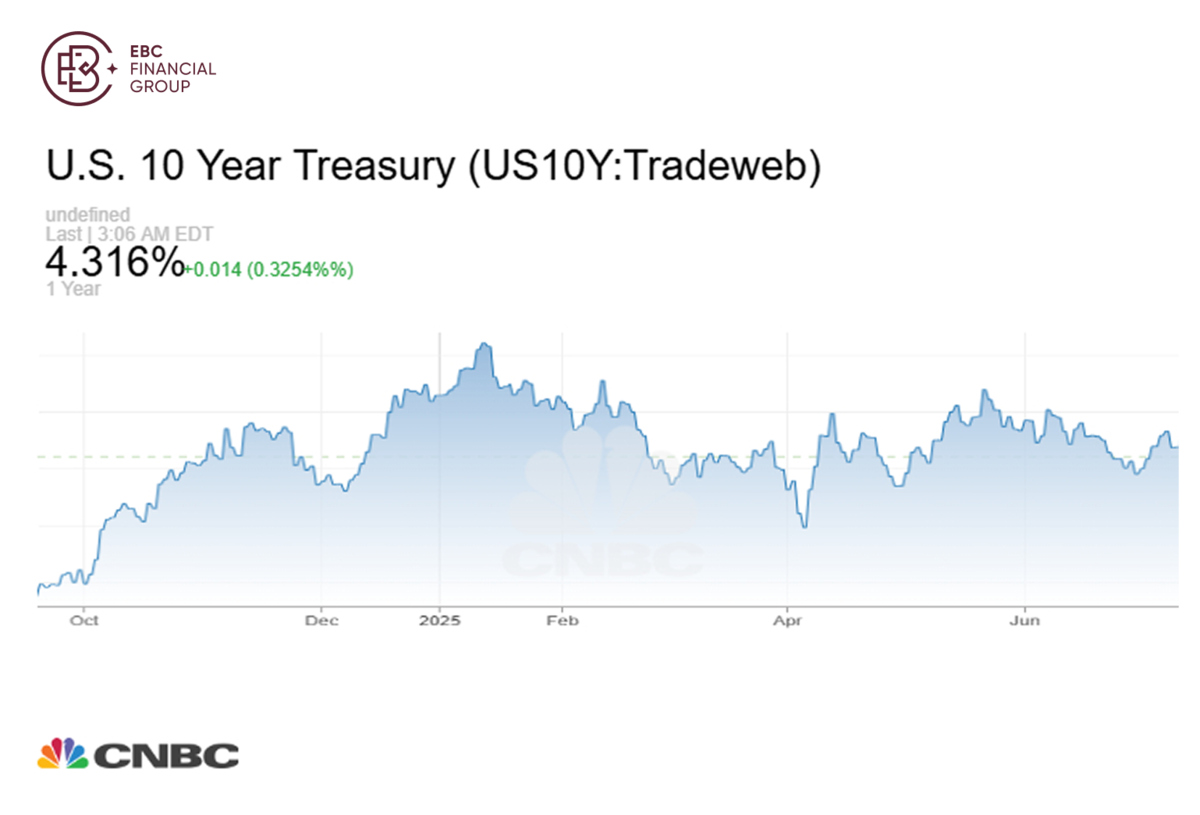

Goldman Sachs said on Wednesday in a research note it expects the Fed to deliver three 25-bp interest rate cuts this year and two more in 2026.

Treasury Secretary Bessent said on Bloomberg TV that he thought an aggressive half-point cut was possible. But US rate futures have priced a 93% chance of a 25-bps easing next month.

The US trade deficit in goods narrowed to the lowest level in nearly two years in June as imports fell sharply. That came in contrast to surging imports in Q1 that reflected a degree of frontloading.

Consumer sentiment soured in August for the first time in four months due to cooling labour market and price hike. MAGA has not delivered given plunging private sector investment in Q2.

S&P Global said it expects "meaningful" federal government revenue from Trump's broad tariff policies to "generally offset weaker" revenue expected from recently enacted major tax-and-spending bill.

The company also warned, "We could lower the rating over the next two to three years if already high deficits increase." The benchmark 10-year Treasury yield perches around 4.3% as of now.

All-in on tech

Owning Big Tech is once again the most popular trade, according to BofA's monthly fund manager survey, as upbeat earnings and improved risk sentiment send investors back into stocks.

Wall Street's largest hedge funds including Bridgewater Associates, increased their exposure to Big Tech in the previous quarter and cut exposure to laggards in industries like defence and consumer.

The macro hedge fund founded by Ray Dalio more than doubled its bets in Nvidia, and increased holdings in Alphabet and Microsoft by 84.1% and 111.9% respectively.

Since the start of the current bull market in October 2022, large-cap technology has been the clear winner in the market. In recent weeks, there have been some signs of rotation under the surface.

Notably the Trump administration is discussing taking a 10% stake in Intel, which is deemed essential for the struggling chipmaker and for the sake of national security.

The BofA noted that that the last notable run of similar outperformance for the 50 largest stocks in the index came in the late 1990s, leading into the bursting of the dot-com bubble.

Following the bust, the market saw a large shift from megacap growth, leading to value and small-cap stocks outperforming during the early 2000s. A similar rotation might be occurring soon, the bank said.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.