- หน้าหลัก

- ชุมชน

- ระบบการเทรด

- Gold Trader

Advertisement

Gold Trader

ผู้ใช้ได้ลบระบบนี้

Edit Your Comment

Gold Trader การสนทนา

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 12, 2020 at 22:28

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Felhagamand posted:

According to my observations, interesting situations with silver are rare, maybe this metal is not very popular?!

Yes, that does appear to be the case. I thought as it is used in solar panels, circuit boards and most importantly human internal instruments (such as pace-makers for an aged population) that it would be more popular from an industrial perspective.

The fact that Bitcoin took a hammering before gold and silver yesterday is very interesting.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 12, 2020 at 22:32

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

KhoiDam posted:

I think I use gold much more often because this asset correlates perfectly with the U.S. dollar and therefore it is much easier to make quality forecasts.

I have trouble forecasting gold and did not see the move yesterday on the books.

My thinking was that if the USD was taking a hit then the price of gold would go up. A bit like a see-saw on the XAUUSD pair.

In my opinion, what we had yesterday was a sell off on gold and strengthen on USD.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 12, 2020 at 22:38

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Saithirana posted:

I would not say that silver is an asset that is rarely used in trading. I have many acquaintances who actively earn on metal values and it brings them pleasure. Another thing is that news that would be related to silver happens an order of magnitude less frequently than news on gold or platinum. On the other hand, silver is less susceptible to strong jumps, and as a rule, the price of this goes from level to level, which allows you to competently think out long-term positions.

Yes, it is interesting, sometimes silver makes a move prior to gold, other times there is a lag and delay of move after gold.

Still, I am bullish on silver and gold.

My basic thinking is that with all the money that is being printed and the devaluation of the dollar out of existence, then where can someone hold something of value? Gold and silver have been stores of value for thousands of years.

Why would someone save up a big pile of cash only to have it devaluing as they sleep? Maybe before when you received a return of interest on your deposits, however those days have passed us.

Holding a silver or gold coin has no counter-party risk. Whereas holding a dollar is holding a bit of paper that a government's claim that is worth is based on faith and confidence that someone else (buyer/seller) believes that it is worth something.

Fascinating times...

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 12, 2020 at 22:55

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Hello followers,

Wow, there was quite a sell-off on gold yesterday! Plus of course other markets crashing.

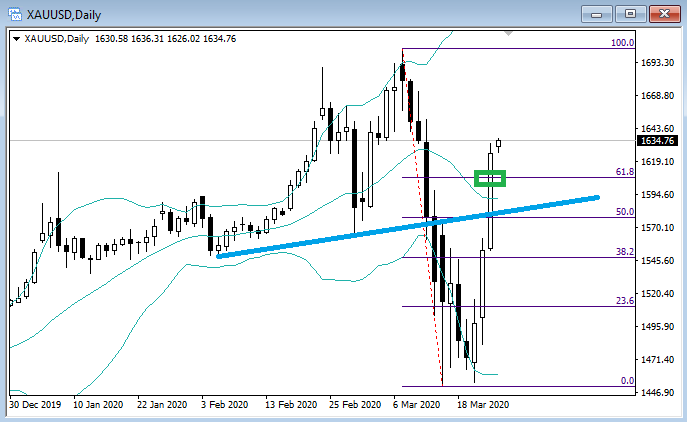

Many people look at the day in isolation and think it is the end of the world, however when you look at the charts over 2-5 years it is not that bad, it is more like a move back to the average longer term moving average.

My take on it was that the panic was about getting out of assets and back into USD.

Bitcoin took an early hammering, gold next and then when the US stock markets opened it was on for young and old! I noticed a trading halt and then a slight pull-back (indicating traders buying in) and then a close at a much lower level.

Of course the virus is a major concern on the markets, however this sort of correction was coming virus or not.

Are we over the worst of it? That is the question...(today will be interesting!!)

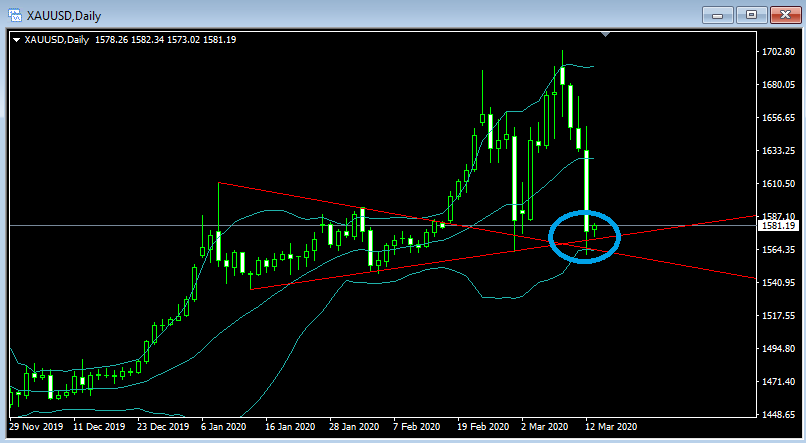

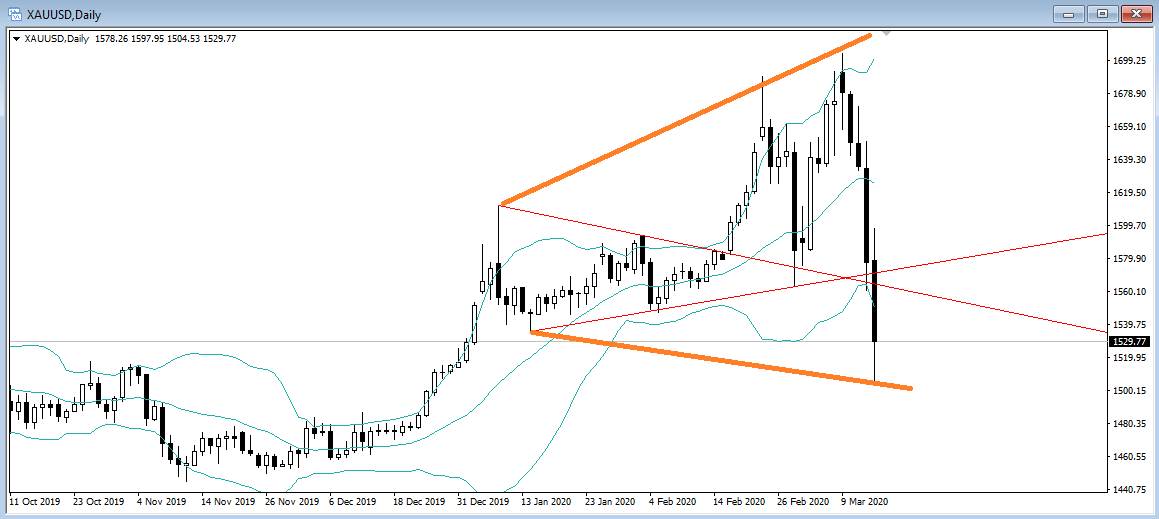

Looking at the gold chart we are at a cross-road. Whilst gold did break the lower line, it did not close below and came back up. This indicates that the upper trend-line may hold. Today's close is important because if the close is below the upper line then it is not looking good for gold.

Honestly, I feel for those that have lost 'hard-earned' money in the markets yesterday and am sure that many people have profited from this correction.

We are in unprecedented times and it is quite clear that even more economic stimulus (money printing) at the top end of town is not working.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 14, 2020 at 03:04

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Zoo Wee Mama...

What a huge sell-off. The buyers are just not there.

The previous daily channel did not hold and we now have higher highs and lower lows with the lows being dominant.

The reversal on DJIA is concerning, down 10% one day, up 10% the next. This is too volatile and am not expecting any normality in the markets next week. Part of me is saying to myself not to be surprised if the banks do not open next week and report an expended closing. I just do not believe the bounce on DJIA and find it difficult to believe that Trump declaring an emergency around the virus could turn things around like this.

Looking at the daily gold chart it is hard to get a clear view of the next few days.

Am still bullish on gold even with the charts showing the opposite.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 20, 2020 at 01:09

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 24, 2020 at 23:25

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Hello followers,

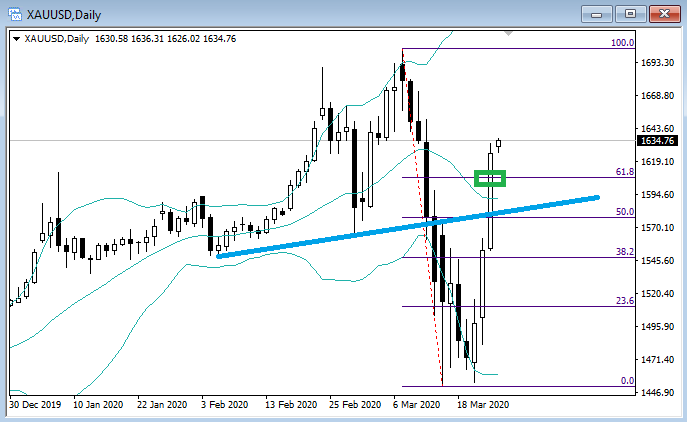

Wow, we have seen quite a recovery on gold.

I have still maintained my bullish view on Gold, especially considering the massive global money printing in play at the moment.

The last few days have been remarkable and my feeling is that with yesterday's performance on the stock markets that there is still further downside around the corner. Stock markets have been up 5% one day, down 10% the next and very choppy as the markets are trying to price in this global pandemic (the pin) as well as the collapse of financial markets (the over-inflated bubble).

What is interesting is that the spread on XAUUSD and XAUEUR has jumped for no apparent reason, almost to $5.00. I have contacted Pepperstone to ask for an explanation.

As for Gold Trader, unfortunately it does not pick up major moves like we have seen in the last few days. So am sitting on my hands waiting for some settling in price.

Wow, we have seen quite a recovery on gold.

I have still maintained my bullish view on Gold, especially considering the massive global money printing in play at the moment.

The last few days have been remarkable and my feeling is that with yesterday's performance on the stock markets that there is still further downside around the corner. Stock markets have been up 5% one day, down 10% the next and very choppy as the markets are trying to price in this global pandemic (the pin) as well as the collapse of financial markets (the over-inflated bubble).

What is interesting is that the spread on XAUUSD and XAUEUR has jumped for no apparent reason, almost to $5.00. I have contacted Pepperstone to ask for an explanation.

As for Gold Trader, unfortunately it does not pick up major moves like we have seen in the last few days. So am sitting on my hands waiting for some settling in price.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 26, 2020 at 08:50

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Hello followers,

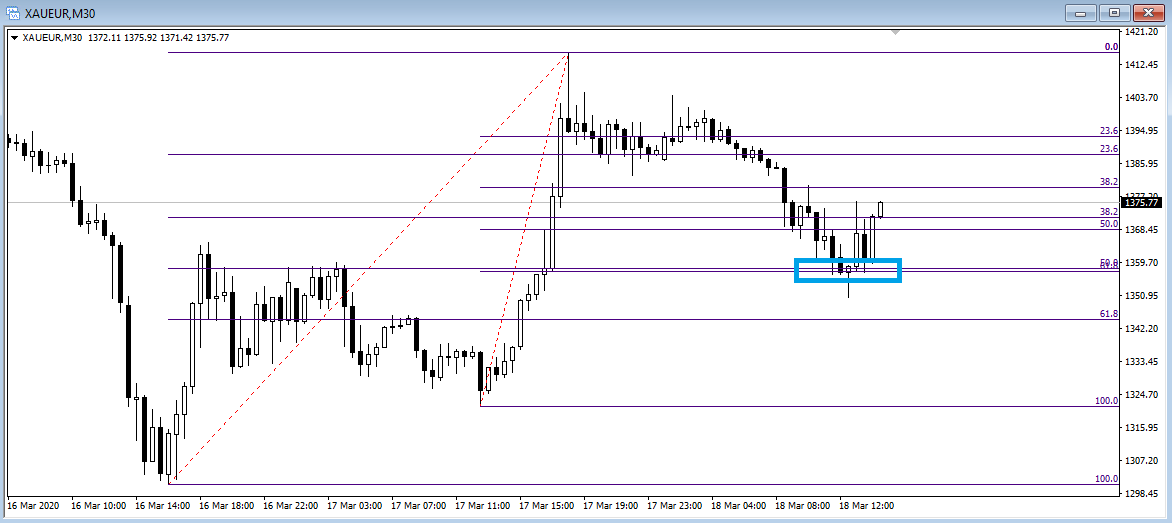

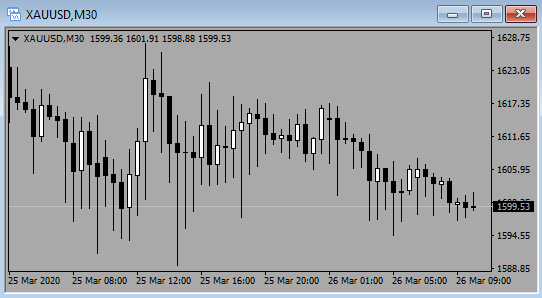

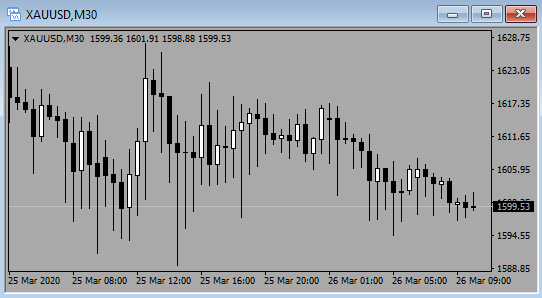

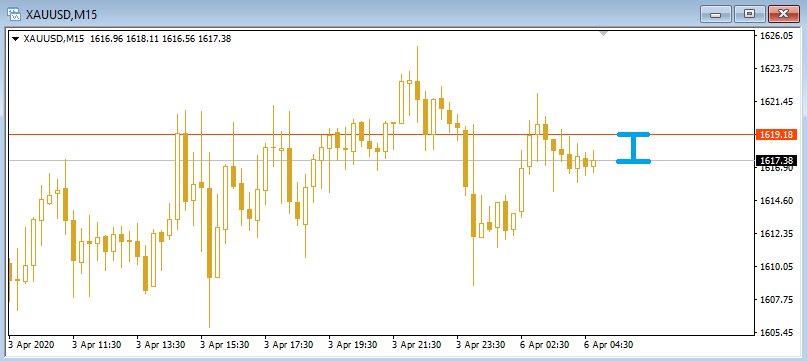

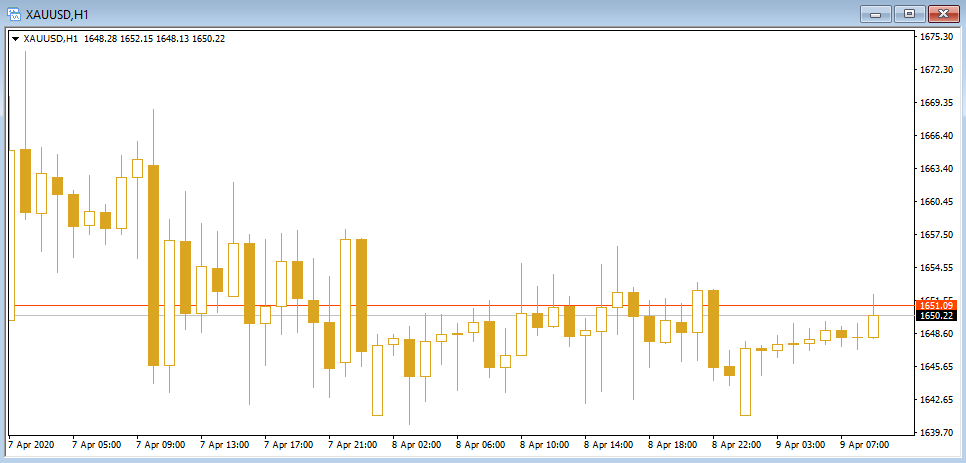

Look at this chart, have never seen this sort of price-action before.

Be careful at the moment on gold pairs. The spreads are very inflated and impacting Gold Trader profitability.

It is almost as if the charts are expecting something and cannot make up its mind as to what direction to go in.

Look at this chart, have never seen this sort of price-action before.

Be careful at the moment on gold pairs. The spreads are very inflated and impacting Gold Trader profitability.

It is almost as if the charts are expecting something and cannot make up its mind as to what direction to go in.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Mar 30, 2020 at 07:59

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Hello followers,

A quick update... Gold Trader does not trade the last 2 days of the month so am waiting for mid week for more trades.

End of month is a common time of volatility and expiring options. Also commercial traders often close positions at the end of the month.

Gold is still showing very high spreads and has been side-ways for the last 4 days. It feels like a major move is brewing. Analyst are predicting further downside, I am on the fence and am waiting for the charts to tell the story.

A quick update... Gold Trader does not trade the last 2 days of the month so am waiting for mid week for more trades.

End of month is a common time of volatility and expiring options. Also commercial traders often close positions at the end of the month.

Gold is still showing very high spreads and has been side-ways for the last 4 days. It feels like a major move is brewing. Analyst are predicting further downside, I am on the fence and am waiting for the charts to tell the story.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Apr 06, 2020 at 02:27

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Hello followers,

Should have had a trade come on this morning however the spreads on gold pairs are high again on Pepperstone.

Have checked and the spreads on currency pairs are normal so am not sure why gold pairs are impacted. Pepperstone said that all brokers are affected however am going to do some comparisons.

Given that the Non Farms on Friday were terrible for USD I am surprised that gold did not shoot up further. This demonstrates that people are converting to USD, so we have a combination of dollar conversion and gold holding up in the circumstances.

Please also note that the difference between spot gold/silver and bullion is increasing even further, especially on silver. It does appear that spot and physical pricing of precious metals will continue to distance from each-other.

Should have had a trade come on this morning however the spreads on gold pairs are high again on Pepperstone.

Have checked and the spreads on currency pairs are normal so am not sure why gold pairs are impacted. Pepperstone said that all brokers are affected however am going to do some comparisons.

Given that the Non Farms on Friday were terrible for USD I am surprised that gold did not shoot up further. This demonstrates that people are converting to USD, so we have a combination of dollar conversion and gold holding up in the circumstances.

Please also note that the difference between spot gold/silver and bullion is increasing even further, especially on silver. It does appear that spot and physical pricing of precious metals will continue to distance from each-other.

เป็นสมาชิกตั้งแต่ Dec 06, 2010

251 โพสต์

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Apr 08, 2020 at 07:38

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

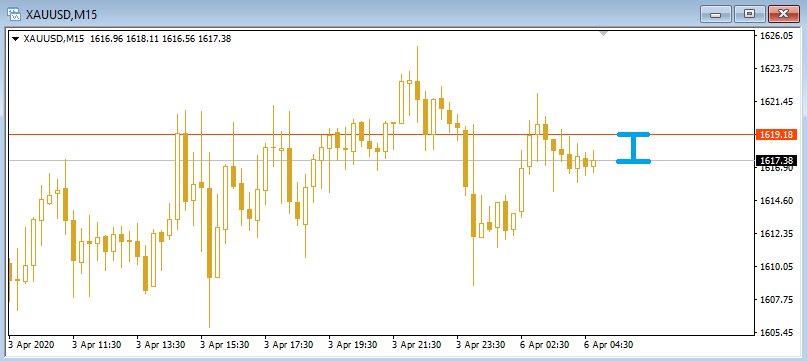

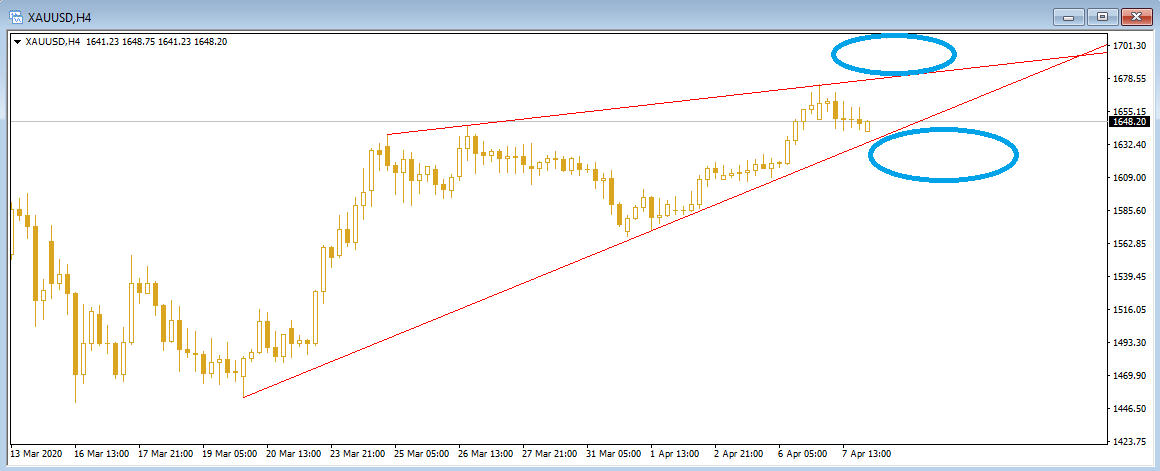

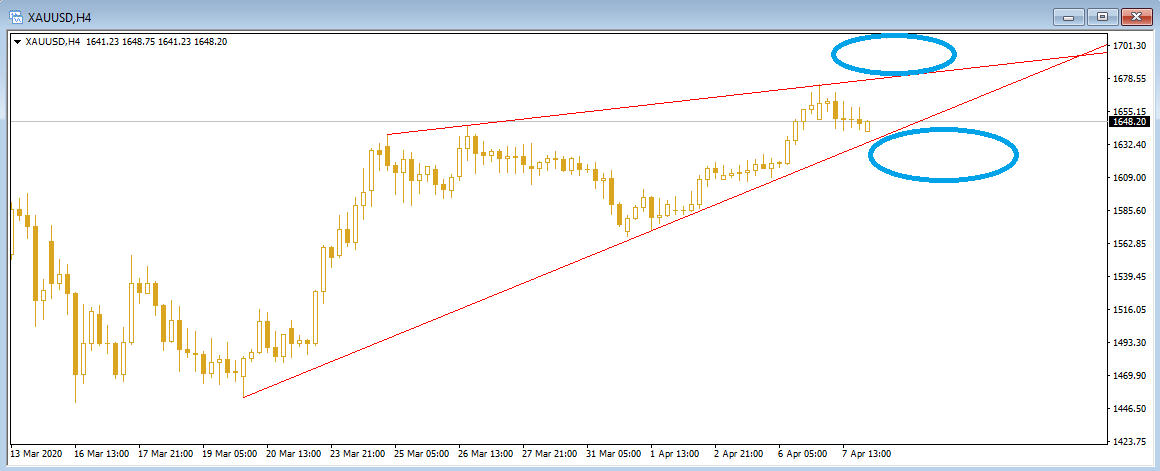

Gold is just going sideways and still jumpy with large spread.

Will be very interesting to see which trend-line is broken.

Some analysts are talking gold down and saying that after Easter there should be a break-down. Others are expecting a retest of the 1702 mark hit a few months back. They may both be right!!

Will be very interesting to see which trend-line is broken.

Some analysts are talking gold down and saying that after Easter there should be a break-down. Others are expecting a retest of the 1702 mark hit a few months back. They may both be right!!

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Apr 09, 2020 at 06:48

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Hello followers,

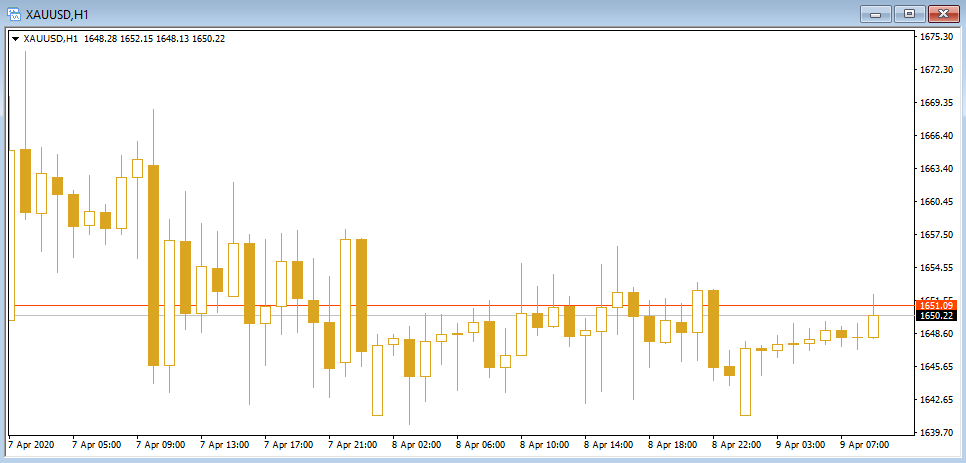

Check out the sideways movement on gold. It has been days now and no trades have been triggered.

Whilst I would love to have trades opened I am also cautious and do not want to trade for the sake of having an open position. The spreads are still considerable and there is a jumpy nature in the movement of the price on gold.

Due to the fact that no trades have now been activated in almost a week I am looking to add a ranging trade component to pick up at the lower oversold region. Am testing and plan to add next week after Easter holidays.

Check out the sideways movement on gold. It has been days now and no trades have been triggered.

Whilst I would love to have trades opened I am also cautious and do not want to trade for the sake of having an open position. The spreads are still considerable and there is a jumpy nature in the movement of the price on gold.

Due to the fact that no trades have now been activated in almost a week I am looking to add a ranging trade component to pick up at the lower oversold region. Am testing and plan to add next week after Easter holidays.

Apr 13, 2020 at 21:38

เป็นสมาชิกตั้งแต่ Apr 21, 2013

258 โพสต์

I'm confused. You manage a buy-side gold EA and the price of gold has gone from 1589 to 1720 in a few days and you've made less than 1%. You don't get too many easy clean moves like that a year.

What have you learned from this mistake?

What have you learned from this mistake?

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Apr 13, 2020 at 23:19

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Gold has broken to the upside and unfortunately no trades were triggered for the Gold Trader strategy. Gold is not coming back to oversold areas for decent entries however do not want to get in and then the price comes down to draw-down and risk loss.

This is a positive for gold pairs where several analysts were talking about a correction straight after Easter.

My opinion is that all this fiat money printing is going to have to put bullish pressure on gold and silver. It is common sense that if the dollar is being devalued further, interest rates are super low and stock markets being propped up with further downside in sight, that gold is a solid store of value.

Also keep in mind that the futures price for gold is higher than the spot. Plus inventory at mints and bullion dealers are very very low. Bullion prices now have a considerable premium.

Saying that, it appears that people are moving into survival modes and keeping cash. The central banks would also not want gold price to strengthen as they want people to retain faith and confidence in dollar (over gold), and it is a sign of higher inflation.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Apr 14, 2020 at 06:33

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

suttos posted:

I'm confused. You manage a buy-side gold EA and the price of gold has gone from 1589 to 1720 in a few days and you've made less than 1%. You don't get too many easy clean moves like that a year.

What have you learned from this mistake?

The EA is not running at the moment. We have very high spreads on gold pairs and the oversold condition for entry has not been met.

Gold Trader is not a longer period trade strategy.

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

Apr 18, 2020 at 00:49

เป็นสมาชิกตั้งแต่ Aug 16, 2011

106 โพสต์

What an amazing two months of price movement on the gold pairs.

First we had the initial financial market shock. Whilst it appears the virus was what popped the debt bubble (and correction we have been waiting for on stock markets), it is not over. Then central banks came out with QE Infinity. So the bubble has been kept from popping by patching over with excessive money printing, and whilst some air has been released from the bubble, it is still inflating at a rate of knots.

What this means for gold is that gold followed down the financial markets, especially as the virus could not be priced into the markets on all fronts. Then the money printing started and we saw a 'V' recovery which has since continued.

The next question is this... where is gold going from here? Late March gold analysts were talking down gold and around the 1630 mark were saying it was going back to 1400. What transpired was a move from 1580 past the more recent 1703 high right up to 1750 territory. The price could not hold about 1703 and yesterday saw a move back to 1680. The daily momentum moved from bullish to bearish on last Wed/Thur, so am looking for a potential move back to 1620.

Whereas before we could discuss physical supply, it is now very apparent that mints and bullion dealers are dry. I checked Perth Mint to buy some silver bullion and they only had 1 oz bars left, no 10 oz or 1 kg. Whist at the moment it is not appearing to impact the spot price, I suspect that in the coming weeks it will, especially as industry starts back up again and they need silver for their manufacturing (circuit boards, pace-makers, solar panels etc...).

Fascinating times.

Gold Trader does not pick up on the major moves, only the small range bound zig-zag buy opportunities. Am waiting to see what happens next week.

forex_trader_493424

เป็นสมาชิกตั้งแต่ Jan 30, 2018

33 โพสต์

Apr 24, 2020 at 10:27

เป็นสมาชิกตั้งแต่ Jan 30, 2018

33 โพสต์

Hi Provider (camerongill),

I like your way of trading. You are responsive and two-way communication.

Can I join your other channel for keeping in touch with you? E.g.; WeChat / Telegram / Facebook Page / FB Group ... etc?

Is this your SignalStart page?

https://www.signalstart.com/analysis/gold-trader/63516

Question:

#1 Why in SignalStart your Drawdown is 16.68% and in myfxbook only 0.91%?

#2 Why you click the red color box in the middle (Drawdown) area, it does not show the Data in Signalstart.

Printscreen example: https://prntscr.com/s55maw

I want to copy your trade!

I like your way of trading. You are responsive and two-way communication.

Can I join your other channel for keeping in touch with you? E.g.; WeChat / Telegram / Facebook Page / FB Group ... etc?

Is this your SignalStart page?

https://www.signalstart.com/analysis/gold-trader/63516

Question:

#1 Why in SignalStart your Drawdown is 16.68% and in myfxbook only 0.91%?

#2 Why you click the red color box in the middle (Drawdown) area, it does not show the Data in Signalstart.

Printscreen example: https://prntscr.com/s55maw

I want to copy your trade!

*การใช้งานเชิงพาณิชย์และสแปมจะไม่ได้รับการยอมรับ และอาจส่งผลให้บัญชีถูกยกเลิก

เคล็ดลับ: การโพสต์รูปภาพ/youtube url จะฝังลงในโพสต์ของคุณโดยอัตโนมัติ!

เคล็ดลับ: พิมพ์เครื่องหมาย @ เพื่อป้อนชื่อผู้ใช้ที่เข้าร่วมการสนทนานี้โดยอัตโนมัติ