Ahead of NFP: looking for signs of a turnaround

Ahead of NFP: looking for signs of a turnaround

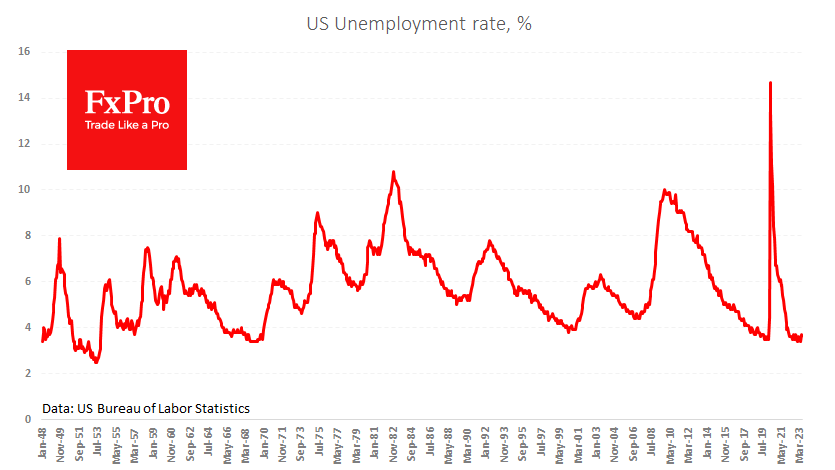

Later on Friday, an important US employment report will be released. On average, analysts expect employment growth of just over 200K, which is in line with the trend rate of hiring during periods of trend GDP growth. Hourly payrolls are expected to slow to 4.2% y/y from 4.4% previously but continue to rise month-on-month. The unemployment rate is also expected to remain at a long-term low of 3.6%.

There have been other data releases in recent days that have also indirectly highlighted the state of the US labour market.

The ADP report, designed the most like the official report, showed a 324K increase in private sector jobs in July, down from 455K the previous month. The official data for June was much more subdued, with an increase of 149K. This indicator has lost much of its predictive power in recent quarters, leaving plenty of room for surprises in the official data.

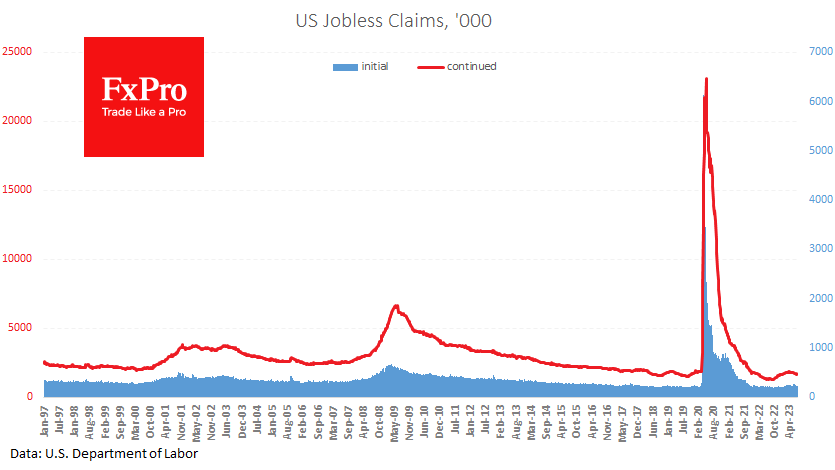

Separately, the strength of the labour market is supported by the weekly jobless claims data. The average number of initial claims over the past four weeks was 228.25K, down from 253.5K a month earlier. Over the past four weeks, the average number of continuing claims was 1712.25K versus 1746K. The lower numbers mean fewer people are unemployed, suggesting increased hiring activity.

Challenger noted a fall in planned company redundancies in July to 23.7K, the lowest since August last year. However, the cumulative total since the start of the year is higher than the 492K figures for 2022 (364K) and 2021 (322K), although not as high as the 2.3M in 2020.

Job vacancies fell to 9.58M from 9.62M a month earlier but remain well above the pre-pandemic peak of 7.5M.

The ISM readings are not so good. The manufacturing employment sub-index plunged to 44.4, the lowest reading since July 2020 and the second consecutive month of decline. In the services sector, employment remains in growth territory, but at 50.7 in July, the index was the lowest since January. In both cases, this signals a turnaround in the labour market.

Eleven out of the last twelve labour market reports have exceeded expectations. There was only one small negative surprise a month earlier, which took more than 3% off the dollar over the following week. But by Thursday, the dollar index had fully recovered those losses.

A second worse-than-expected report in a row could crystallise the market pressure and become the first signal of a trend reversal. The wage rate is also important for the dollar's momentum: a better-than-expected reading is a reason for the Fed to tighten policy, which is positive for the dollar. Weak wage growth and strong employment can revive the appeal of risky assets to the detriment of the USD.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)