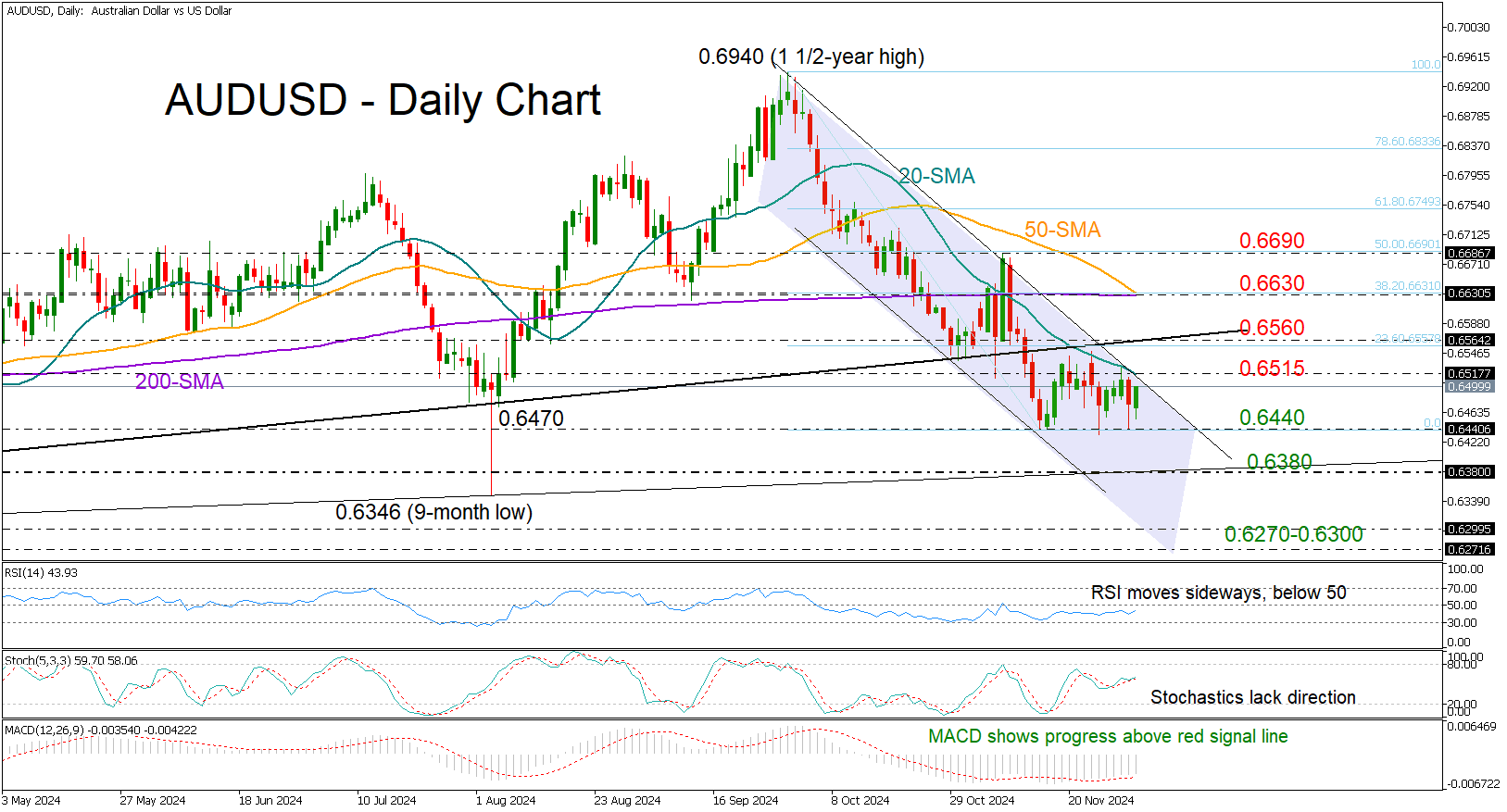

AUDUSD trapped in a bearish formation

AUDUSD kicked off the week on a weak note, failing to break above its 20-day simple moving average (SMA) for the second time, with losses capped near its recent low of around 0.6440.

The pair is consolidating at the bottom of a two-month downtrend, and a bearish breakout remains possible as the 50-day and 200-day SMAs form a "death cross."

The technical signals, however, are mixed. Hence, traders may stay on the sidelines until they see a decisive close above 0.6515 or below 0.6440. If the bearish scenario plays out, immediate support could come from the 2022 support trendline at 0.6380, a break of which could squeeze the price toward the 0.6270-0.6300 constraining zone.

In the bullish case that the pair accelerates above 0.6515, resistance could instantly occur near the former support trendline from 2023 at 0.6560. A successful move higher could target the 50- and 200-day SMAs at 0.6630 and then November’s high around 0.6690. Additional gains from there would signal a bullish trend reversal in the short-term picture.

In brief, AUDUSD remains exposed to downside risks as its ongoing consolidation phase is developing within a bearish formation. A clear step below 0.6440 could motivate more selling, particularly if the 0.6380 support cracks too.

.jpg)