Dollar, Treasuries and stocks extend slide on fiscal concerns

Budget bill concerns weigh on US dollar

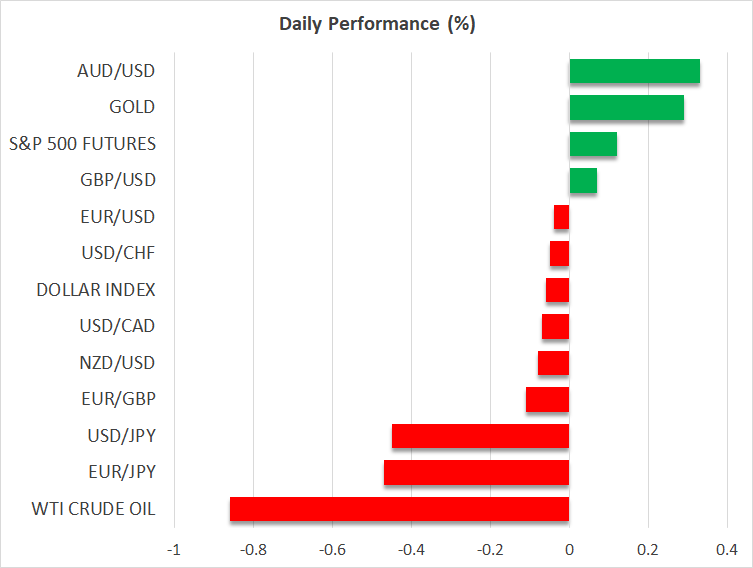

The US dollar extended its slide against its major peers on Wednesday, weighed by increasing fiscal concerns as the US Congress made another step towards passing President Trump’s bill for massive tax cuts and spending.

A Republican-controlled house committee approved the bill, setting the stage for a broader House vote as soon as today. That said, its passage would still send the proposal to the Senate, where more debate could take place.

Back in November, Trump’s tax-cut promises were one of the reasons investors were excited and willing to increase their risk exposures. That said, now they are facing a reality that was missed then. Following the downgrade of the US government’s credit rating, Trump’s bill is expected to add around $4 trillion to the US debt over the next decade.

With that concern, investors have ridden the ‘Sell America’ bandwagon, abandoning the US dollar, equities and government bonds, with the 30-year Treasury yield climbing to around 5.10% for the first time since November 2023. This is one of the rare occasions where the dollar and Treasury yields are not moving in tandem.

US PMIs and Fed’s Williams on today’s agenda

Following the US-China trade truce, expectations of massive tax cuts and spending in the US are corroborating expectations that the Fed may not need to proceed with aggressive cuts this year. According to Fed funds futures, investors believe that two more quarter-point rate cuts may be warranted, matching the Fed’s own projections.

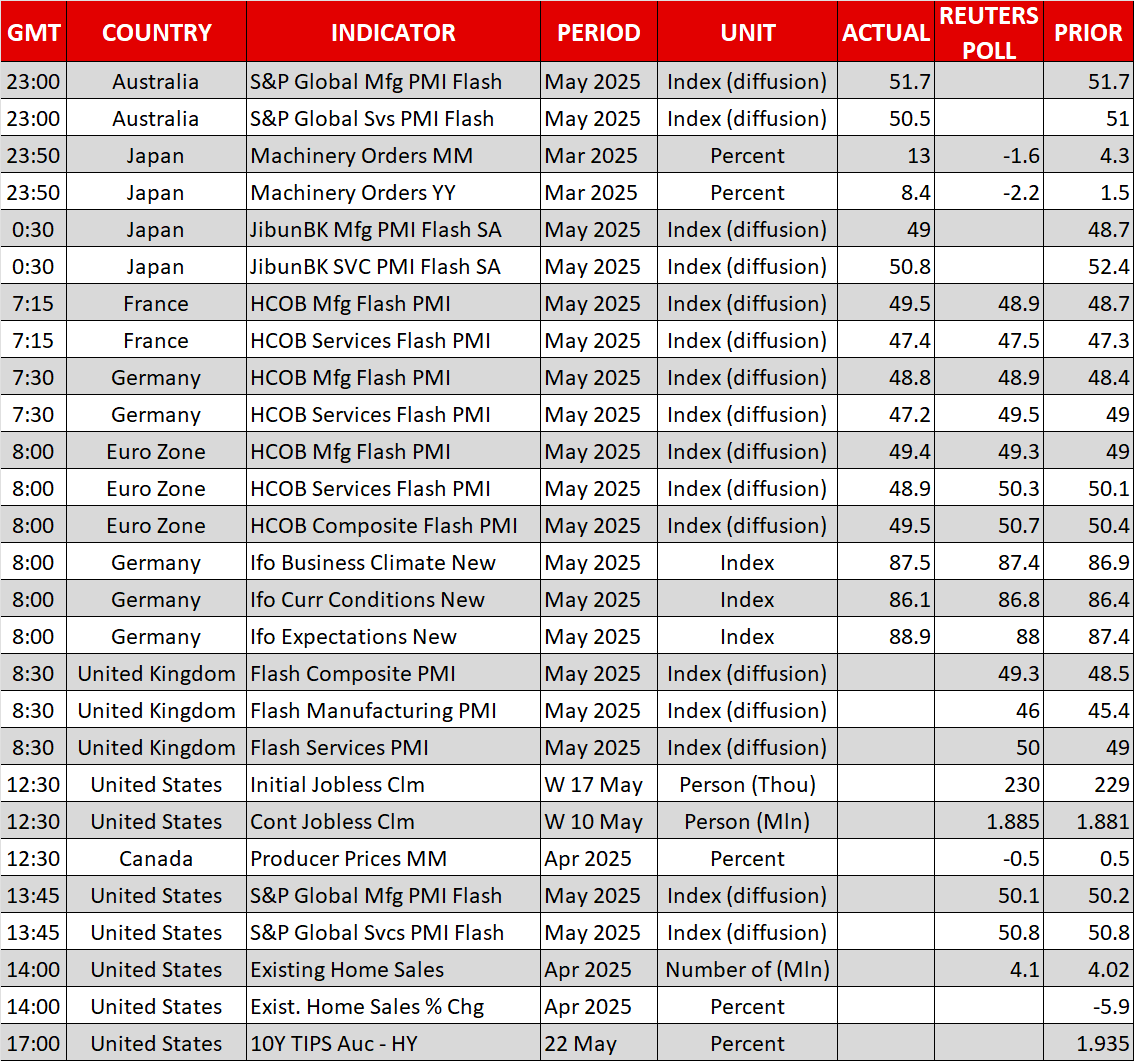

That said, the US preliminary S&P Global PMIs for May and comments by New York Fed President John Willams later today could well impact those bets. Further weakness in the PMIs coupled with remarks that there are still risks to the economic outlook could prompt investors to increase their rate cut bets, which could weigh further on the US dollar.

The Eurozone PMIs have already been released, with the composite index dropping into contractionary territory, though investors are still penciling in only 50bps worth of additional rate cuts by the ECB this year. The UK prints were slightly better than expected.

Stocks extend slide, gold rallies, oil pulls back

Wall Street indices lost notable ground, with the Dow Jones losing nearly 2% on Wednesday, as market participants diverted their flows to safe-haven assets again, like gold, the yen, the euro and the franc.

However, the most prominent winner was the precious metal, which received an extra boost by reports that Israel is planning to attack Iran. However, the announcement of a new round of nuclear talks between the oil-producing nation and the US helped ease fears of an imminent attack.

Oil prices were also impacted by the positive news as it offsets the risk premium that was added due to the concerns of an Israeli attack. Iran is the third-largest producer within the OPEC organization and a conflict could well impact supply from the country. On top of that, stronger sanctions by the US should the talks collapse could also weigh on Iran’s oil exports, thereby lifting oil prices higher, unless OPEC is quick to offset the shortage.

Bitcoin skyrocketed to a new all-time high today as the ‘Sell America’ trade has sparked hunting for alternatives to US assets. The recent rally of Bitcoin alongside gold corroborates the view that cryptos have chameleon properties. They can easily switch from behaving like risk-linked assets to acting as safe havens.

.jpg)