Dovish RBZN shocks Kiwi

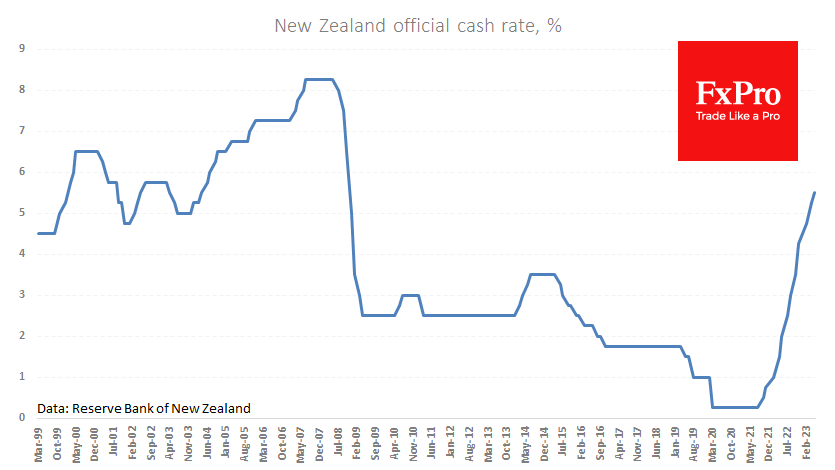

On Wednesday, the Reserve Bank of New Zealand raised its key rate by 25bp to 5.5%, the highest since October 2008, which was widely expected by markets. The RBNZ's accompanying commentary was full of dovish signals.

The central bank noted easing inflationary pressures and easing problems in global supply chains and labour market shortages. In addition, lower consumer and construction activity was reported, while house prices returned to more sustainable levels.

Finally, the RBNZ expresses confidence that a continued restrictive level of interest rates will return inflation to the desired 1-3% trajectory.

These and other signals in the Reserve Bank of New Zealand's comments were seen as a willingness to end the interest rate hike cycle. This shocked the markets, which were more in tune with signals of a pause but not a peak rate.

Add the outright pulling away from risky assets, and you have an almost perfect storm. As a result, the NZDUSD lost over 2% over Wednesday, down to 0.6100, the lower end of the range of the last two months and under the 200-day moving average. The move looks excessive for one day, suggesting some potential for a short-term rebound. However, from a broader perspective, this is a bearish combination for the NZD over the medium term.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)