EBC Markets Briefing | Sterling eased amid bond turmoil

The British pound remained on the back foot on Wednesday after snapping a fifth consecutive day of decline in the previous session, as concerns about Britain's fiscal sustainability continued to weigh.

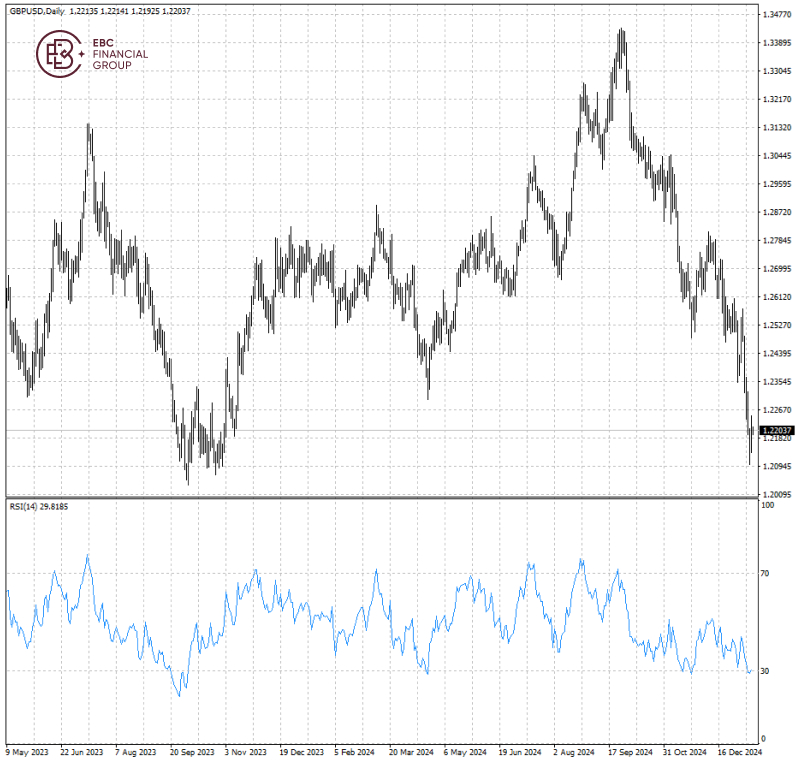

The currency has hit a fresh 2.5-month low with heavy government bond supply putting pressure on British asset prices. Higher yields mean fiscal spending cut may be needed to meet fiscal rules.

Last week demand for pound options surpassed levels seen during the mini-budget crisis — and even around the 2016 Brexit. Traders are preparing for the pound to tumble below $1.20.

Some traders even bet on a drop below $1.12, the weakest level in more than two years. In comparison, strategists surveyed by Bloomberg on average see the pound rising to $1.26 by the end of the quarter.

Some headwinds behind the last year’s strength has been fading, such as higher inflation among developed economies. Consumer prices in the UK is expected to grow by 2.6% year over year last month.

BOE Deputy Governor Sarah Breeden said last week that recent evidence supported the case to cut interest rates gradually but that it was tricky to gauge the right speed of easing.

RSI stayed around 30, suggesting that sterling is nearly oversold. Hence, a rally could be in the making and we see resistance at 1.23.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.