Forex anticipates the end of the shutdown

A strong economy typically translates to a strong currency. Why should the US dollar fall after the shutdown ends if the American economy is on a solid footing? According to Rabobank, the resumption of statistical publication after the government reopens is expected to show an improvement in the situation. The USD index rose 3% after falling 10% in the first half of the year, thanks to rapid GDP growth following a disastrous first quarter. Investors' revised views on the fate of the federal funds rate also contributed to this. The chances of a rate cut in December fell from 90% to 62%.

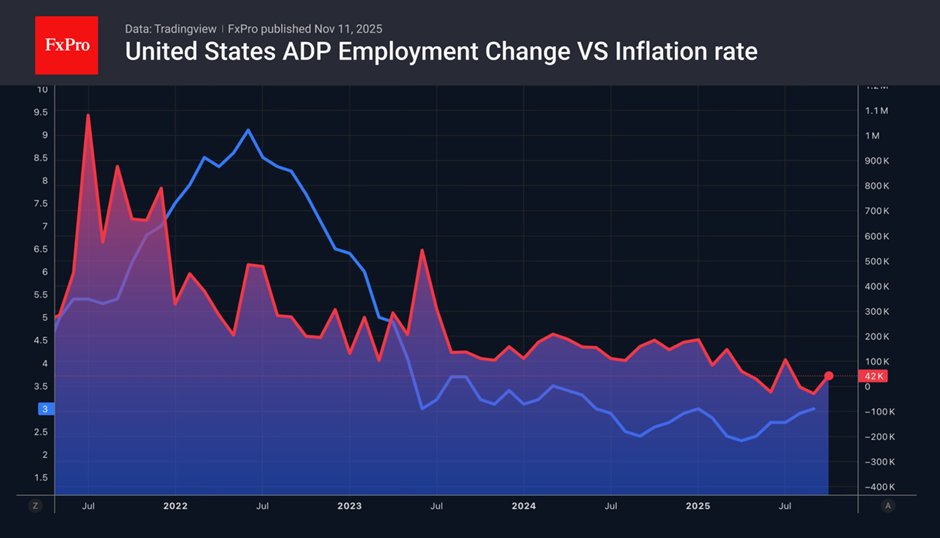

Morgan Stanley and MUFG, on the other hand, believe that official statistics will confirm data from alternative sources, indicating a cooling of the labour market. With inflation growing slowly and inflation expectations remaining stable, this will allow the Fed to continue cutting rates. Fed member and Trump appointee Stephen Muran is ready to cut them by 50 basis points in December. Fed President Mary Daly warned against the mistake of maintaining a tight policy for too long.

The Senate has decided to end the shutdown, but the House of Representatives and the president must give their approval. The bill provides for the government to reopen only until 30 January. Will it shut down again in February?

Rumours of a reduction in US tariffs from 39% to 15% have had a positive effect on the franc. Donald Trump said that he had hit Switzerland too hard. The White House would like to see this country succeed. The 15% rate will correspond to the size of import duties on the EU. Talk of its decline has brought the USDCHF down to its lowest level since the end of October.

The rise in US stock indices and rumours that the Reserve Bank would end its cycle of rate cuts had a positive effect on the Australian dollar. The consumer confidence index, which exceeded 100 for the first time since February 2022, contributed to the AUDUSD rally.

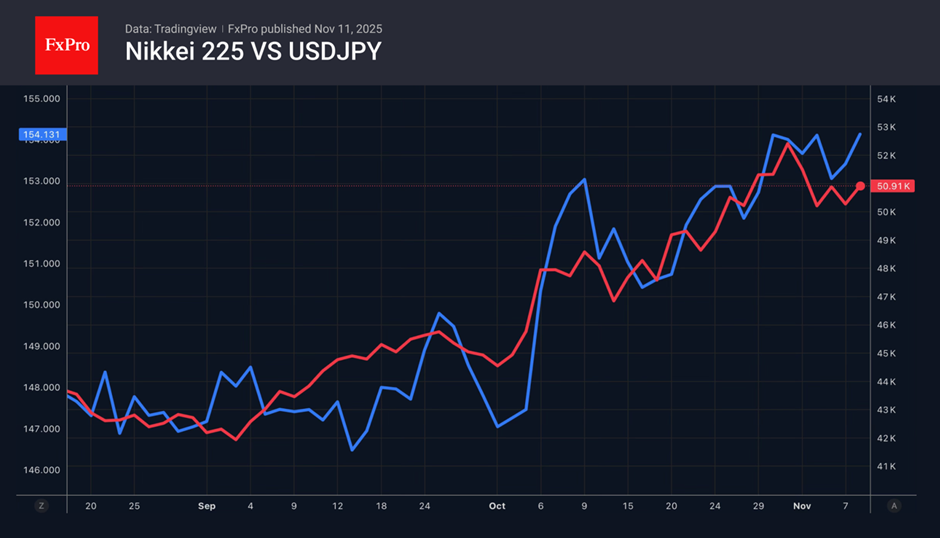

Talk of an end to the shutdown added fuel to the fire of yen selling. The yen is a safe-haven currency, so improved global risk appetite is supporting USDJPY. At the same time, hedging is putting pressure on the yen. American investors are actively investing in the Nikkei 225 and hedging currency risks by selling the yen.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)