Getting ready for a decline in gold

Gold has been behaving erratically, having had a positive and negative correlation with global risk appetite in recent days.

On Friday, the price set an all-time high above $2430, losing $100 before the end of that day, nullifying the most furious final part of the rally within four hours. The final sell-off was in unison with the markets' fall. But on Monday, the pressure in the stock markets intensified again, and gold moved higher.

Neither geopolitics nor fear of interest rate moves explain these shifts. Gold seems to be living its own world, in which geopolitics is used as a convenient explanation for the rise, and the rise of the dollar is used as an ex post facto explanation for the decline.

In our view, the price run-up on Thursday and Friday morning was so significant because it occurred in thin air territory after many days of making new highs and caught a wave of stop orders above $2400.

The impressive profit-taking at the end of the day on Friday had every chance of reversing the uptrend, which most often happens. However, the growth at the end of Monday raises doubts about such a straightforward development of events.

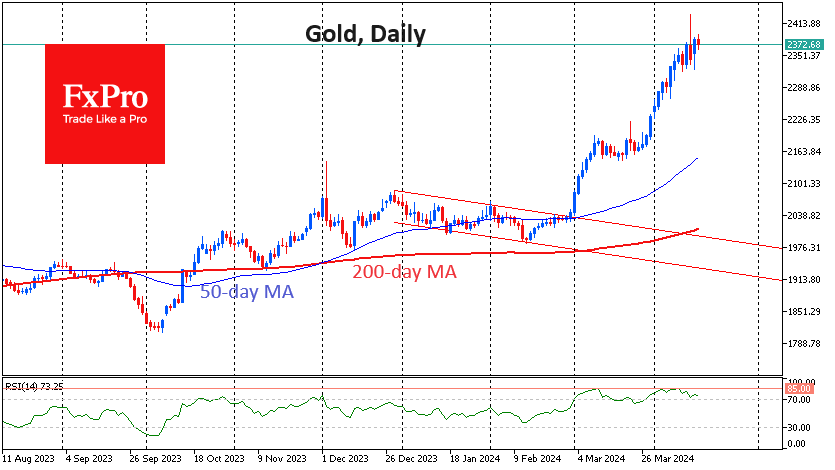

On the daily timeframes, the RSI index rolled back to 73, which is on the border with the overbought area, and recorded two peaks near 85 in March and April. A further pullback to the area below 70 would be a harbinger of a broad correction.

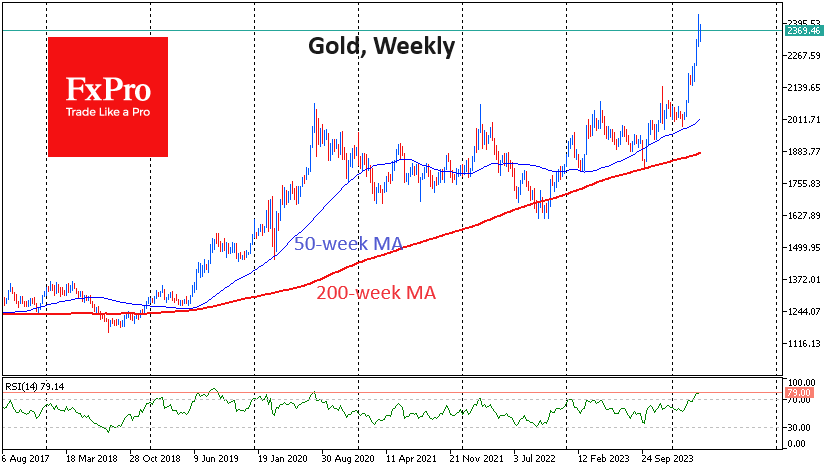

On the other hand, on weekly timeframes, the RSI is above 79, an overbought area that gold has touched only five times since 1980, and each time, it has been followed by a correction or the start of a bear market within 1-4 weeks. The exception to this was 1979-1980, when the value of the ounce increased, and relatively short-lived consolidations followed growth impulses.

Market tensions in recent days have also worked in favour of the bears in gold. Contrary to popular logic, gold rises against general risk demand only in the first days of the sell-off. If the pressure on equities becomes a trend, gold quickly catches up and overtakes the markets in its decline, only to be stopped by a monetary policy reversal.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)