Gold: Yet Not Broken

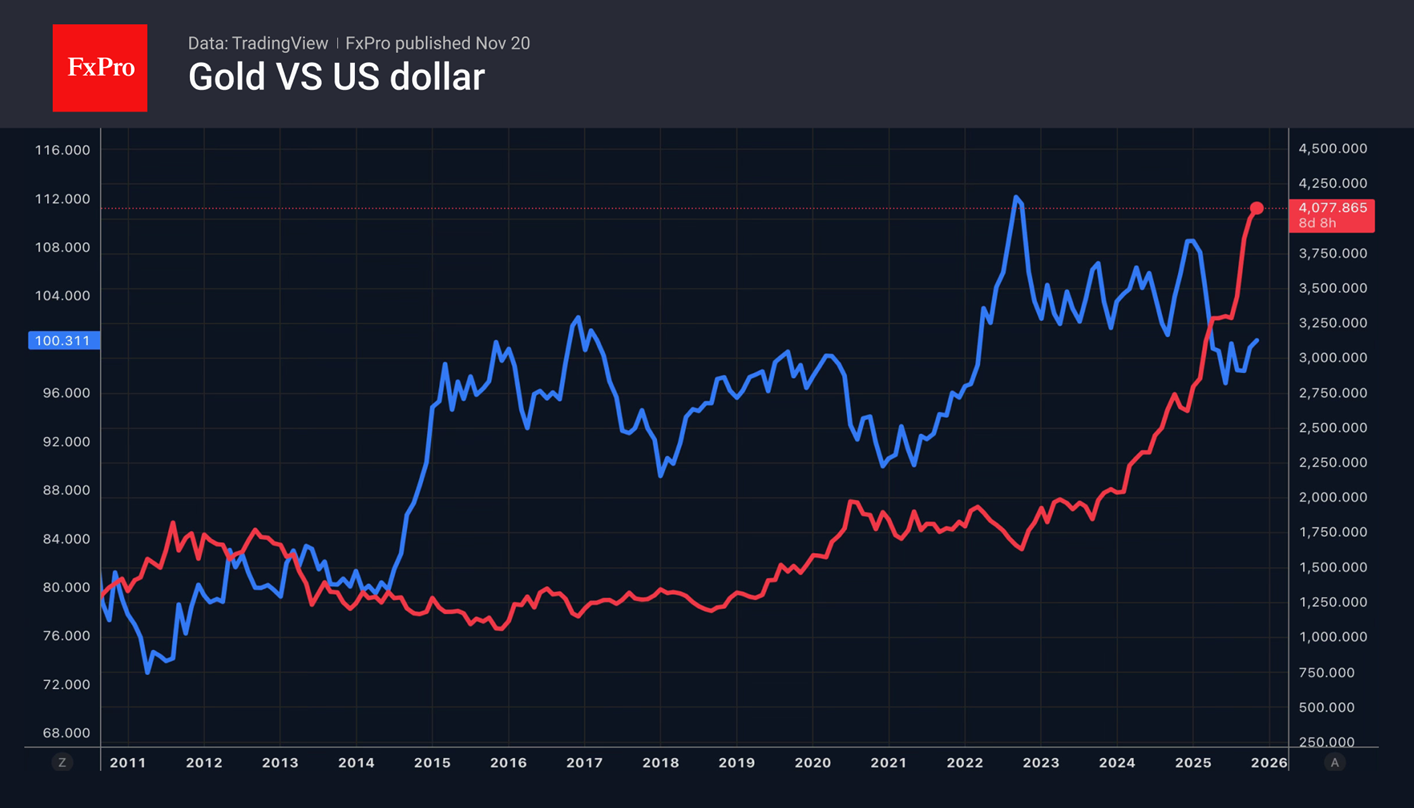

Gold managed to withstand the pressure of the US dollar and rising Treasury yields. The Golden Bugs even mounted a counterattack for a while, backed by positive signals from the physical metal market. However, the decline in the chances of a federal funds rate cut in December to 32% has clipped their wings.

According to Goldman Sachs estimates, central banks purchased 64 tons of gold in September, three times more than in August. TD Securities sees signs of increased demand from large investors for ETFs, and UBS has raised its 2026 forecast by $300 to $4,500 per ounce. About 26% of Bank of America respondents believe that gold will outperform commodities and currencies over the next year.

We continue to believe that the collapse in prices a month ago put an end to gold's three-year rally. However, it has been holding up fairly well in recent weeks, ignoring both the stronger dollar and the progress of the peace plan for Ukraine. Earlier this year, similar issues had a noticeable impact on traders, causing prices to fall. However, bulls are now holding gold above the trend line, which is the 50-day moving average. A fall below this level could change the prevailing trade for this instrument.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)