Is the NZD USD Dropping Towards Yearly Lows?

Your NZDUSD trading guide for November 19, 2025, by Ultima Markets.

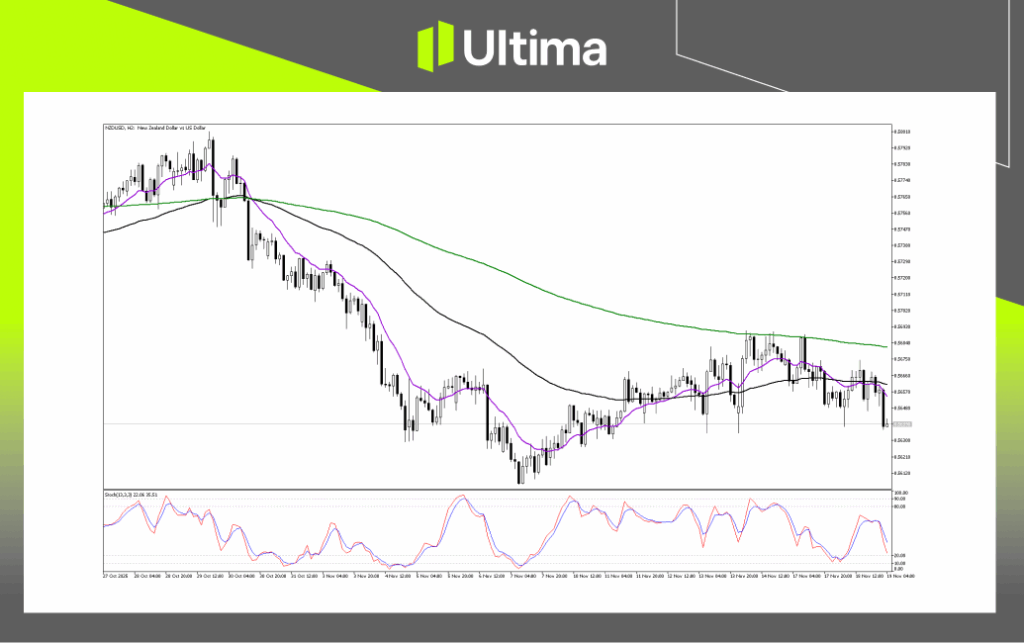

NZDUSD Set for Potential Rebound After Prolonged Bearish Downtrend Since late June 2025, the pair has been entrenched in a downtrend marked by lower highs and lower lows. Currently, the price is trading below all three moving averages, which are aligned in a bearish setup. A "death cross" in late August/early September further confirmed the long-term bearish momentum.

Since late June 2025, the pair has been entrenched in a downtrend marked by lower highs and lower lows. Currently, the price is trading below all three moving averages, which are aligned in a bearish setup. A "death cross" in late August/early September further confirmed the long-term bearish momentum.

However, the Stochastic Oscillator has recently moved out of oversold territory below 20, indicating that selling pressure may be easing. This could open the door for a period of consolidation or a brief corrective rally, despite the broader downtrend.

Key Levels

The immediate support zone is between 0.5610 and 0.5620, reflecting the low established in early November 2025. This level is crucial for the bears to sustain control, and a break below it would signal the continuation of the downtrend.

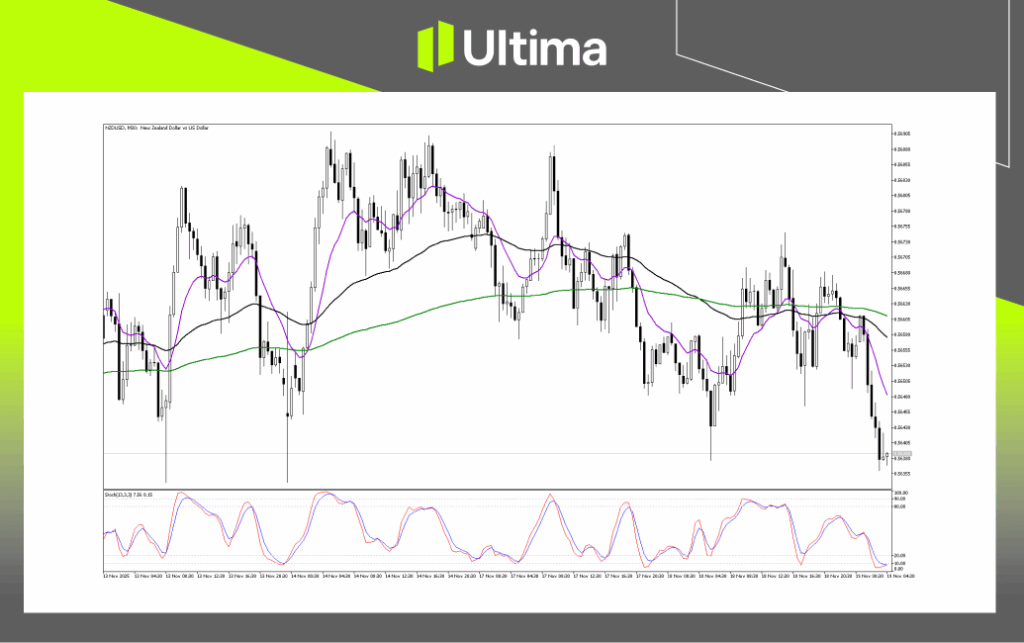

NZDUSD Breakdown Eyes Key Support

The pair has fallen below the lower end of its recent consolidation range, which had been confirmed between roughly 0.5650 and 0.5690. This breakdown signals the end of the previous corrective phase and suggests the ongoing downtrend is likely to resume.

Breakout Scenarios

The immediate support level is around 0.5633, which marks the low of the latest bearish candle. The more significant support zone lies near 0.5612, corresponding to the major swing low from November 7th and acting as the floor for the entire corrective phase. The 0.5612 level is important to watch, as a breach would signal a strong continuation of the bearish trend.

NZDUSD Bearish Momentum Builds

The price is trading well below all three moving averages, the short-term purple, medium-term black, and long-term green, which have all acted as strong resistance levels between 0.5660 and 0.5665. These moving averages have consistently rejected the price's attempts to rise, leading to the current sell-off. Now, the moving averages are diverging and pointing downward, signalling the continuation of bearish momentum.

Bearish Breakout (Continuation)

A sustained break and a close on the M30 chart below the immediate low of 0.5638 would trigger a bearish breakout. This would indicate that the downtrend is likely to continue without significant interruption, confirming the breakdown and opening the door to the next major support level around 0.5612.

Bullish Reversal (Short-term Correction)

For a bullish reversal to gain ground, the price must halt its downward movement and recover above the minor resistance at 0.5650. A decisive close above the key resistance zone at 0.5665 would confirm the reversal, indicating that the price has overcome the resistance cluster and the breakdown point.

Such a move would suggest that the recent sell-off was a "bear trap", neutralising the bearish pressure and possibly leading to a range-bound market with the potential to retest higher resistance at 0.5673. However, with the current bearish momentum, this bullish scenario remains less likely.

Navigating the Forex Market with Ultima Markets

When it comes to forex trading, staying informed and making data-driven decisions is important for success. Ultima Markets is committed to equipping you with the insights needed to navigate the markets confidently. For personalised guidance tailored to your financial goals, don’t hesitate to reach out to us.

Join Ultima Markets today and gain access to a comprehensive trading ecosystem, complete with the tools and resources you need to excel. Through UM Academy, you’ll also find the education and support to sharpen your trading skills and stay ahead of the curve. Keep an eye out for more updates and expert analyses from the Ultima Markets team.

—–

Legal Documents

Trading leveraged derivative products carries a high level of risk and may not be suitable for all investors. Leverage can magnify both gains and losses, potentially resulting in rapid and substantial capital loss. Before trading, carefully assess your investment objectives, level of experience, and risk tolerance. If you are uncertain, seek advice from a licensed financial adviser. Leveraged products are not intended for inexperienced investors who do not fully understand the risks or who are unable to bear the possibility of significant losses.

Copyright © 2025 Ultima Markets Ltd. All rights reserved.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.