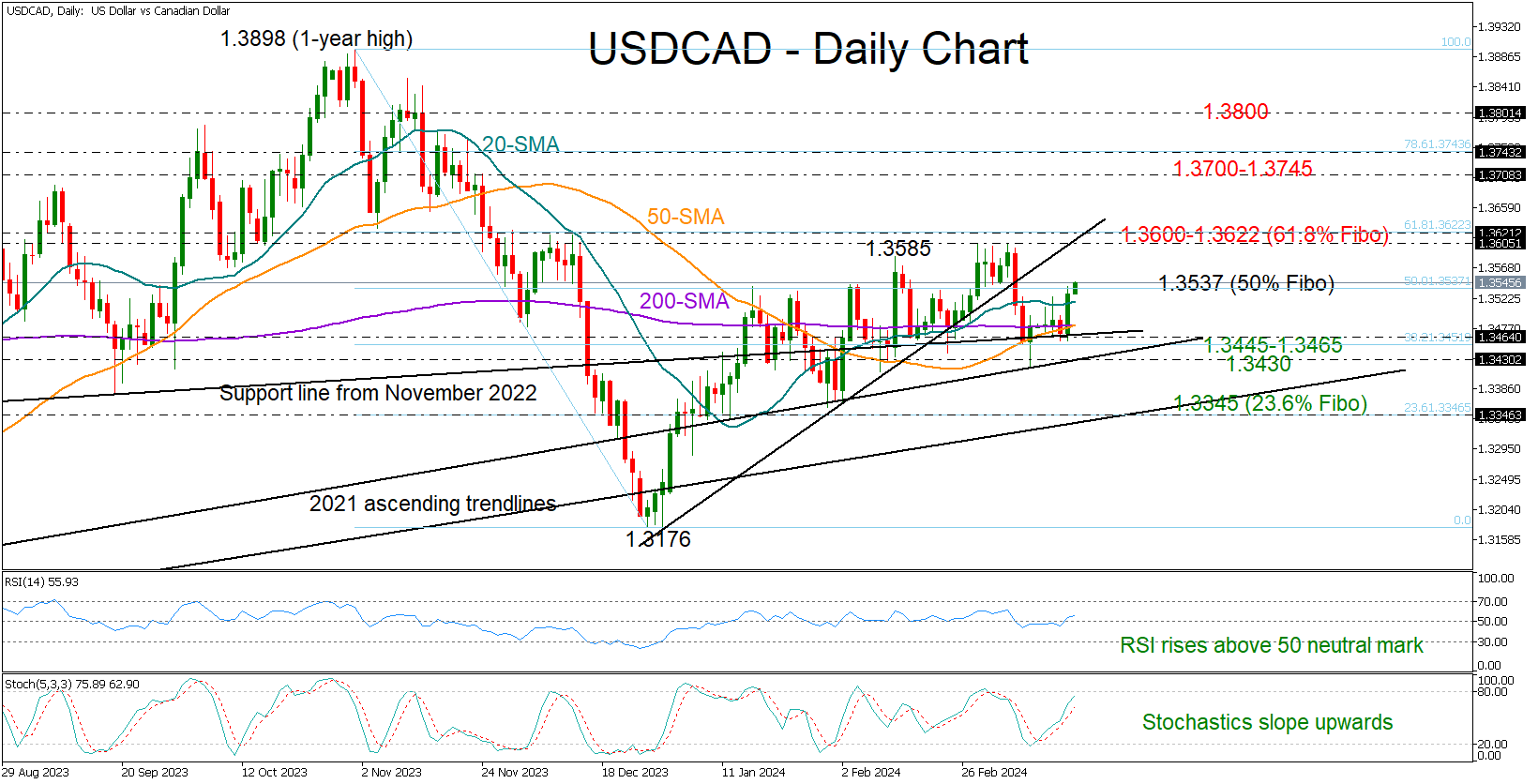

Is USD/CAD poised for another bullish round?

USD/CAD made a strong comeback on Thursday, surpassing its simple moving averages (SMAs) and breaching the 1.3500 level after encountering fresh buying around the familiar long-term line from November 2022.

The 50% Fibonacci retracement of the November-December 2023 downleg is currently challenging the bulls around 1.3535. The chances of the bulls winning the game there are high because the RSI has crossed the neutral mark of 50 and the stochastic oscillator is showing an upward trend. If that proves to be the case, the pair might speed up to test the crucial resistance zone of 1.3600-1.3622, where the broken ascending trendline from December is placed. Breaking through that wall could be a game-changer, reigniting the 2024 uptrend and propelling the pair to the 1.3700-1.3745 area.

In the event the 1.3535 bar blocks the way up, the price might revisit the 1.3455-1.3465 area on the downside, where the 38.2% Fibonacci number is also positioned. Slightly lower, the 2021 ascending trendline could also act as a safeguard around 1.3430, preventing a freefall towards the 23.6% Fibonacci of 1.3345 and therefore a trend deterioration.

To summarize, USD/CAD could experience more positive trading sessions in the near term, particularly if the bulls break through the resistance of 1.3535.