USDCHF bullish odds increase after 4-month lows

USDCHF extended its three-week bearish wave, dipping as low as 0.8683 on Thursday before closing the day with mild gains above the 0.8700 round level.

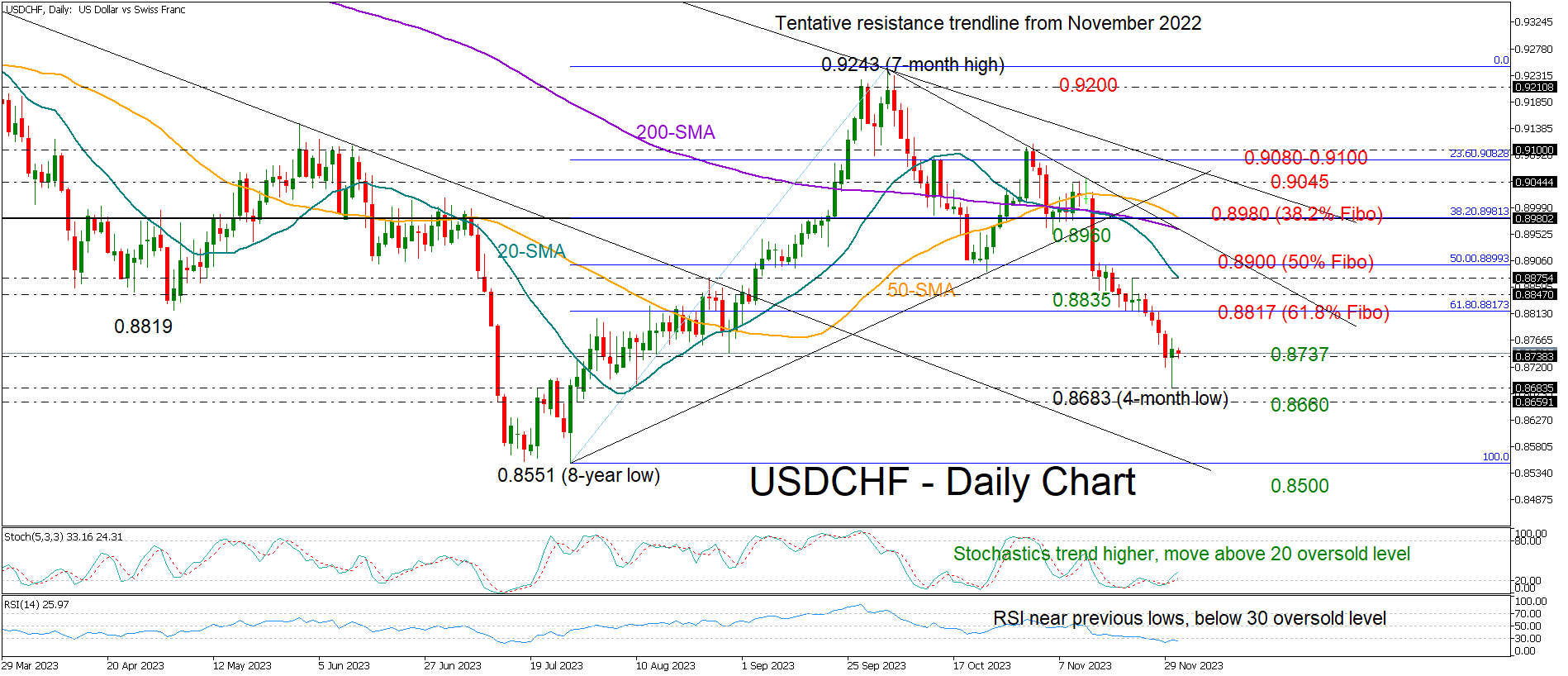

Although Friday’s session started with weak momentum ahead of the ISM business PMI figures, traders might attempt to push the pair higher according to the technical indicators. The RSI is near its previous lows in the oversold zone, while the stochastic oscillator has started to make higher highs and higher lows to exit the oversold zone below 20, both making an upside reversal or some stability likely. Moreover, Thursday’s candlestick seems to have taken the form of a bullish hammer, but more gains are required to confirm it.

On the upside, the area between 0.8815 and 0.8900 formed by the 61.8% and 50% Fibonacci retracement levels of the previous upleg could be a hurdle given the constraints within the region. A decisive close above it could underpin buying appetite, lifting the price forcefully up to the 200- and 50-day simple moving averages (SMAs), where the 38.2% Fibonacci mark is also located at 0.8980. Additional gains from there might take a breather around 0.9045 before the attention turns to the 23.6% Fibonacci level of 0.9080 and the 0.9100 psychological mark.

In the bearish case, where the price slips below 0.8737, support could commence within the 0.8660-0.8683 territory. If that base proves fragile, the pair might fall directly to July’s eight-year low of 0.8551. A continuation below 0.8500 could see a test around the January 2015 barrier of 0.8370.

All in all, USDCHF could switch into recovery mode in the short-term, though only a bounce above 0.8900 would add credence to a potential rebound.

.jpg)