All Eyes on US CPI as Market Volatility Builds | 24th October 2025

All Eyes on CPI

Global markets traded cautiously on Thursday as investors positioned themselves ahead of the highly anticipated US CPI inflation report, which is expected to provide fresh clues on the Federal Reserve’s next policy steps. The US Dollar Index remained below the 99.00 level, while risk assets and commodities moved within narrow ranges amid thin volumes and mixed sentiment. Gold and silver edged lower as traders preferred to stay on the sidelines, while the Australian and New Zealand Dollars drifted as participants awaited direction from inflation data and ongoing US–China trade talks.

Gold Price Forecast (XAU/USD)

Current Price and Context

Gold is trading slightly lower near $4,230, pressured by a modest recovery in the US Dollar ahead of the CPI inflation release. Investors are refraining from large bets as they await confirmation on whether inflation will steer the Fed toward earlier rate cuts.

Key Drivers

Geopolitical Risks: Geopolitical tensions remain subdued, reducing immediate demand for defensive assets.

US Economic Data: CPI data later today will be the major driver, with traders expecting a slight cooling in inflation.

FOMC Outcome: A dovish signal from upcoming Fed meetings could reinforce gold’s upside.

Trade Policy: Market optimism around a potential US–China understanding has kept volatility in check.

Monetary Policy: Expectations of rate cuts continue to support gold’s broader bullish tone.

Technical Outlook

Trend: Consolidating after testing record highs earlier this week.

Resistance: $4,280

Support: $4,180

Forecast: Neutral to mildly bullish; CPI data will dictate short-term direction.

Sentiment and Catalysts

Market Sentiment: Investors are cautious but lean slightly bullish on expectations of easing inflation.

Catalysts: The CPI print will be the key near-term trigger for volatility.

Silver Price Forecast (XAG/USD)

Current Price and Context

Silver trades near $48.40, slipping as traders reduced exposure ahead of the CPI data and amid optimism for a potential US–China trade breakthrough.

Key Drivers

Geopolitical Risks: Reduced geopolitical friction has lessened the appeal of metals as defensive assets.

US Economic Data: Inflation data could shape near-term sentiment; softer numbers may boost demand.

FOMC Outcome: Hints of easing policy could renew buying interest in silver.

Trade Policy: Prospects of improved trade relations weigh on safe-demand metals.

Monetary Policy: Broader Fed dovish expectations continue to support longer-term outlook.

Technical Outlook

Trend: Slightly bearish in the near term.

Resistance: $49.10

Support: $47.80

Forecast: Mild downside bias unless inflation data disappoints.

Sentiment and Catalysts

Market Sentiment: Cautiously neutral as traders await US data.

Catalysts: CPI outcome and follow-through on trade progress.

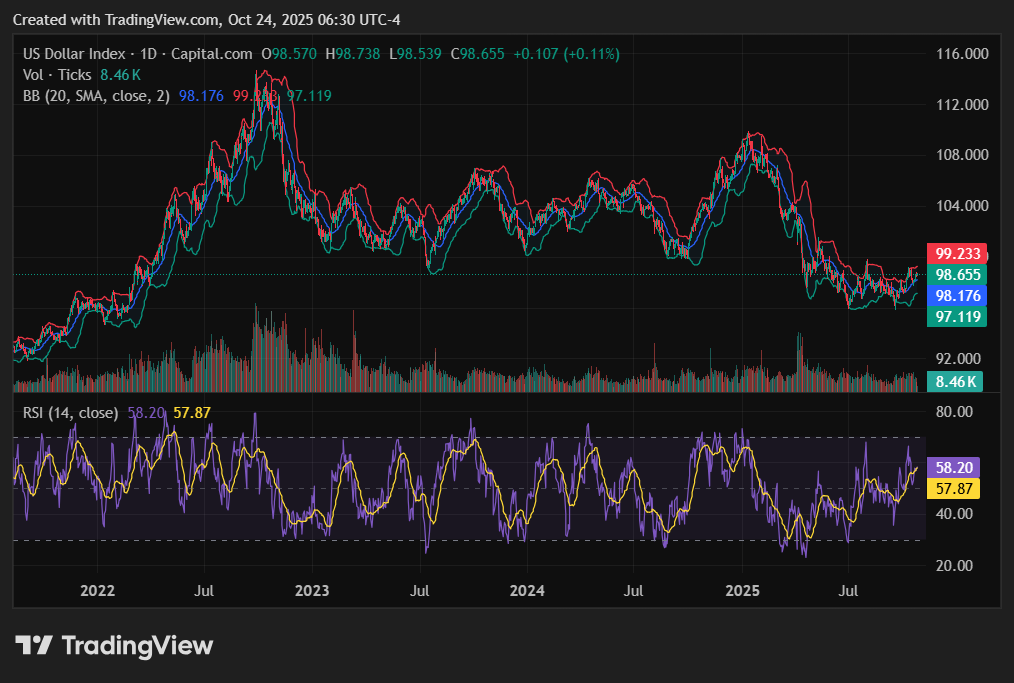

US Dollar Index Forecast (DXY)

Current Price and Context

The US Dollar Index hovers just below 99.00, reflecting uncertainty ahead of the CPI report. Traders are balancing between cautious optimism on inflation easing and the Fed’s recent dovish tone.

Key Drivers

Geopolitical Risks: Stabilized global conditions have muted safe flows into the Dollar.

US Economic Data: CPI inflation data will be the dominant factor shaping direction.

FOMC Outcome: Markets expect a more accommodative stance if inflation softens.

Trade Policy: Ongoing trade discussions with China inject mild optimism into markets.

Monetary Policy: Expectations for mid-2026 rate cuts persist.

Technical Outlook

Trend: Consolidation phase after a recent pullback.

Resistance: 99.40

Support: 98.60

Forecast: Neutral with slight downside bias if inflation cools.

Sentiment and Catalysts

Market Sentiment: Traders remain cautious and data-dependent.

Catalysts: US CPI release and Powell’s post-data remarks.

NZD/USD Forecast

Current Price and Context

NZD/USD is trading near 0.5750, steady as investors await both the US CPI data and potential progress in US–China trade talks. The pair has recovered from recent lows but remains sensitive to risk sentiment.

Key Drivers

Geopolitical Risks: Calmer trade relations support mild Kiwi resilience.

US Economic Data: CPI data will influence USD direction and Kiwi volatility.

FOMC Outcome: A dovish tone could give the pair upward momentum.

Trade Policy: China’s improving trade stance could bolster New Zealand’s export outlook.

Monetary Policy: RBNZ remains cautious amid global economic uncertainties.

Technical Outlook

Trend: Sideways consolidation.

Resistance: 0.5780

Support: 0.5710

Forecast: Slightly bullish if US inflation cools.

Sentiment and Catalysts

Market Sentiment: Neutral with cautious optimism.

Catalysts: CPI report and any updates from US–China discussions.

AUD/USD Forecast

Current Price and Context

AUD/USD trades just below 0.6480, pressured by renewed USD strength ahead of inflation data but supported by steady Chinese PMI readings. Traders remain hesitant before key US macro releases.

Key Drivers

Geopolitical Risks: Calmer global conditions keep risk appetite steady.

US Economic Data: CPI report will be pivotal for near-term price action.

FOMC Outcome: Any dovish cues could lift the Aussie.

Trade Policy: Australia’s trade link to China remains a key stabilizing factor.

Monetary Policy: RBA maintains a cautious tone amid domestic growth concerns.

Technical Outlook

Trend: Mild downtrend.

Resistance: 0.6510

Support: 0.6440

Forecast: Slightly bearish before CPI, turning bullish if data weakens USD.

Sentiment and Catalysts

Market Sentiment: Mixed as traders await direction.

Catalysts: US CPI results and China’s economic data updates.

Wrap-up

Market sentiment remains tethered to inflation expectations, with traders bracing for potential volatility once CPI figures are released. A stronger-than-expected print could bolster the US Dollar and dampen risk appetite, while a softer reading might reignite rate cut bets and lift major currencies and precious metals. Until then, markets are likely to maintain a cautious tone, with limited conviction ahead of the key data release.

Ready to trade global markets with confidence? Join Moneta Markets today and unlock 1000+ instruments, ultra-fast execution, ECN spreads from 0.0 pips, and more! Start now with Moneta Markets!