Bitcoin hit new highs but then dropped back down

Bitcoin hit new highs but then dropped back down

Market Picture

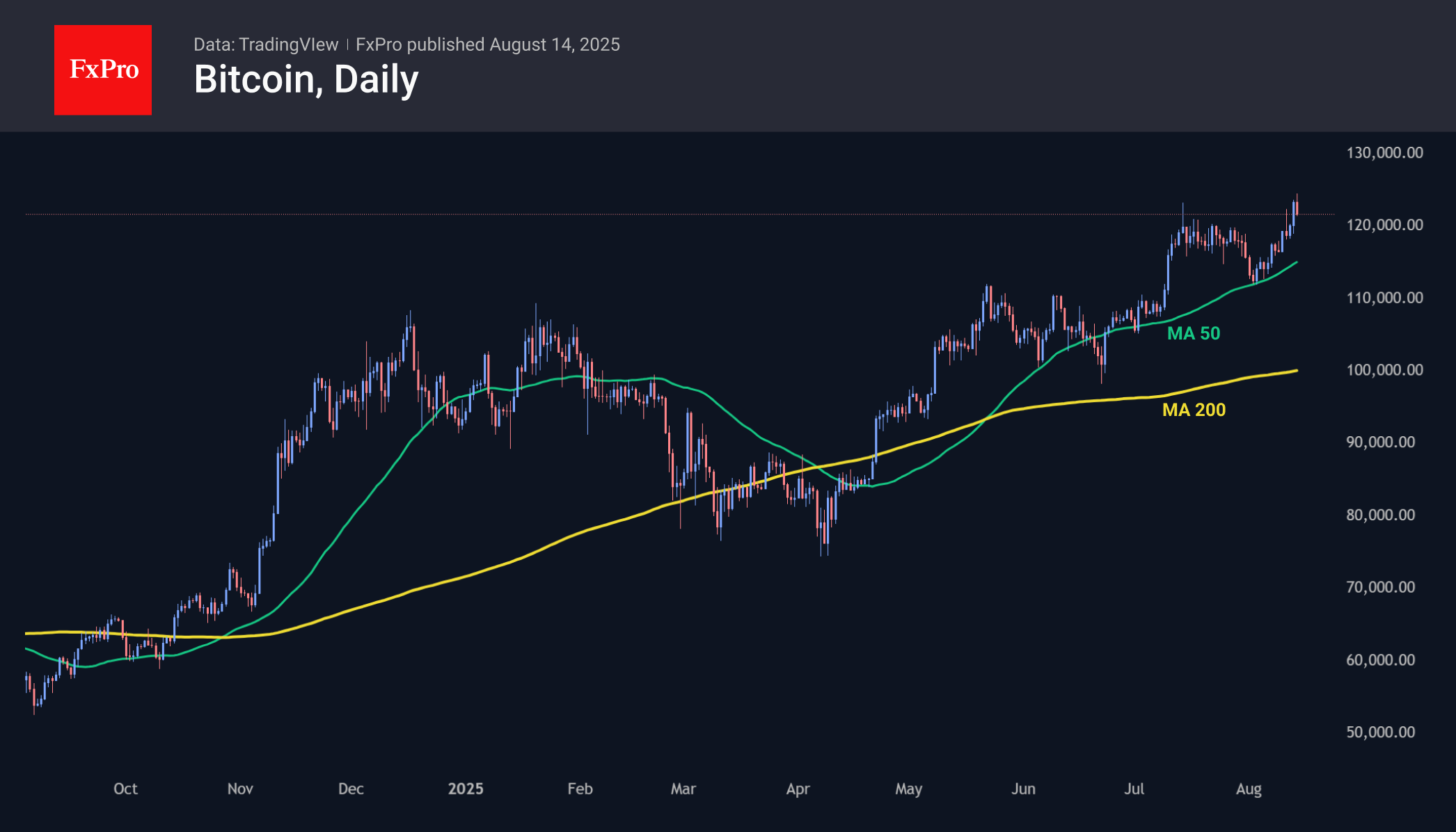

The crypto market cap rose to $4.20 trillion on Thursday morning before dropping back down somewhat to $4.14 trillion. But even with the correction, the daily gain is close to 2%, led by Bitcoin's slide to a new peak of $124.5K. Among the major coins, Cardano (+18%), Near Protocol (+6.2%) and Trump (+5.9%) were the leaders.

The sentiment index rose to 75, ready to move into the extreme greed zone. It was previously held at this level throughout the second half of July, but the entire crypto market was in a range at that time.

Bitcoin gained steadily throughout Wednesday, gliding to a new all-time high of $124.5k in thin early trading in Asia on Thursday, but falling back below $122K at the time of writing. Buyers intensified their push on the back of positive sentiment in global markets, where many key indices were updating their all-time highs.

Among the top altcoins, Cardano stood out over the past day. Its price exceeded $1, last seen in early March, and its growth today is about 15%, almost doubling the price from its lows in early July. The bullish breakout is supported by the formation of a ‘Golden Cross’, when the 50-day moving average tops the 200-day MA. Such technical signals work very well on relatively small financial instruments. The potential target for the bulls now looks like the $1.15 area — the resistance area for this year.

News Background

CryptoQuant notes a surge in network activity — the daily transaction volume on the Ethereum network reached a record high of nearly 1.875 million.

On Wednesday, Ethereum exceeded $4,700 for the first time since November 2021 and is aiming for historic highs above $4,800. Polymarket users estimate the probability of the altcoin reaching $5,000 by the end of August to be 71%.

Standard Chartered has raised its forecasts for Ethereum. By the end of the year, ETH could rise to $7,500 and reach $25,000 by 2028. Since June, corporate treasuries and ETFs have accumulated 3.8% of Ethereum's market supply. Another important event for ETH was the signing of the US GENIUS Act in July, establishing federal rules for stablecoins.

Solana exceeded $200 for the first time since 23 July, despite potential profit-taking by major players. The Hong Kong crypto exchange OSL HK launched Solana trading for retail investors. At the same time, public companies continue to accumulate SOL. For example, DeFi Development Corp. (DDC) reported owning 1.3 million SOL worth about $250 million.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)