Dollar gains ahead of shutdown-delayed NFP, yen slumps

Hawkish Fed minutes fuel the dollar

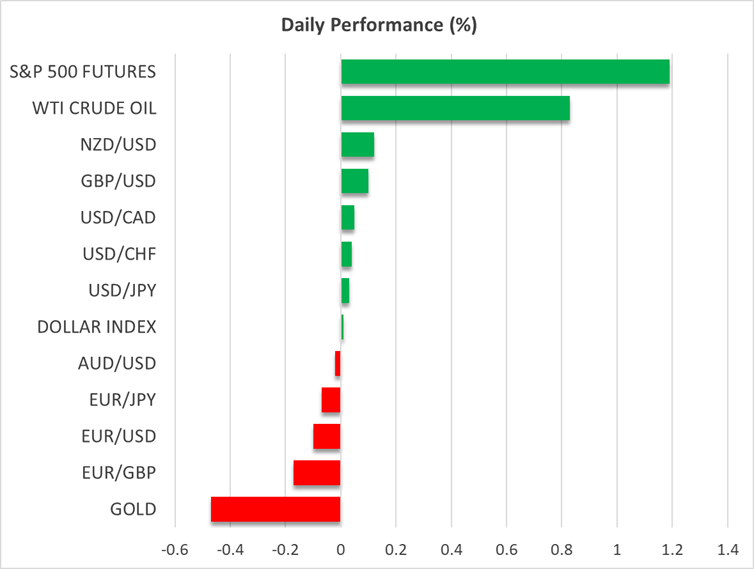

The US dollar outperformed all the other major currencies yesterday, gaining the most against the Japanese yen and the New Zealand dollar. Today, it remains strong against most, correcting somewhat lower against the kiwi.

What may have added extra fuel to the dollar’s engines were the minutes of the latest Federal Reserve monetary policy decision. The minutes revealed that “many” participants argued that a December rate cut is not necessary, while “several” believed that a reduction may be warranted.

Although investors have already listened to some policymakers pushing back against a December action, the word “many” in the minutes may have been interpreted as outnumbering the “several”, and that’s why the probability of 25bps rate reduction at the Fed’s upcoming meeting is now resting at around 25%, half of last week’s 50%.

Having said that though, most Fed members agreed that further reductions to the federal funds rate would be appropriate, which means that a potential December break will not be a signal of change in course. This allowed market participants to continue penciling in around 75bps worth of rate cuts for next year. In other words, a December rate cut was not taken off the table, it was just pushed into 2026.

Will shutdown-delayed NFP impact Fed rate cut bets?

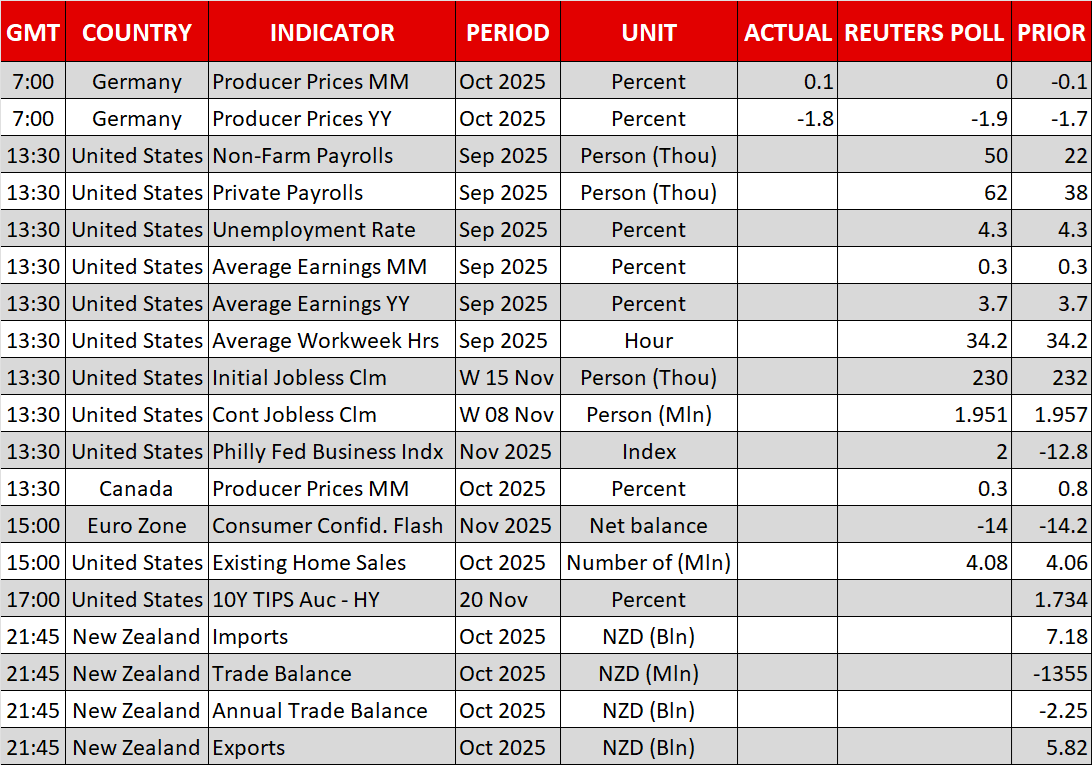

With that in mind, market participants are likely to lock their gaze to the shutdown-delayed NFP report for September, due out today. Although private and Fed-compiled reports have already provided a glimpse of how the labor market has been performing, official data may be more influential for Fed policymakers when conducting monetary policy.

Expectations are for a small improvement in job gains, to 53k from 22k, but that may not be enough to lead traders to reduce their 2026 rate cut bets, especially with the ADP suggesting that US firms shed around 2.5k jobs per week in the four weeks ending on November 1. For traders to adopt a more hawkish stance, an NFP reading of above 100k may be needed. The last time the US economy gained more than 100k was back in April.

Katayama did not discuss yen with BoJ’s Ueda

The yen was yesterday’s main loser, with dollar/yen climbing above the January 23 high of 156.80 as Japan’s Finance Minister Katayama said that the yen was not part of her discussion with BoJ Governor Ueda.

Traders may have interpreted this as a signal that intervention is not imminent and that’s why they added to their yen short positions. Japan’s Overnight Index Swaps (OIS) market continues to suggest only a 30% probability of a December rate hike by the BoJ, but a slim majority of economists in a Reuters poll believed that officials would press the hike button when they next meet. Board member Koeda noted earlier today that they must continue to normalize policy to avoid creating unwanted distortions.

There is also the paradox that further declines in the yen could make a hike even more likely as policymakers would like to prevent a spike in inflation. With Japanese yields also surging due to PM Takaichi’s dovish fiscal stance, investors may have been in a “Sell Japan” mood lately, and it remains to be seen whether the BoJ will indeed decide to raise interest rates soon or whether authorities will intervene into the market and buy the yen as dollar/yen approaches the 160.00 psychological zone.

Nvidia’s revenue forecasts top estimates

On Wall Street, all three main indices finished Wednesday’s session higher and accelerated their rally in after-hours trading after tech-giant Nvidia announced revenue forecasts well above analysts’ expectations, easing somewhat concerns that stretched valuations could trigger market turbulence soon.

Having said that though, with the forward price-to-earnings ratio of the S&P 500 still near its 2020 highs and well above its 10- and 20-year moving averages, fears of a tech bubble bursting are unlikely to vanish.