EBC Markets Briefing | Oil prices down as Trump targets Saudi

Oil markets sank on Friday, a day after US President Donald Trump pressured OPEC and its de facto leader Saudi Arabia to lower prices in a broad push to drive up crude production.

Saudi Arabia's crude oil exports in November jumped to their highest in eight months. Iran delivered a conciliatory message to Western leaders in Davos, denying it wants nuclear weapons.

Trump said he would add new tariffs to his sanctions threat against Russia if the country does not make a deal to end its war in Ukraine. Kremlin said Russia had so far received no specific proposals for talks.

He also said his administration would "probably" stop buying oil from Venezuela. The country/s oil exports to the US soared 64% to some 222,000 bpd last year, making it its second-largest export market behind China.

Shrinking US crude inventories, which hit their lowest level since March 2022 last week according to the EIA. But the drawdown was smaller than analysts had expected.

Trump's tariffs policies with Canada and Mexico likely the first victims, and the potential the newly inaugurated president will push for higher US oil output, also weighed on crude oil prices, analysts said.

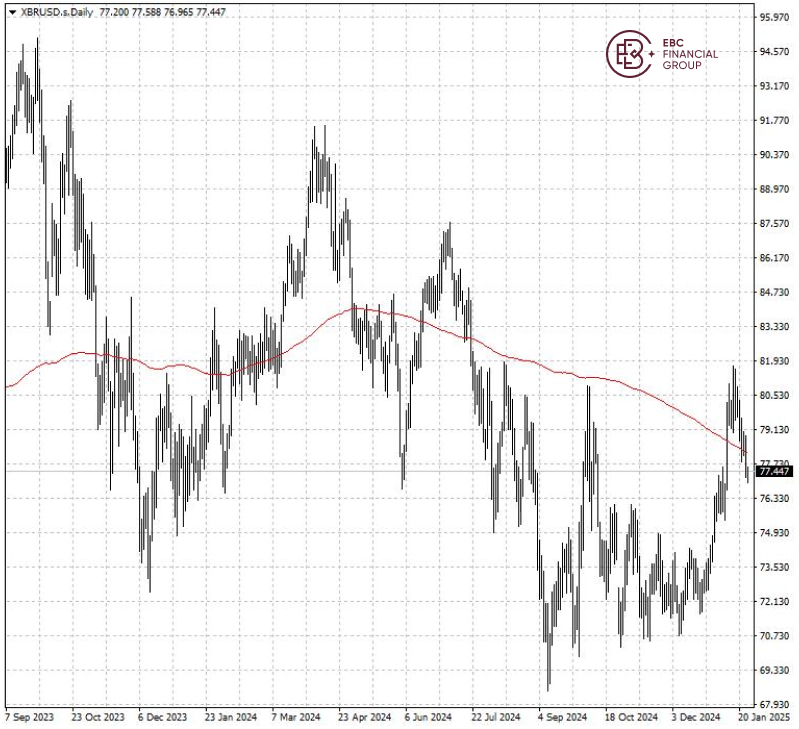

Brent crude remained below 200 SMA, with few signs of recovery. As such a push lower towards $75.6 is in the cards.

EBC Financial Risk Management Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.