Fed uncertainty puts stocks on edge, dollar edges up

Fed officials sing from same hymn sheet

Expectations of two rate cuts by the Fed are in doubt again as investors pared back some of their bets following a string of hawkish commentary by Fed policymakers in the last 24 hours. Markets had priced in 50 basis points of cuts after the somewhat cooler CPI report as well as the disappointing retail sales figures for April. But expectations have been trimmed again to around 42 bps, pushing Treasury yields higher.

Whilst Monday’s speakers, which included vice chairs Jefferson and Barr, did not see the need for a rate hike, none flagged that a rate cut was imminent. Even the Cleveland Fed’s Mester, who until now had maintained her forecasts for three rate cuts, said this would no longer be appropriate.

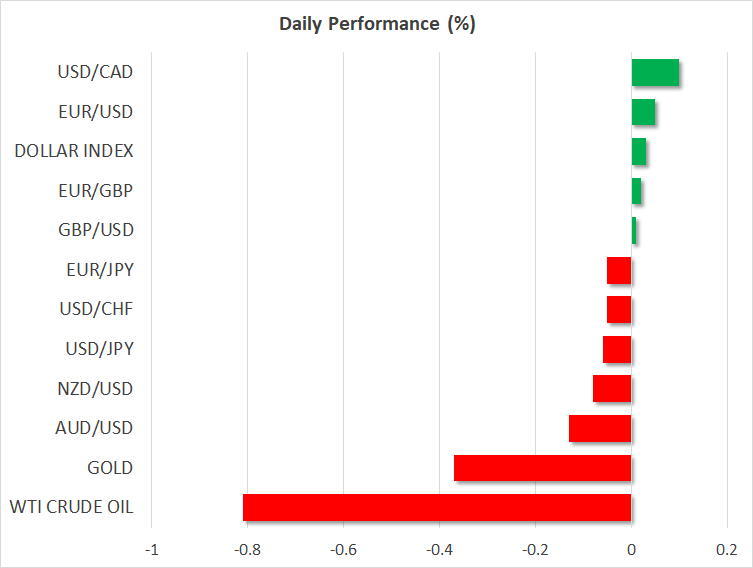

Yen, euro and aussie slip, pound bucks the trend

The US dollar firmed, clawing back some ground against the euro and yen. But the pound extended its gains, as it sought to establish a foothold above $1.27. It’s unclear what’s driving sterling higher this week as UK CPI data due tomorrow is expected to show a big drop in the headline figure and BoE Deputy Governor Broadbent yesterday gave a further hint that rates could be cut this summer.

The yen drifted lower despite more warning by Japan’s finance minister, while the Australian dollar was not impressed by the minutes of the RBA’s last policy meeting, which disclosed that policymakers had discussed a rate increase.

RBNZ meeting, Fed minutes and Canadian CPI eyed

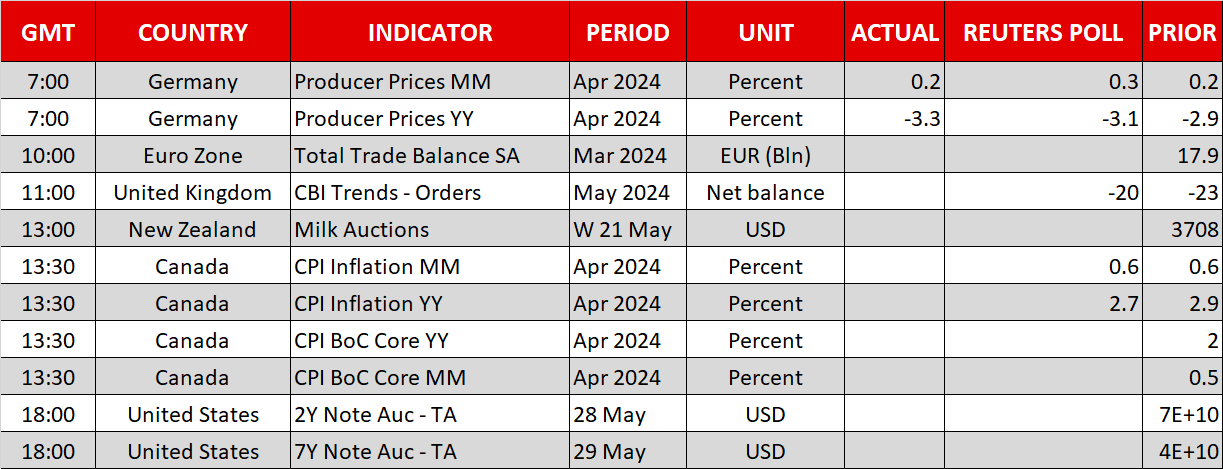

It will be the New Zealand dollar’s turn to take the spotlight early on Wednesday when the RBNZ announces its latest policy decision. Any clues about the timing of the first rate cut will be crucial for the kiwi.

The Fed’s meeting minutes are also due tomorrow and there’s a risk that any hawkish surprises could further rattle markets. On the whole, though, the minutes are unlikely to offer any fresh views and the focus will be on the remaining speakers this week.

Ahead of all that, CPI numbers out of Canada will be watched by the loonie as the Bank of Canada could join the ECB and BoE in cutting rates soon.

Cryptos rally but commodities and stocks struggle

In commodities, oil and gold pulled back from yesterday’s highs amid doubts about Fed policy and a stronger dollar, but copper bounced back on Tuesday in a choppy session.

Oil prices are likely being weighed by the absence of any new developments in the Middle East. Although speculation about succession in Iran and Saudi Arabia could have implications on energy policy in the region, it will be a while yet until there is something substantial for the markets to react to.

Equities were also subdued as the Fed’s ‘higher for longer’ mantra kept Wall Street bulls in check. Nevertheless, the Nasdaq managed to close at a new all-time high yesterday, with the focus now shifting to Nvidia’s earnings tomorrow.

In cryptos, the major cryptocurrencies rallied on Monday, led by ether, on reports that the US Securities and Exchange Commission is close to approving a spot ether ETF. Hopes that a decision could come as early as this week drove ether prices up by more than 19%, while bitcoin climbed 7.7%.

.jpg)