Forex goes to safe havens

Progress in negotiations between Democrats and Republicans on resuming government operations has cooled the enthusiasm for the US dollar among bulls. The dollar index has taken a step back from its local high, as the record-long shutdown may soon come to an end. The Fed will begin to receive data and will cease to be cautious. The chances of a rate cut in December have risen to 74%, and Treasury yields have fallen.

The greenback was supported by increased demand for safe-haven assets amid a pullback in US stock indices and the Supreme Court's willingness to hear the case on the legality of tariffs. Predictit gives a 73% probability that Donald Trump will lose. Polymarket estimates the chances of such an outcome at 64%. The cancellation of import duties will be a blow to the US economy and the dollar. Refunds and an increase in the budget deficit will require a reduction in government spending and an increase in taxes. This will slow GDP growth and force the Fed to aggressively cut rates.

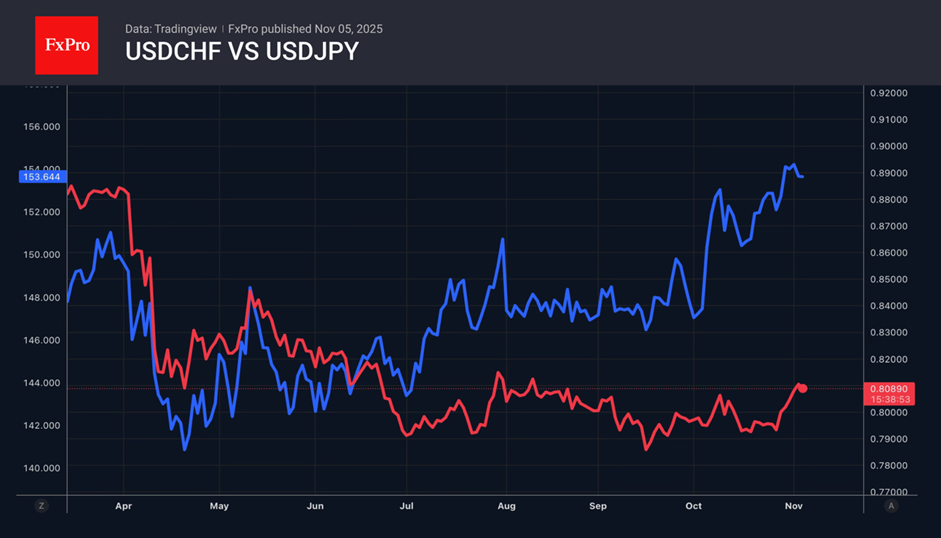

Nevertheless, in the short term, increased volatility in financial markets may support the dollar and other safe-haven currencies. USDCHF and USDJPY retreated from local highs. The Swiss franc was under pressure due to concerns about the National Bank's return to a negative interest rate policy. The yen is concerned about the Bank of Japan's reluctance to signal a continuation of the monetary policy normalisation cycle.

In the minutes of the last BoJ meeting, some members of the Governing Board referred to the need to be cautious. In their opinion, it is necessary to consider that Japan has experienced a long period of deflation. High rates could cause it to return to that state. Such rhetoric reduces the likelihood of an imminent increase in the overnight rate and puts pressure on the yen. At the same time, increased verbal interventions and growing demand for safe-haven currencies amid rising volatility are contributing to mixed dynamics in USDJPY.

The pound fell to April lows due to Rachel Reeves' unwillingness to repeat Labour's pre-election pledge not to significantly raise taxes. The Chancellor blamed the previous Conservative administration and trade friction for damaging the British economy.The FxPro Analyst Team

-11122024742.png)

-11122024742.png)