Frank entered the turbulence zone, ball on the side of the SNB

Frank entered the turbulence zone, ball on the side of the SNB

USDCHF is trading below 0.8000, returning to the area of 14-year lows after rebounding from these levels in July. Earlier, in 2010 and 2014, the pair traded lower only in free-fall mode, forcing the central bank to intervene and reverse the trend. Although the Swiss National Bank has cut its key rate twice this year, and the Fed did so most recently in December last year, the dynamics of the currency market clearly show how the market values policy predictability and trade surplus this year.

At its quarterly meeting on 25 September, the SNB has every opportunity to increase pressure on the currency by easing monetary policy, as other competitors (the ECB, the Bank of England and colleagues from New Zealand and Australia) have implemented more easing measures this year.

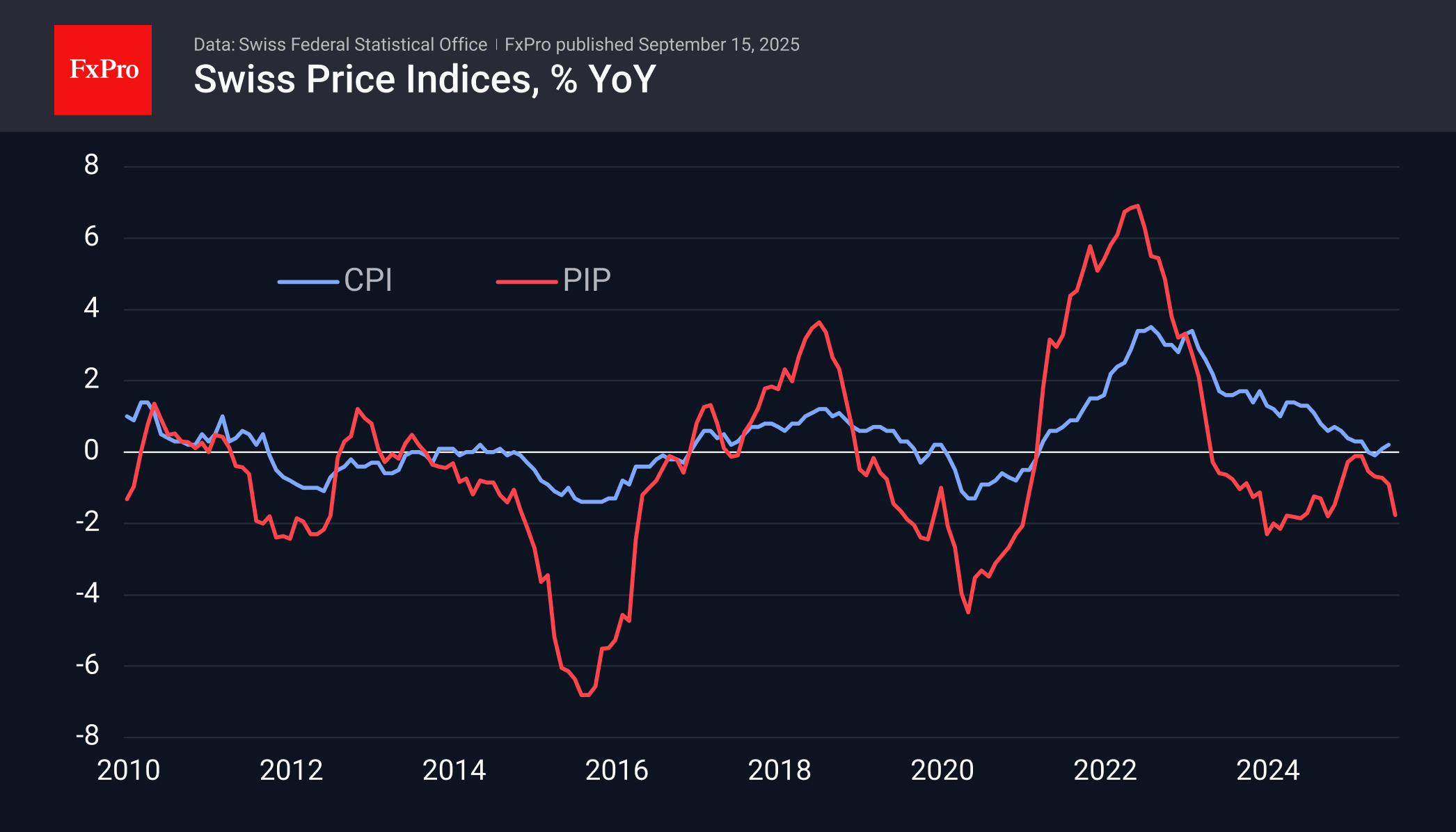

Inflation needs support, not restraint. A recent report on 15 September noted the fourth consecutive month of decline in the producer and import price index, totalling 1.3%, with August accounting for almost half of this decline. From August last year, the decline had accelerated to 1.8%, the largest since June 2024, remaining in negative territory for the last 28 months. Annual consumer price inflation is close to zero, and the sharp decline in PIP increases the risks of deflation in the coming months.

Foreign trade is also showing the first signs of problems amid the strong franc. July estimates showed exports falling by almost a quarter compared to March's peak, with imports down more than 22%.

The consumer climate index also resumed its decline in August, which should help strengthen the position of doves in the central bank.

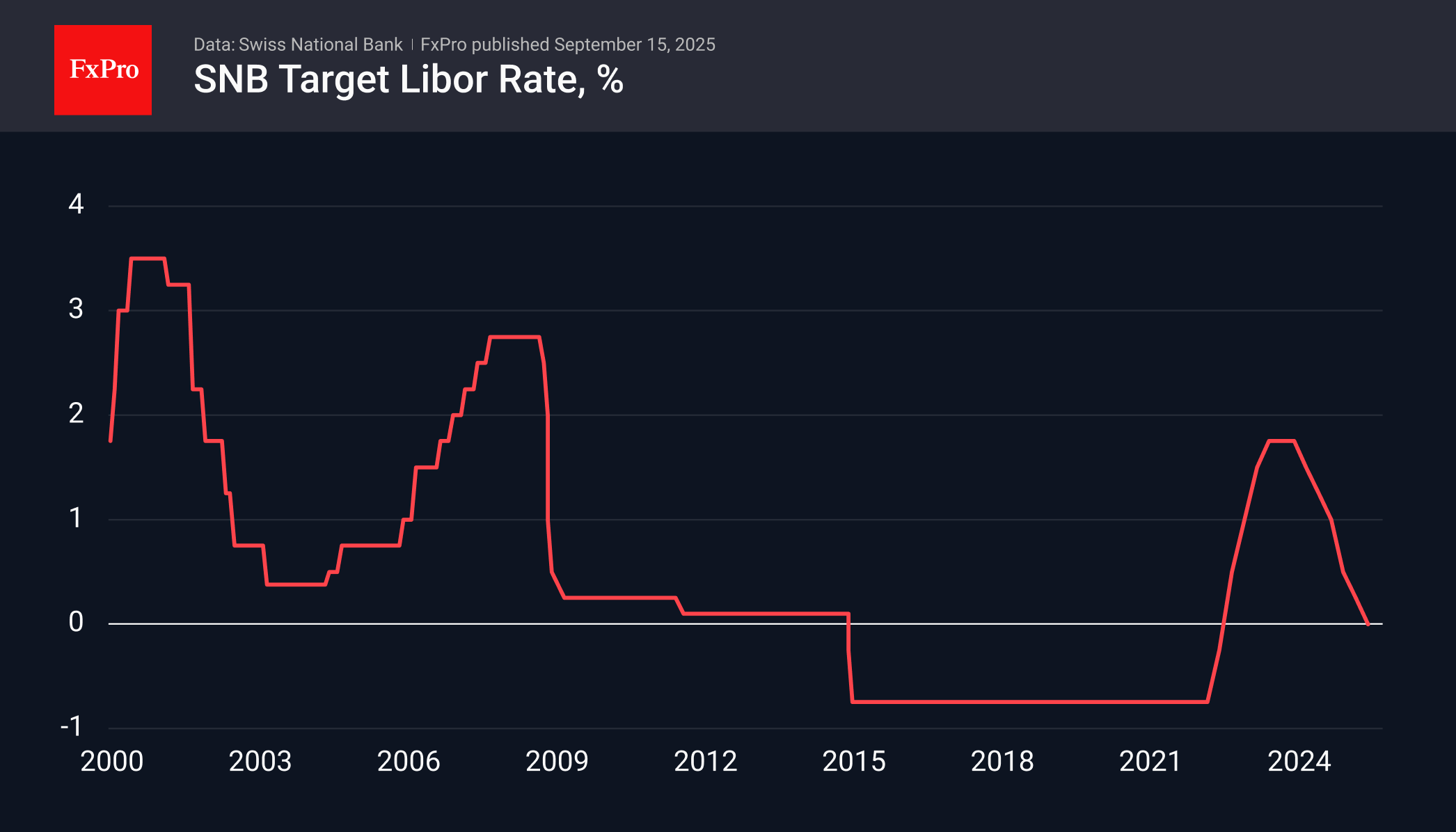

The SNB already lowered its target rate to 0% in June, returning to zero or negative rates for the first time. The bank has previously indicated that it is prepared to go lower. Still, we also believe that further steps carry the risk of a resumption of forex interventions involving the printing of francs to buy foreign currency. These measures are designed to increase the supply of CHF on the global market. Such measures could halt the franc's appreciation against key global currencies, which is beginning to harm the national economy.

If these assumptions are confirmed, current levels could prove to be a turning point for USDCHF and other crosses with the franc.

By FxPro Analyst Team

-11122024742.png)

-11122024742.png)