FX interventions kicking USD to correction

FX interventions kicking USD to correction

As we previously warned, major central banks worldwide that hold massive amounts of dollar securities, are stepping up interventions to support their national currencies. On Wednesday, China, Japan, and Switzerland resorted to such measures. The UK and India used earlier the same tool.

Countries are using this short-term tool to stop the one-sided selling of their national currencies. A longer-term measure is to raise rates, but its side effect is that the time lag and the impact on the real economy, many of which are already heading for a recession, is too long.

On the speculative side, other consequences of this intensification of FX interventions are essential. More dollars are becoming available in the financial system, which counteracts the kind of liquidity drying that the Fed is engaged in by sharply raising rates and shrinking the balance sheet.

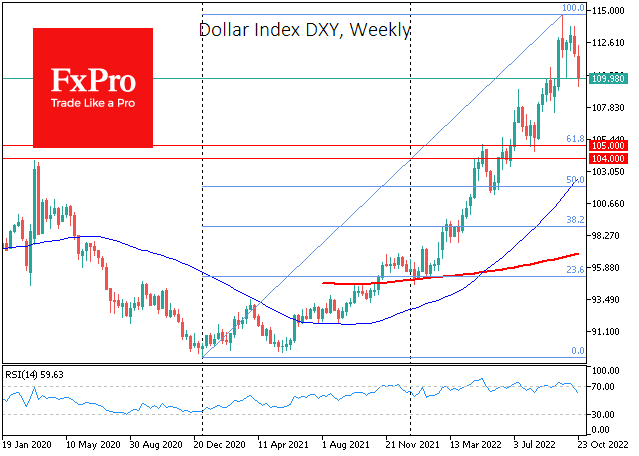

Central banks' very regular dollar sales are setting the stage for at least a corrective pullback. Yesterday, for the first time since January of this year, the DXY Dollar Index was 1% below its 50-day average, which acts as a medium-term trend signal line.

Looking at the chart outside the context of FX interventions, the sharp dip below the line calls into question the continuation of the dollar's rising trend. More locally, without the dollar returning to gains before the end of this week, the priority scenario for the FX market could be a correction in the DXY.

Given the total amplitude of the rally from the "double bottom" of January-May 2021 to the highs of September 2022, a pullback to the 104-105 area is possible. The target range's lower end was the Dollar surge's highs in March 2020. The 200-day moving average, which serves as a long-term trend indicator, pulls into the same area. The upper boundary is the retracement area to the 61.8% level of the dollar's rise since the beginning of 2021.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)