GBPUSD keeps August rally on pause

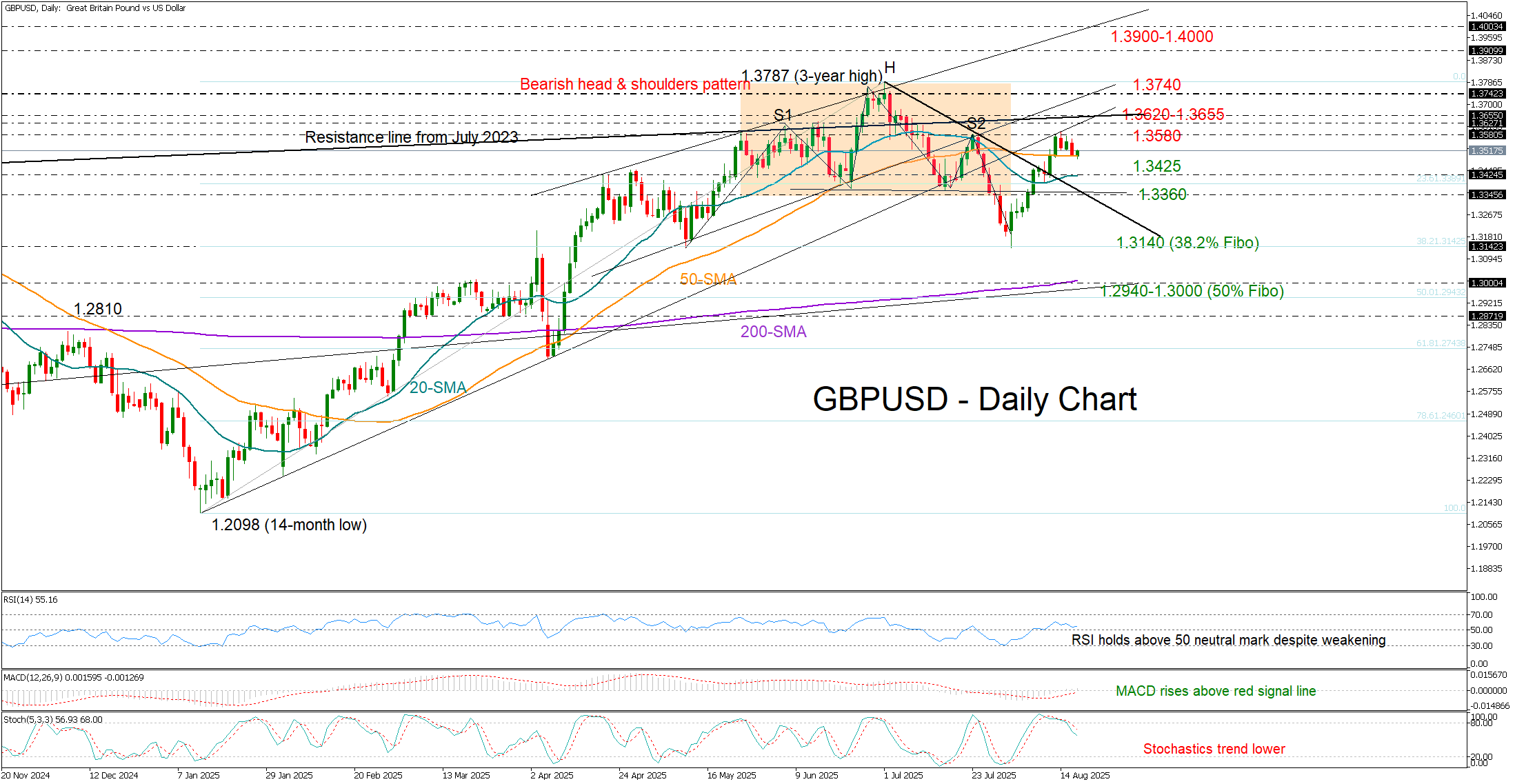

GBPUSD is trading quietly ahead of a busy UK data calendar, consolidating between the recent high of 1.3580 and the 50-day simple moving average (SMA) at 1.3500.

So far, August has been favorable for the pair, with the price climbing more than 3% from the low of 1.3139, largely driven by a weaker US dollar. Stronger-than-expected UK GDP growth figures failed to negate the bearish head-and-shoulders pattern, leaving attention now on upcoming CPI inflation, S&P Global business PMIs, and retail sales. These releases could provide fresh insight into whether a pause in the BoE’s rate-cut cycle is possible in the coming months.

Technical indicators suggest there is still some upside potential. The MACD is gradually strengthening in positive territory, while the RSI is holding above its neutral 50 mark. If the 50-day SMA holds firm, the pair may attempt a move higher towards the key resistance area at 1.3620–1.3655. A break above this zone could open the way for a retest of July’s high at 1.3740, with further gains targeting 1.3900–1.4000 or even 1.4070.

On the downside, a drop below 1.3500 could see the pair testing support between the 20-day SMA at 1.3425 and the broken resistance trendline near 1.3360. A decisive bearish move there could drive the price down to August’s low of 1.3139. Below that, the 200-day SMA at 1.3000 would come into focus.

In summary, while technical signals point to some buying interest, GBPUSD will need to invalidate the short-term bearish structure with a move above 1.3655 to strengthen market confidence.

.jpg)