Japanese yen benefits from hopes of change in the BoJ approach

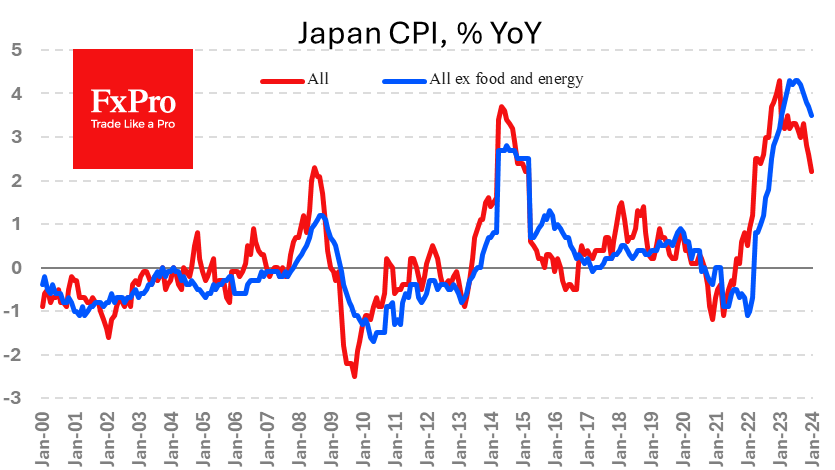

Japanese consumer inflation slowed from 2.6% y/y to 2.2% y/y in January. The data was slightly higher than the expected 2.1%, providing temporary support for the Yen, which rose 0.4% after the release, pushing USDJPY back to 150.10.

Prices excluding food slowed to 2.0% year-on-year, the lowest since March 2022 and back to the BoJ's target. However, an even less volatile measure excluding food and energy slowed to 3.5% from 3.7% in January. These are still the highest levels since the early 1980s, so they warrant the regulator's attention.

The inflation data also helped push Japanese 2-year government bond yields to their highest levels since 2011.

The latest inflation figures have raised expectations of imminent changes in monetary policy. Observers are predicting that the zero-interest-rate policy will be abandoned as early as April this year. The strengthening of these expectations supports the yen by narrowing the yield spread between yen-denominated debt and other reserve currencies.

At the same time, Japan has repeatedly surprised with its passivity in recent years, so it is worth remaining sceptical about its ability to make real changes. This is doubly true when the Fed, the ECB and the Bank of England pick their moment to start cutting interest rates. Fears that the yield spread will narrow too quickly could lead the Bank of Japan to opt for inaction once again.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)