Markets await September NFP after Fed hawks spook markets

All eyes on September NFP as rate cut hopes dim

Expectations of a December rate cut by the Fed have fallen below 50%, following a slew of hawkish remarks last week that sent gold, equities and Bitcoin into a spin, while the US dollar bounced off from two-week lows. Regional Fed presidents Schmid, Logan and Hammack rounded up the week’s hawkish rhetoric on Friday, casting doubt on the urgency to trim rates in December, just a day after the Minneapolis Fed’s Kashkari highlighted the need to wait for more data.

But the lack of panic among Fed officials despite signs of stress in the US labour market will be put to the test this week as the first batch of delayed data will hit the markets following the government reopening last Thursday.

The September payrolls report, which was almost complete before the Bureau of Labor Statistics was forced to postpone it, will be released on Thursday, with more rescheduling expected next week. Whilst the September report is somewhat outdated now and there’s question marks about whether the October data will ever get released, any negative surprises are likely to spark a sharp repricing in rate cut expectations for December, which have fallen to about 40%.

Tariff reprieve lifts mood slightly amid inflation worries

The minutes of the Fed’s October policy meeting are also due this week and although most FOMC members have already expressed their views since that gathering, any further evidence of a widening split between the hawks and doves could unnerve markets where investors are on edge at the moment.

The Fed is clearly not happy with inflation continuing to run around 3.0% rather than decline towards 2.0% and seems to be running out of patience as to how much longer it should overlook the upward pressure stemming from higher tariffs.

However, there has been some relief on that front after President Trump announced late on Friday a tariff exemption on more than 100 food items in an effort to reduce the cost burden on households. Imports of coffee, tea, cocoa, beef and other food products will no longer be subject to additional levies.

There was also good news for Switzerland after negotiators managed to strike a deal to lower the country’s steep tariff rate from 39% to 15% in last-ditch talks in Washington on Friday.

Equities steadier, cryptos bounce back

All this is aiding sentiment somewhat at the start of the week, pulling US futures higher. However, European shares continue to struggle as the main focus for equities is Nvidia’s earnings on Wednesday.

With concerns about AI valuations persisting, Nvidia’s Q3 results will act as a crucial bellwether for the sector.

US retailers will also be in the spotlight, hence, there’s likely to be ongoing caution until investors have a better view of where things stand for the US economy and corporate earnings.

Still, cryptocurrencies were buoyed enough to stage a recovery attempt on Monday. Bitcoin surged by more than 2% and Ether by almost 4% at the start of European trading. Hints from New York Fed President John Williams that the Fed may soon need to restart bond purchases to tackle the recent tightening in financial conditions could be contributing to the improving sentiment.

Gold and dollar treading water ahead of jobs data

But as the recent selloff wiped out all of Bitcoin’s year-to-date gains, gold remains about 55% up in 2025, even after last week’s tumble. The precious metal has been under pressure from fading expectations that the Fed will lower rates in December. The incoming data will be vital in setting the mood until year end.

The US dollar had a better week, but only just. Doubts about the US economy are holding back the gains but that could change if the September jobs numbers aren’t as bad as feared.

Pound and yen under scrutiny

However, investors should be paying more attention to the pound and yen this week as UK and Japanese government bond yields have soared in the past few days on growing worries about rising debt levels in both countries. The two currencies were last week’s worst performers and remain on the backfoot today.

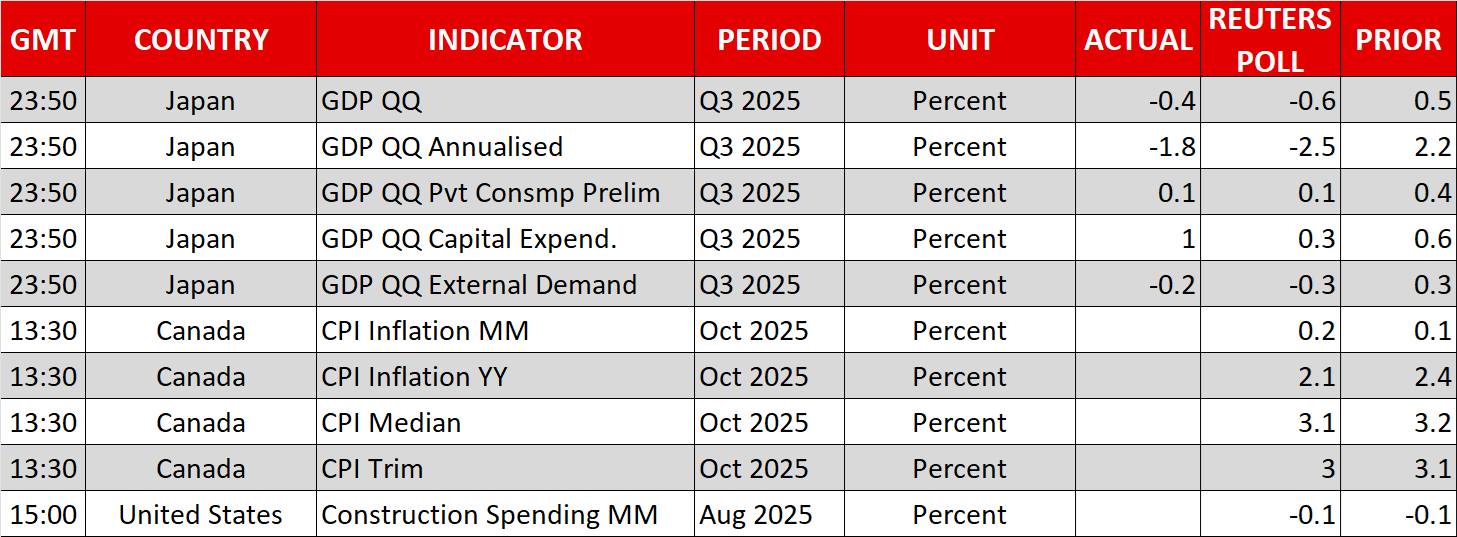

GDP figures released earlier today showed that the Japanese economy shrank in the third quarter, dragged by lower exports due to the higher US tariffs. The contraction was less than expected but this nonetheless supports the Bank of Japan’s caution in hiking rates too quickly. The question is, how much further can the yen weaken before the government has to step into FX markets to prop it up, as it’s back in the 155.00 zone today amid some tensions with China that could hit Japan’s tourism industry.

In the UK, Wednesday’s CPI report will take centre stage as an expected fall in headline inflation to 3.6% could seal the deal for a December rate cut by the Bank of England.

In the meantime, Canadian CPI numbers will be watched later today.

.jpg)