Nasdaq100 is overheated. What are the targets for a correction?

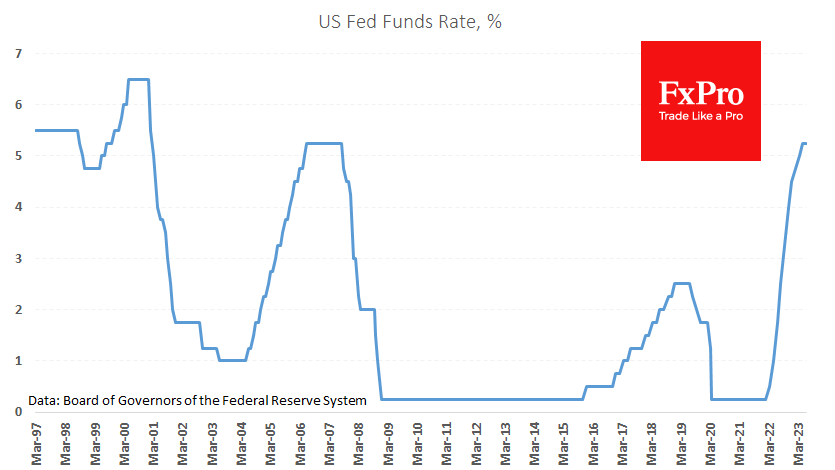

The Fed has paused its policy tightening while projecting two more rate hikes this year and no policy easing in the near future. This is more hawkish than the market expected, which anticipated a hike in July and a possible rate cut soon after.

Surprisingly, the stock market closed at multi-month highs, shrugging off the potential negative impact of the Fed. The low level of trust in Fed policy may explain this, as markets form their medium-term expectations without relying on central bank forecasts.

However, this argument is not very convincing. Markets were right in 2018 when they challenged an overly hawkish Fed, which reversed its policy in the summer of 2019 and its rhetoric six months earlier. They may be hoping for a similar scenario now. But how the Fed surprised the markets a year ago by delivering a dramatic rate hike as promised is worth remembering.

After dropping 1.4% following the FOMC decision and comments, the Nasdaq100 index gained about 1.7% and closed Wednesday at 14-month highs, briefly surpassing 15000.

The technical analysis indicates an overheated market. On the weekly and daily timeframes, RSI is in overbought territory (above 70), which suggests an imminent correction. The Fear & Greed Index at 82 leads to the same conclusion, matching the highs of February 1 this year, which preceded a 1.5-month correction.

Interestingly, both fundamental and technical analyses favour a decline or at least a significant correction. Cryptocurrencies, commodities, and bonds also signal a reduced demand for risk, but stocks have shown a remarkable upward trend until recently.

However, the Nasdaq 100 futures have lost around 1% since the start of the day on Thursday. If this is the beginning of the expected correction, the index could retreat to 14300 without much resistance in the next couple of days. A full-fledged medium-term correction is unlikely before a drop to 13750, where the 50-day moving average, the area of the May rebound impulse, and the local August 2022 peak converge.

If the markets reach these levels and the Fed does not make a U-turn like in Christmas 2018, we should brace for a fall as low as 12800.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)