RBNZ warns it is not done with tightening

RBNZ warns it is not done with tightening

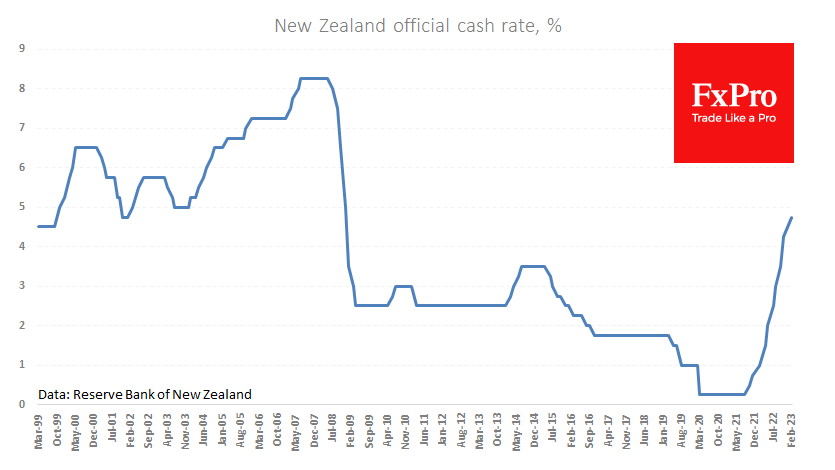

The Reserve Bank of New Zealand hiked its cash rate by 50 points to 4.75% early in the day. The rate has been raised by 425 points over the last ten meetings since October 2021, the sharpest uninterrupted hike in modern history.

In an accompanying commentary, the Bank forecasted a hike to 5.5% by September this year, leaving considerable room for further increases at subsequent meetings. Even so, New Zealand’s interest rates are now at their highest level since 2008. Before the "era of zero interest rates" that began after the global financial crisis, rates above 5% were the norm. Expected rates are, therefore, well within the norm. Moreover, the RBNZ expects the cash rate to fall later.

The NZDUSD initially received buying support from the RBNZ's decision and comments but later came under pressure from the global reduction in risk appetite that started earlier in the US. At the time of writing, the NZDUSD is slightly declining so far this week but has managed to hold above its significant 200-day moving average. The pair has withstood the onslaught of sellers on the way down in December and January.

Relatively hawkish comments from the RBNZ have supported the NZD, suggesting New Zealand will go further than many developed central banks in raising interest rates. At the same time, it is essential to recognise the widening trade deficit, creating a permanent capital outflow. On balance, it is too early to say that the NZDUSD has corrected the initial upward momentum from October and is preparing for a new wave of strengthening above 0.6500. It should be ready to fight for the trend in the coming days. A victory for the bulls can only be declared when the NZDUSD crosses 0.6350, while a victory for the bears can be declared when it falls below 0.6190.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)