Risk sentiment falters, dollar fails to materially capitalize

Risk assets are under pressure

Risk sentiment appears fragile at the start of the new month. The cryptocurrency market was the first to show cracks yesterday, as both bitcoin and major altcoins came under severe pressure. Bitcoin is now trading just above $104k, while ether has quickly sunk below the $3,500 level, partly due to a $100 million theft from a major decentralized-finance protocol.

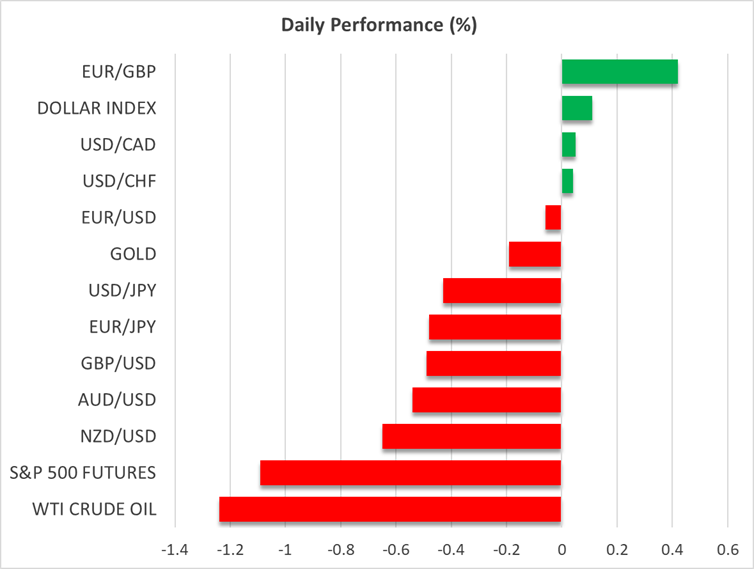

The historically best month of the year for the Nasdaq 100 – with the other major US stock indices also performing quite well – has started on the back foot. US indices finished yesterday's session on a mixed note, but futures indicate sharp losses at today’s open, with the S&P 500 index potentially erasing the October 27 gap higher.

That said, the current decline is not yet alarming. It has been repeatedly noted that aggressive rallies need plenty of short-lived corrections, otherwise they are at risk of protracted sell-offs.

Notably, both the dollar and gold have yet to benefit from the unravelling risk-off sentiment, with the latter still battling with the $4,000 level. It could be an early indication that this drop in equities could be repositioning and profit taking, and not a risk-off reaction, which traditionally tends to benefit gold, at least during the first leg of stocks’ sell-off.

What are the likely triggers for this decline in equities?

While fundamentally little has changed since Friday – with the Atlanta Fed GDPNow Q3 growth estimate rising to 4.0% from 3.9% despite the mixed ISM Manufacturing survey – one could say that the main difference from Friday is the realization that the Fed might not cut rates in December.

With Chair Powell highlighting that the almost certain December cut is up in the air, and the market currently pricing in a 67% chance of another 25bps in mid-December, down from the 95% before last week’s meeting, the debate between FOMC members has commenced.

Quite evidently, there is a split between the two camps about the Fed’s course of action. The doves have opted to ignore elevated inflation and instead highlight that the current labour market weakness could gain momentum, leading to significant job losses.

On the other hand, after agreeing to both the September and October rate cuts, the hawks are nervous about persistent inflation and highlight the absence of official data releases. Governor Miran is excluded from this equation, as he appears to be on a quest to impress Trump and retain his seat at the table.

FOMC board member Bowman is scheduled to speak later today, but, as per usual, investors should not be surprised if a number of FOMC officials make unscheduled comments.

All in all, we might be reaching a stage where the absence of official data means no Fed rate cut in December. Considering the lack of appetite from both Republicans and Democrats for a compromise, the US federal government shutdown could gradually morph into a significant risk-off factor ahead of the December Fed meeting.

US Supreme Court also in focus

Additionally, the countdown to Wednesday’s Supreme Court hearing is almost over. US Treasury Secretary Bessent is expected to represent the US administration at tomorrow’s hearing of oral arguments about Trump’s ability to impose tariffs using a 1977 law.

RBA holds rates but aussie does not gain

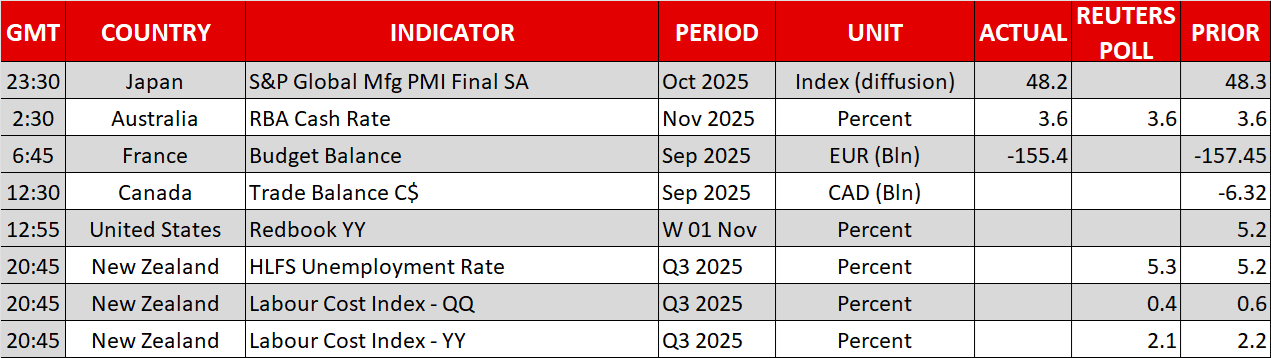

As widely expected, the RBA unanimously decided to keep its cash rate unchanged at 3.6% at today’s meeting. It remains both cautious and alert to the current heightened level of uncertainty, repeating its “will do what it considers necessary” commitment in order to meet the dual mandate of price stability and full employment.

Based on its projections, inflation is expected to remain above target until mid-2026, with some deceleration afterwards opening the door to a rate cut by end-2026. For now, though, it is obvious that the bar is very high for Governor Bullock and her team to cut rates. The next “live” meeting is probably February, as the December gathering does not include quarterly projections, necessary to justify a rate cut.

While one could say that the RBA was a touch more hawkish than anticipated – especially Bullock’s comment that “we did not consider cutting rates” – the aussie failed to benefit, potentially falling victim to the current risk-off sentiment. A drop below the busy 0.6427-0.6458 zone could really challenge the prevailing upward glide since late December 2024.

.jpg)