The crypto market has returned to this week's lows

The crypto market has returned to this week's lows

Market Picture

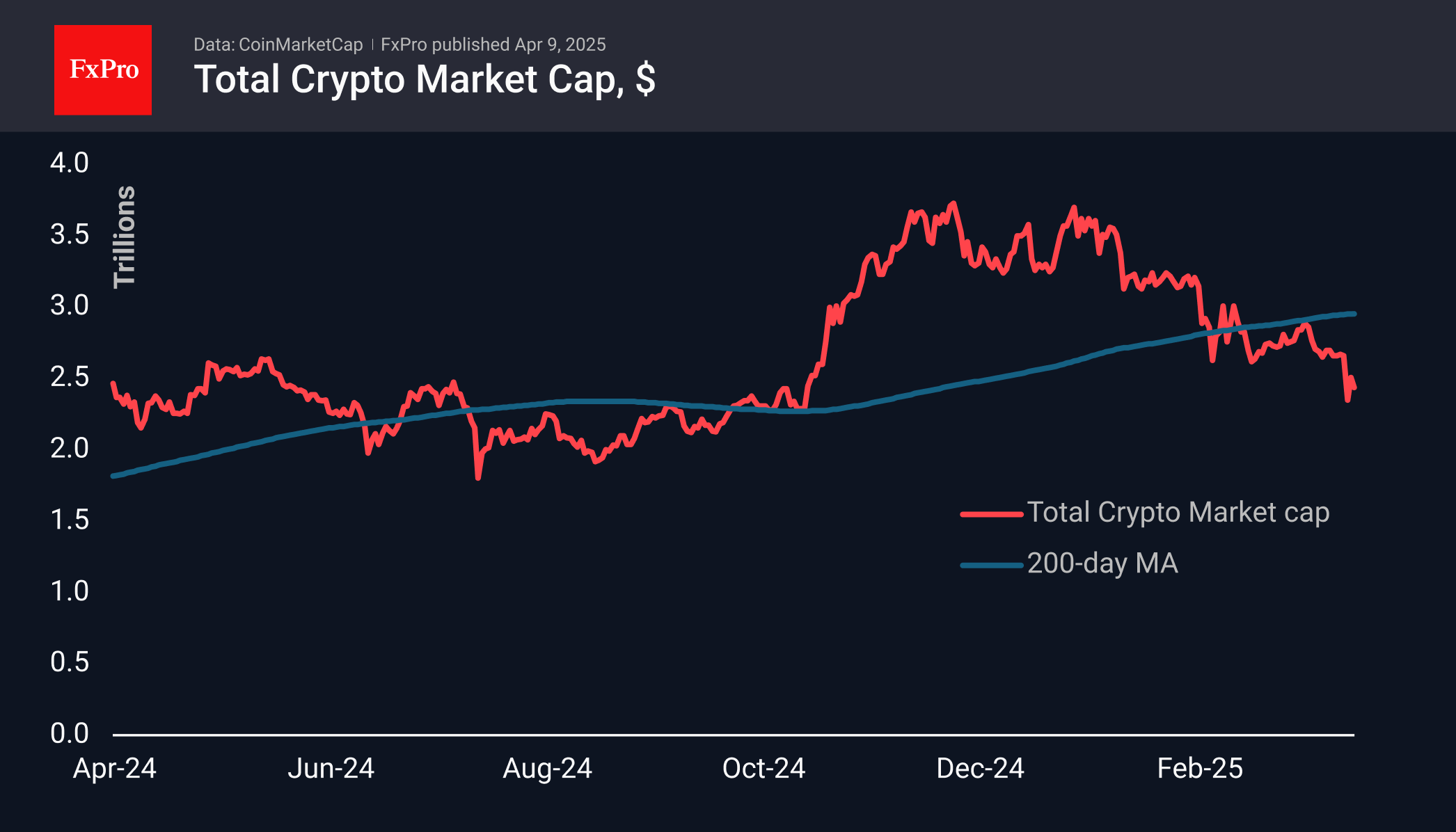

Crypto market capitalisation declined more than 2% in 24 hours to $2.46 trillion. As was the case at the beginning of the week, the intraday dip below $2.40 trillion attracted buyers. As is often the case, an important resistance level became support. From around these levels, we saw the start of the rally after Trump's election, and now the fightback is intensifying again, as seen in the increased trading volumes.

Crypto market sentiment was at its lowest point in the last five weeks, with the corresponding index to 18 (extreme fear) declining. By the index's design, these levels are buying opportunities. However, it is much more prudent to buy when the index is confidently moving out of the extreme fear zone.

Bitcoin was down to $75K early in the day, approaching Monday's lows and echoing the dynamics of U.S. stock indices. Selling is starting from increasingly lower levels, with the RSI index above the oversold area on daily timeframes. This fails to attract buyers on dips and sets up a wait-and-see approach.

XRP is testing its 200-day average, having pulled back to the $1.82 area, 45% cheaper than its peak price in January, and back to the 2021 highs. A failure under this line could accelerate the sell-off of the fourth-largest cryptocurrency.

News Background

Bernstein noted that Bitcoin has proved more resilient amid tariff turbulence in markets than during previous crises. The first cryptocurrency is still worth investing in as a means of saving in the long term.

Bitcoin could collapse to $10,000, warns Bloomberg Intelligence senior strategist Mike McGlone. This could happen as part of a global correction in financial markets. According to the analyst, “the entire crypto space needs to be cleaned up, just as it was with the dot-com bubble.”

Ethereum's fall below its realised price ($2200) indicates panic among owners of the second most capitalised cryptocurrency, which historically serves as a bullish signal for the medium term, CryptoQuant notes.

Built-in Telegram Wallet will soon be available to US users. The service will be launched in the second quarter of 2025.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)