Three pillars of yen's strength

Three pillars of yen's strength

The Japanese yen was the hero of the day on Thursday, adding over 1.7% against the dollar and 1.6% against the euro since the start of the day. The yen has been sided by Japan's regional banks, which are rumoured to be lobbying for the abandonment of the yield targeting policy. On Thursday, USDJPY dipped below 145, and EURJPY fell under 156.

Simultaneously, markets are laying that Fed and ECB rates have reached a plateau, and the next step will be to lower them. The logical outcome of this divergence is an accelerated narrowing of yield spreads between Japanese government bonds and other major economies, which brings capital back into the yen.

Yen appreciation has been on a steady course since early November, a couple of weeks after the peak in US 10-year yields, when markets became convinced that their decline had become a trend.

Also, the yen may work the cautious mood of the stock markets in recent days. The yen is very often used as a funding currency to buy risky assets. The shift of market sentiment to profit-taking on major indices triggered a predictable deleveraging on the yen.

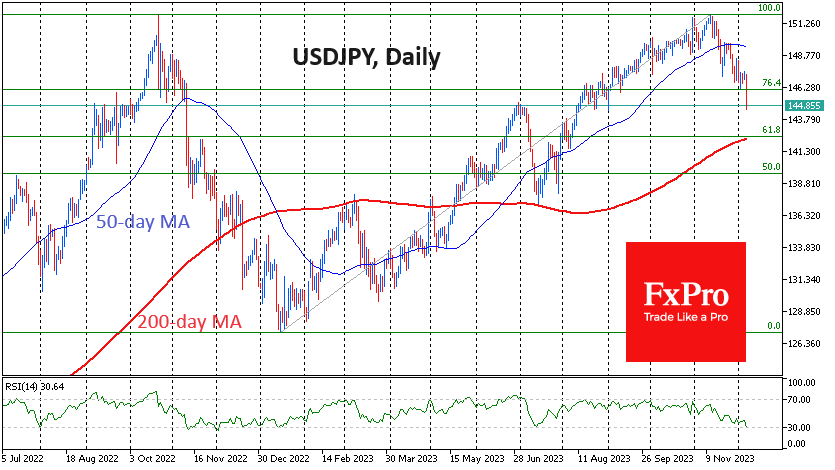

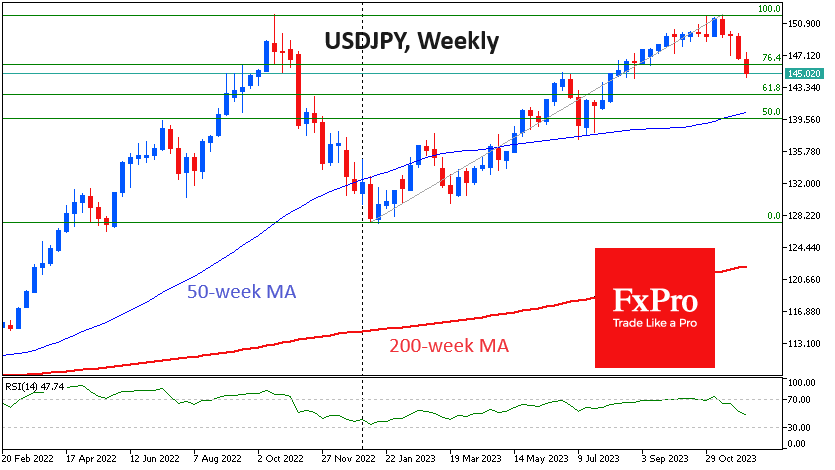

Technically, USDJPY formed a double top at 151.9, which was touched in October 2022 and November 2023. The most conservative approach suggests a final reversal signal only after a failure under the local low below 128, which took four months last time but may take two or three quarters.

On lower – daily – timeframes, we can talk about the breaking of the uptrend if the USDJPY falls below 142.4. The 200-day moving average and the level of 61.8% of this year's growth amplitude intersect here. A consolidation below will indicate the breakdown of the uptrend and open the way to 128. Still, we should be ready for a long tug-of-war and recharging of the JPY bulls on the approach to 143, as the pair will be significantly oversold by RSI even on weekly charts. At the same time, an oversold exit on daily timeframes is likely to be just a reason for local stops in the declines, just as it was in the yen strengthening cycle a year ago.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)