Trade optimism rises ahead of US-China talks but dollar slips

US and China aim to defuse tensions

Negotiators from the world’s two largest economies will meet in London today as the US and China seek to bridge the gap in their long-running differences over trade following the shaky truce agreed last month in Geneva. Since those first round of talks, the two sides have accused each other of violating the terms of the temporary deal. But a call between the US and Chinese leaders last week appeared to put the negotiations back on track.

Hence, there is reasonable optimism that the second round of talks this week will lead to a further thaw in trade relations between Washington and Beijing. The US is hoping that the Chinese will loosen their export restrictions on rare earths, which are crucial for the tech industry. China on the other hand wants greater access to advanced American technology such as AI chips, as well as for the White House to grant more visas for Chinese students.

The US team is again being led by Treasury Secretary Scott Bessent and Trade Representative Jamieson Greet. But Commerce Secretary Howard Lutnick is also attending this time, suggesting that an easing of chip curbs may be on the cards.

Some optimism and a lot of caution

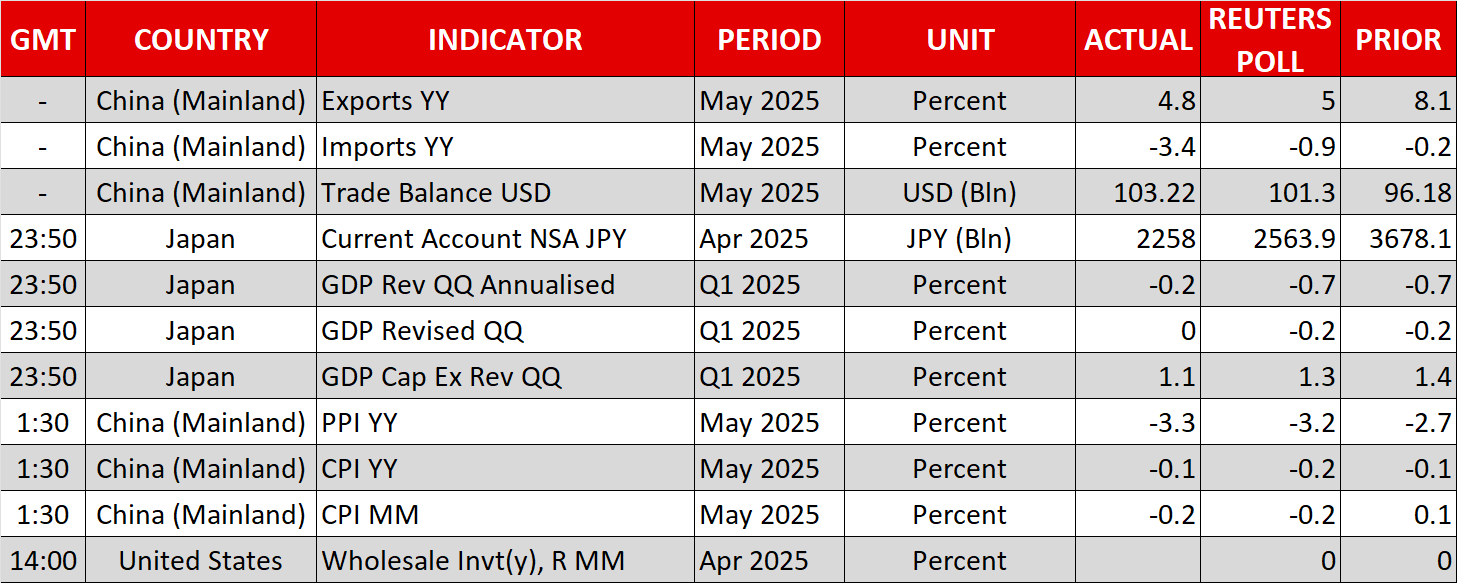

The stakes are high for some fresh breakthrough in the London talks as the rebound on Wall Street is cooling off while the US dollar remains pinned near its April lows. But China is also under pressure to maintain the trade truce as data out this morning showed that exports to the United States plummeted by 34.4% in May from a year ago, in a sign that the higher tariffs have started to bite.

China-listed shares in Hong Kong drove the Hang Seng index to its highest since March today amid the rising hopes of substantial progress in the negotiations. Adding to the optimism are the indications of intensified efforts by the US to conclude some new trade deals, particularly with India and Japan, before the July 9 deadline for the reciprocal tariffs.

But there is also a lot of caution still, and US futures are trading flat at the start of today’s European session.

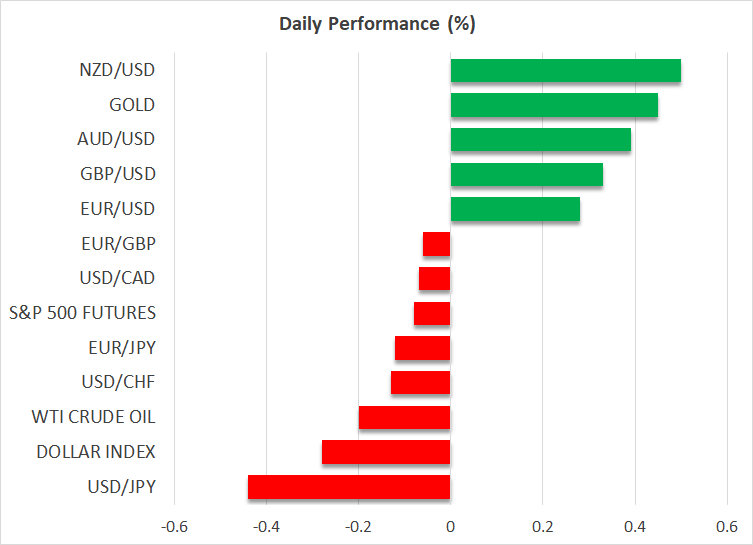

Aussie and yen outperform

In the currency markets, the Australian dollar, which often trades as a liquid proxy for China’s economy, is one of today’s strongest performers, climbing back above $0.65.

The Japanese yen is also up sharply against the US dollar, following comments by Japanese Prime Minister Ishiba that Japan is “shifting to a phase” where interest rates are on an upward trend. His comments come after the US Treasury said in a report last week that the Bank of Japan should continue to hike rates in a bid to normalize the yen’s weakness, raising speculation that the exchange rate is being discussed in the trade negotiations between the two countries.

The dollar is back down at around 144.10 yen today, finding little support in the renewed efforts on all sides to ease trade tensions.

LA riots might be aiding gold

The positive headlines on trade are being overshadowed by the increasingly violent protests in Los Angeles over the deportation of migrants and the question marks surrounding the legality of President Trump’s decision to deploy National Guard troops to quell the demonstrations.

The unease about the Trump administration’s heavy-handed response not just to the protests but also on the immigration raids themselves that sparked the anger may also be giving gold a bit of a leg up. The precious metal is recovering back above $3,320, having briefly breached $3,300 earlier in the session when the positive risk sentiment was somewhat stronger.

Dollar soft despite solid NFP, CPI eyed next

Dollar demand could pick up later in the day should the situation in LA de-escalate and there are some encouraging headlines about the US-China trade talks. But in the meantime, it’s a little worrying that Friday’s fairly upbeat jobs report only offered a modest boost to the greenback.

It’s possible that some traders are sticking to the sidelines ahead of Wednesday’s CPI report for May, which may show that US inflation is creeping up again as the higher tariffs kick in.

.jpg)