US house prices continue to fall

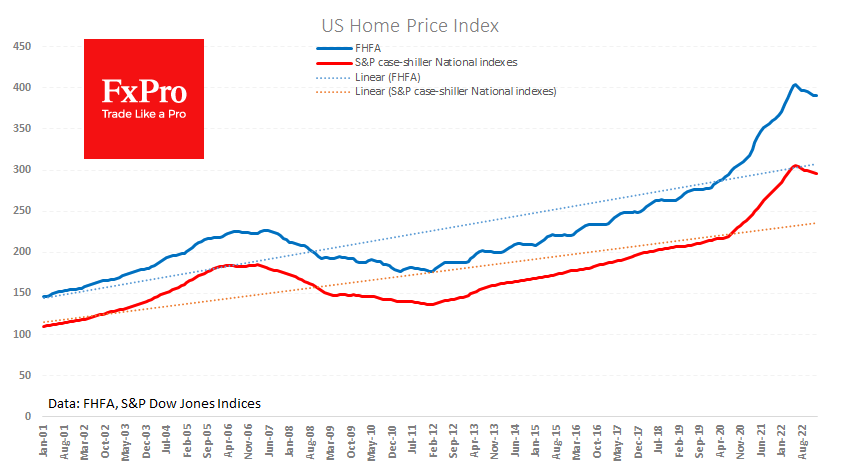

The S&P CoreLogic Case-Shiller house price index for the 20 largest US metropolitan areas fell for the seventh consecutive month in January. The index fell by 6.8% during this period, and the annual growth rate slowed to 2.6%. The annual growth rate peaked in April last year, shortly after the Fed began to raise interest rates. The nominal level of the index peaked in June when the central bank began to raise interest rates by 75 points at once.

From this perspective, the housing market is now dragging down headline inflation rather than heating it.

A separate Federal Housing Finance Agency report showed a less aggressive price fall nationwide. Prices rose 0.2% m/m and 5.3% y/y in January.

Cooling the housing market could be an important reason for the Fed to stop tightening policy. However, the price correction is unlikely to be complete. Both price indices published today have broken away from the trend rate and are now around a quarter above the trend level.

The housing market is an interesting leading indicator for the economy. In the US, house prices also closely correlate with final demand and stock market indices. However, the history of the mortgage crisis suggests that markets fall when house prices are actively falling. Still, the gradual cooling of prices may not be detrimental to the market recovery, as seen from 2009-2011, when there was a clear divergence between rising markets and falling house prices.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)