US PPI Above Expectations Did Not Dampen Risk Appetite

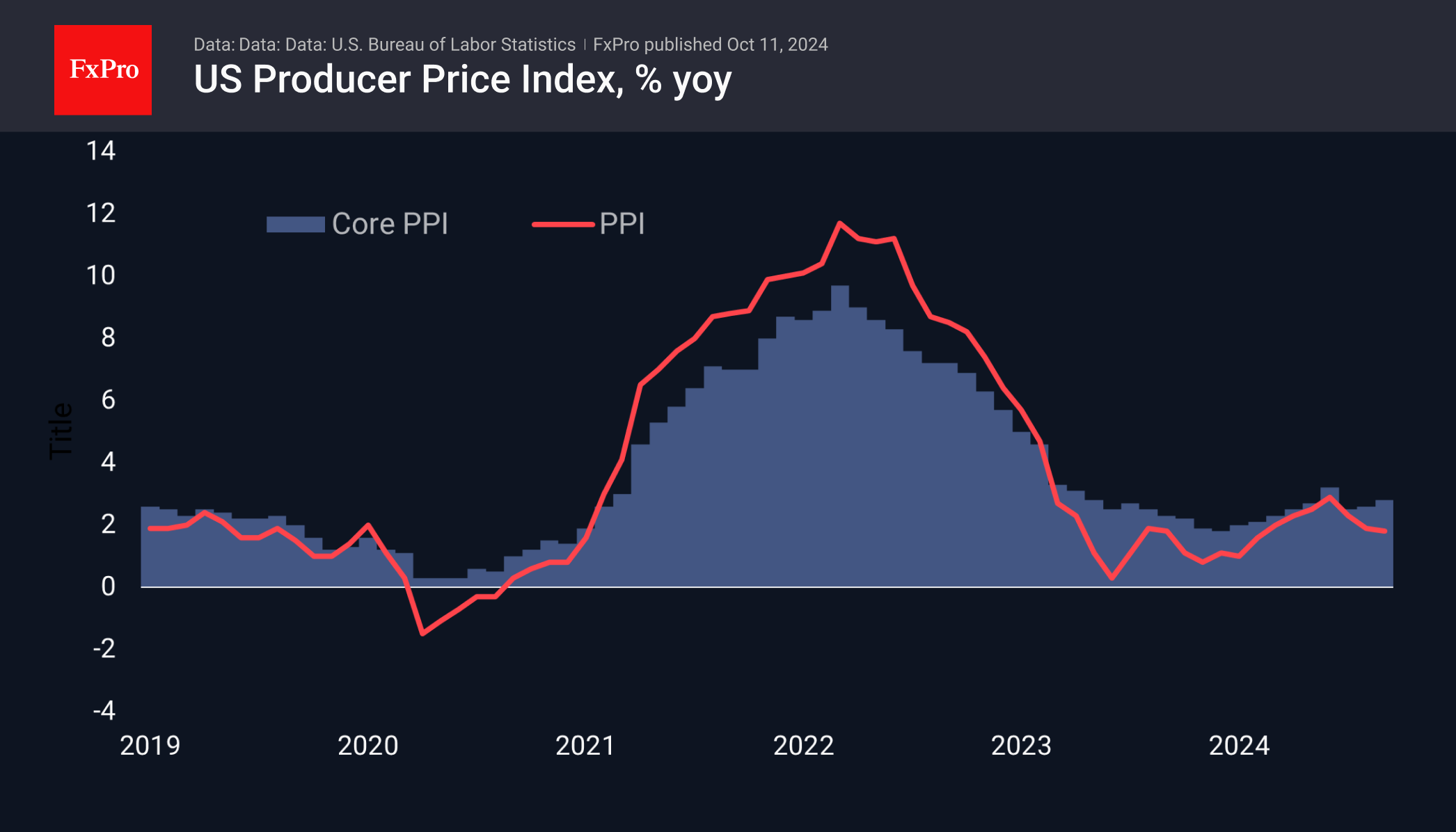

US producer prices rose at a faster pace in September than analysts had forecast. The headline PPI slowed to 1.8% y/y instead of the expected 1.6%. The core price index, which excludes food and energy, accelerated to 2.8%. While this is not the 3% peak we saw in June, it has been on an upward trend since the beginning of the year, from 1.8% in December.

This trend in the core growth index is a cause for caution, as it suggests a smooth rise in consumer prices over the coming months. The decline in commodity prices in the third quarter was reflected in a slowdown in the headline PPI but did not affect the core index due to rising service prices and tight labour market conditions.

Released in the afternoon after the more important consumer inflation indicator, the PPI supported risk appetite in markets where the S&P500 continued to storm to all-time highs and gold rose 1%. As long as investors see strong inflation as a sign of a strong economy, this will continue, but this could change if inflation becomes an obstacle to a rate cut.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)