USDJPY trades lower around 147.50

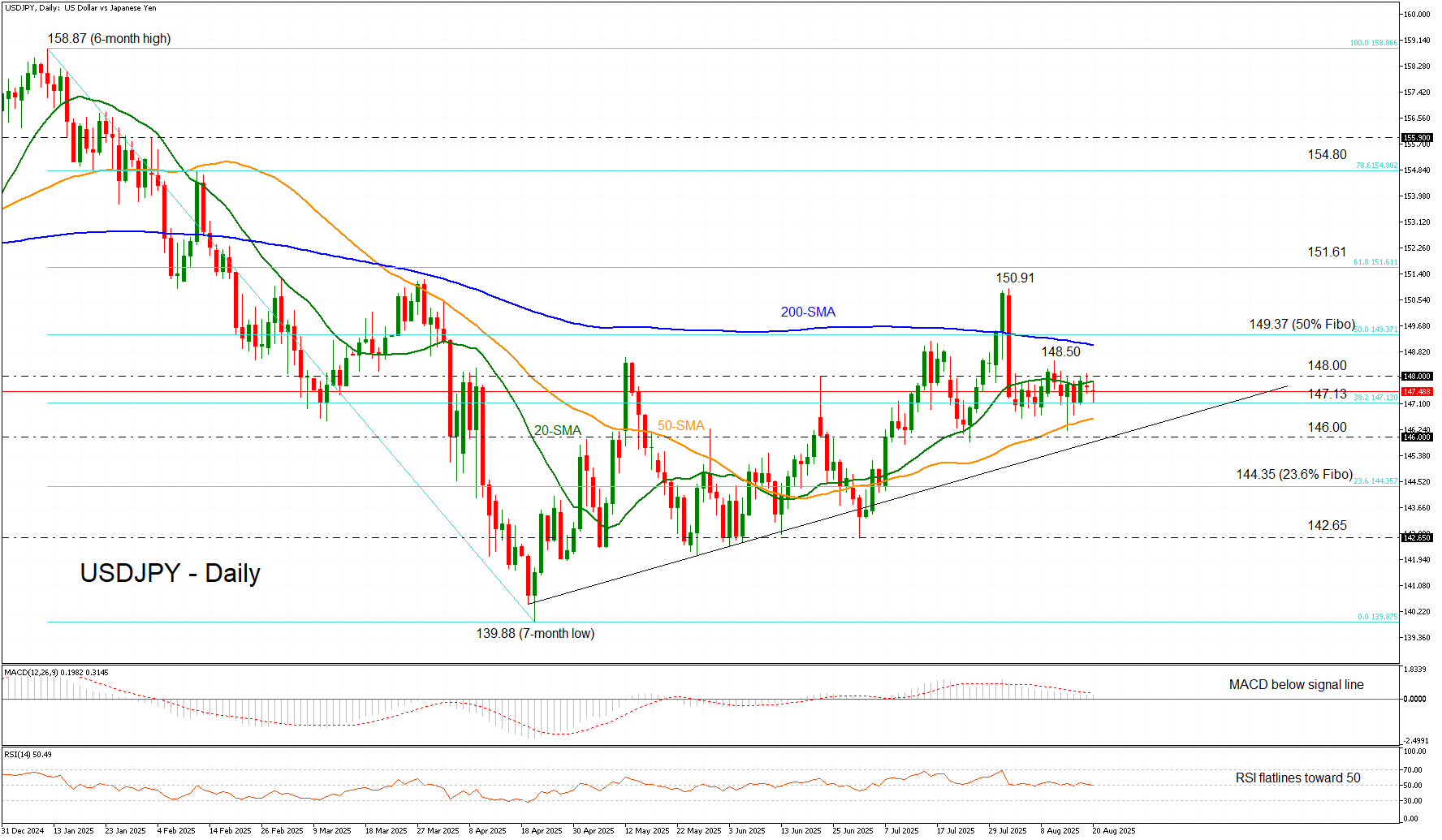

USDJPY is consolidating around familiar levels near 147.50 at the time of writing, with the 20-day simple moving average (SMA) continuing to cap upside attempts since the beginning of the month. The pair failed to push decisively above this barrier, even after last Thursday’s rebound from multi-week lows near 146.00. For now, price action remains subdued ahead of Fed Chair Powell’s speech at the Jackson Hole Symposium, while uncertainty lingers over Japan’s economic outlook and the timing of the next potential rate hike.

The momentum indicators are consistent with this indecisive tone. The MACD is hovering just above zero but remains below its red signal line, while the RSI is flatlining around the neutral 50 level, suggesting that selling pressure could re-emerge.

That said, initial resistance on the upside lies at the 20-day SMA just below the 148.00 psychological mark, followed by the August 12 peak at 148.50. Above that, the bulls could then challenge the 200-day SMA, which corresponds with the 50% Fibonacci retracement at 149.37.

Conversely, initial support could be found at the 38.2% Fibonacci retracement of the January-April downleg at 147.13. A deeper pullback would likely test strong support around the 50-day SMA just above 146.00, reinforced by the medium-term ascending trendline in the same region. A clear break below this zone could open the door towards the 23.6% Fibonacci at 144.36, with further downside risks extending to the April seven-month low of 139.88.

All in all, the medium-term bullish picture remains intact despite the latest consolidation between 147.00 and 148.00. However, as long as the 20-day SMA acts as strong resistance, near-term weakness cannot be ruled out before the bulls attempt another recovery.

.jpg)